Show notes –

Join Shannon & Christine as they chat about Financial Wellness.

Join us in community: https://women-connected-in-wisdom.mn.co/feed

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Our Sponsor – Shealo Glo – Now offering Subscriptions * Delivered on the 1st & 15th!

Stillpoint: A Self-Care Playbook for Caregivers

Book a free coaching consult with Christine here: https://www.christinegautreaux.com

Like & Subscribe to get notifications of when we are live:

Women Connected in Wisdom Instagram

Women Connected in Wisdom on Facebook

Pinky gave LLC’s to graduating class

Unsinkable Albany State University

Connect with Felecia at www.feleciafrayall.com

Join Christine for the InterPlay Life Practice Program for Helping Professionals

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Shannon M. 0:06

How are you doing?

Christine Gautreaux 0:19

Do we want to real? How are we doing today?

Shannon M. 0:22

It’s up to you. What are you comfortable with? You know, I like to be real?

Christine Gautreaux 0:25

No, I used to I believe in showing up authentically and y’all. Today is Wednesday, May 25. And I am in Texas, doing eldercare with my parents, and a lot of big changes happening. And also, you know, just a little bit down the road from Uvalde, where we just had another mass shooting in our country.

And, you know, we just had buffalo, that was a race crime. And now we’ve got another mass shooting, where more children have died. And, you know, if I really want to be honest, I could say a lot of customer dread at this moment, but we’re not ready for that. And, and my heart is broken, and I am exhausted.

And I am… I want policy and change. You know, I want policy change, not policy, you know what I mean? I want to, I want this to quit happening in this first world country, I want our babies to be safe. And, and, you know, I don’t have to say this to my friend or to our listeners. But you know, black and brown bodies are disproportionately affected by this. And again, that was the case. And yeah, you know, I wrestled with myself, do we take today off? Do we not? I mean, thing is, if we took a day off, every time there was a mass shooting in this country, we wouldn’t have a podcast. And that is heartbreaking to me. That is heartbreaking to me that we have to have these conversations. And some people don’t want to have them right.

Shannon M. 2:11

And is yes is heavy, you know, and that. I also think that’s why it’s necessary that we have them when we say how do we do it? We’re not asking how do you staple 10 pieces of paper together versus 100 get a different stapler, Amazon will help you with that, you know, like that’s not what we’re talking about. We’re talking about? How do you process something and day after day, your trauma dies today and tomorrow. And if you choose not to show up on that day, we’ll be missing a lot of days. And that is not always sustainable. So how, what do we do in this situation? Right? Absolutely.

Christine Gautreaux 2:49

And and to put a note on that, like if you took the day off? Absolutely, I 100% support you in that if you needed to do that for your well being absolutely. And in there’s times we can’t take days off, right, or we don’t have the choice or the privilege to do that. So how do we how do we maintain our self care in the midst? So we often say crisis chaos, but like this is crisis and trauma? And yeah.

Shannon M. 3:20

Yeah. And And honestly, I love what we’re talking about today. And I know we haven’t, we should probably jump into it. So we can start a deeper conversation, but just have go ahead and have a conversation. That is what I think about with financial wellness, you know, I have the opportunity to if somebody passes away, I can take more than two, maybe three days off, you know, if, if I need to sit down for my mental health. I don’t have to even question if I hesitated or not, you know, don’t have to hesitate about the hesitation because I’m off because that’s absolutely what I want to do every single time. But we know

Christine Gautreaux 3:55

that’s not an option for a lot of people. So you’re right, that it ties in with what we’re talking about today.

Shannon M. 4:00

And it’s my motivation every day to be able to work so I can afford to be able to take the time that I need to take. Right? Yeah. Well,

Christine Gautreaux 4:09

should we do our official intro and get into this deeper conversation? Yeah, no, that was a heavy start. But it’s really you asked how it was and that’s, that’s how I

Shannon M. 4:19

talk about it. You know, it’s how we deal with things really. Let’s do this. Okay, ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of Shiloh glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness. And

Christine Gautreaux 4:41

I am Christine Gautreaux, a white social justice advocate and international speaker, coach and published author who helps you upgrade yourself and community care.

Shannon M. 4:52

Yes, and together we are women connected in wisdom a podcast grounded in the eight dimensions of wellness Welcome, welcome to our show.

Christine Gautreaux 5:00

And we like to get together every week to have intentional conversations about how do we be wise in business relationships and with our wellness, because it’s a lot.

Shannon M. 5:09

Yes. It is a lot. And I’m actually gonna go ahead and share a definition here too. So we can completely dive into the deep end off the jump and board off the diving board, and have this conversation. So financial wellness, is an intentional approach to your relationship with money as a tool. It includes the stability with current finances, increasing positive financial behaviors, like budgeting, reducing debt, saving, and investing. Financial Wellness incorporates knowledge and skills that helps to change behavior, reduce financial stress, and creation of a strategic financial plan to reach desired financial goals.

Christine Gautreaux 5:58

I need to take deep breath on that one.

Shannon M. 6:03

For me, it’s the I mean, it’s a lot of things, let’s say if I had to pick something specifically, and we always talk about what speaks to us than a definition, when we read it, right, again, the reduced financial stress, compared to two years ago, may I had just moved out of my apartment, forcibly because of my financial position to today, paying off student loans literally paid off one today, you know, that’s a blessing to be able to do that. And it’s because of the strategic financial plans that I’ve put together, you know, learning what I didn’t know, learning from the things I saw myself doing and getting a community with, like minded people will give me strategies and support and everything else. But even when you have all those things, the news like we’re talking about, is difficult to to hear, especially when it’s more consistent than we want it to be.

Christine Gautreaux 7:00

Well, and one of the things that ties into what you’re saying, Shannon that I think about is often when I feel helpless, like that was one of the feelings I was feeling when I heard the news yesterday, is often when I feel helpless. action helps me to not feel like I sit and feel my feelings, but also like, I like to take action. And so then if I have financial resources to donate, like, right, donate to causes that, you know, like we talked about Buffalo and buffalo happened.

And, you know, I got online. And, you know, one of the big things that wasn’t talked about a lot, in addition to the horrendous race crime was, when that atrocity was committed in that community, it took out their grocery store, because a food desert had been created in that community from inequity. And so then people’s food source was affected. So, you know, one of the ways I had to not feel helpless was to get on and find organizations that were on the ground to donate to them to directly impact what was going on on the ground. And so I think about that, when it ties to financial wellness, I had a teacher one time tell me, you, it doesn’t serve anybody, for you to be poor. Like when we resource ourselves well, we can can share with other people and help help other folks and, and make a difference in the world. Right.

And I know, I was raised in an environment where you saw that where money was evil, or you know, you didn’t, you know, so there’s a lot of those stories tied up with financial wellness, a lot of times, I think for a lot of people, like depending on what you’re taught, and to be able to get rid of some of those stories to make a difference in the world like to be financially well, and be able to, you know, you get to choose what kind of person you are, whether you have money or you don’t have money. And I think that was one of the things to realize it’s like, okay, if I have extra resources, of course, I’m gonna share, that’s who I am as a person, and I’m going to be generous, and I’m going to use it to make a difference and automatically going to talk turn into that evil stereotype that you think about that, you know, is out in the world, right? We absolutely are very glaring that we won’t name on this show. But like, there’s that piece, right?

Shannon M. 9:19

Yeah, yeah, no, absolutely. And as far as the character part of who you are as a person, that’s why I’m intentional about the people who I surround myself with, you know, I hope my my circle will say, hey, getting the kind of out of line, you know, I know, out of pocket things and had to come back and say, You know what, I realized that it was not even when I said that or that I missed part of what I needed to consider when I said that and I actually feel this way. So I think that’ll help with that part. But I feel like it’s really important, especially as women because we are givers to explore how we feel about our finances. You know, just like you said, I can give to this this organization that’s helping them The ground. One, I love the fact that you always think about how can I take care of myself and the community. But we also can’t give away bricks to our house trying to help somebody else. So if we’re going to continue to give at the rate that we’ve been giving, I wouldn’t say diminish the rate that we’ve been giving and go backwards. I would just say, let’s be financially well and give from the overflow instead of from the things that we need. Right?

Christine Gautreaux 10:24

Right. Oh, Lolita is listening. Hello, Nika. He says, I didn’t think about the creation of the food desert when the grocery store wasn’t available.

Shannon M. 10:33

That’s the first thing I thought about to be honest with you. Is it day in the store? What? What about?

Christine Gautreaux 10:38

Yeah, what it meant? Yeah, absolutely. Well, I think about, I want to say I woke up thinking about this this morning, in our show today, Shannon, and I’ve seen, you know, the work I do in the world with self care, and in order to sustain community care, and I was thinking about the five skills of self care that we talk about and Stillpoint. And I was thinking about, how would we apply them to financial wellness, right, and I want to talk about this with our guests when she comes up. And I’m excited to talk to her about her work in nonprofits. And I know Luke is listening for that. Absolutely. Aloha, I like and so when I think about the five skills of self care, you know, the first is sorting and separating what belongs to us and from what belongs to others. So just what you said was financial wellness, right? What separate like out your budget, like what do you need really to thrive in to survive, and then to be able to give from that overflow? Number two on the skill is letting go and surrendering learning when and how to do this, like, I know you and I’ve had some conversations, it was like, oh, yeah, this isn’t working. I gotta let go of that and do something different. Right? Yeah. And that was self care. But it was also financial care. Number three is building and using partnership power to get help from others. And I heard you reference that when you talked about manifesting Mondays in the your support people in your life and, and that when we talk about this, and when we have guests, like our guests today, come on and share with us, that’s a way to do partnership power. Luca is collaborative partner with me and we’re talking about really cool event coming up. And that getting together to build that financial wellness. So number four is stepping back to see the big picture and the relationship between the parts. I think you are amazing at this with financial wellness, because you are a note taker. So like, you look back and you’re like, oh, yeah,

Shannon M. 12:34

okay,

Christine Gautreaux 12:36

if I do this, this is gonna happen. If I do this, this is gonna happen. I just I was intrigued when I thought about applying the self care skills to finances. Because number five, you know, is exercising choice by saying yes, and saying no. So that one really plays in to financial wellness, we often have to say no to things in order to say yes to the things we really want. Are our values or what we want to create.

Shannon M. 13:04

Yeah. And it’s, especially as a small business owner, right. We started about started well, we talk about startups and pinkie just gave all these LLCs I don’t know if you saw this, Christine, we haven’t talked about it yet. But how, yes, Pinky, gabled. LLCs for the Clark Atlanta. I was lit. Okay. I was so excited. Because of you watching this, yes. Okay. But so excited. And I knew that, you know, all the stuff that we talked about is very important to delve into, because you can, you can wait, I’m sorry, what was the last point that you made about the five steps to self care? What was the last one

Christine Gautreaux 13:46

boundaries about making choices? And say, saying no. So you can say yes to other you can say

Shannon M. 13:53

yes. And so it reminds me of a Kimmeridge, one of my chemistry teachers from high school. And he used to say you can do anything and depending on what order you do it in, right, and that always stuck with me. And so finances is just like that you can do a lot of stuff if you do it in the right order. But if you do it in the wrong order, it could also tear down that house that you’re trying to build. And then we look around and wonder why we’re not in, you know, in the Emerald City yet. And it’s because we’ve been given our bricks away. Well, I want to go to the Emerald City because I was born in May. So maybe that’s just me. I think you get what I’m saying.

Christine Gautreaux 14:29

Like is taking notes, so I just have to give him a shout out. He’s taking notes and writing down all the what it means about self care. So

Shannon M. 14:39

letting go and it’s important. I feel like I could break it down into each one of those things. You know, especially as women sometimes we we take care of other people’s stuff when we should be focusing on our own partnership power for businesses. We talk about self care and community care and how to do it in business. That’s huge. You don’t always have to get everything If you’re a personal money and even when we’re talking about tech strategy, that’s a whole nother conversation we could have and why you might not want to do that that might not be the most strategic thing. If you’re being intentional, right?

Christine Gautreaux 15:11

I know that our guest is having a tech issue. So I just want to let the folks that are listening know, that’s why we’re going a little long, and we may end up going the whole time, because she was all signed in ahead of time and is having a few tech issues. So I just wanted to let you know, Shannon, so we can keep talking about it. And also, so if our regular listeners are like, wait a second

Well, we did have this other stuff Brooks talked about, too, you know, I yeah, I think about? Well, I mean, you know, it’s my gym, as far as self care. So I think about how it ties to all the dimensions of wellness. But really, when I think about finances, and I think about how often they can be stressful for folks, right? Whether it’s in the per person, my tongue is not working today, the personal relationship, it can be fine. If we’re taking care of ourselves and like being embodied and taking deep breaths and knowing what we need, then we can make it work right. Or it can be if we’re looking for funding for an event or if we’re looking for a nonprofit, again, I mean, I’ve worked in nonprofits for years, and a lot of folks don’t take care of themselves in nonprofits, because they’re always having to hustle and make money. So it is tied into the wellness. And I see our guests has made it back. So Shannon, do you want to say anything else before we introduce and bring her up?

Shannon M. 16:42

No, let’s go ahead and do that. All right, let’s

Christine Gautreaux 16:45

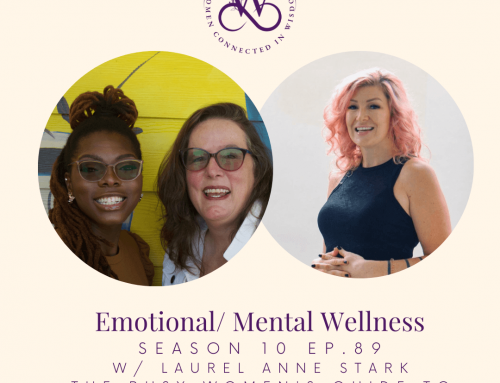

do it, y’all. I’m excited to introduce our guests today. Felicia, frail, Avila frail actually is proof that it is possible to pursue passion and fulfill purpose. And Atlanta, Georgia native. Y’all those are rare. We Shannon and I both live in Atlanta. But you know, an original Jordyn Atlanta native Felician takes pride in her role as a mentor to at risk and misguided teens. A teen mother at the tender age of 15, Felicia overcame every obstacle presented by society. She continued to excel academically and graduated on time receiving her high school diploma and principals Scholarship Award from Tri Cities High School in East Point Georgia. Immediately following graduation, Felicia attended the unsinkable Alabama State University as a first generation college student. During her tenure at Albany State, Felicia served her student body through various leadership positions in student government association. She also pledged to the delta rho chapter of Delta Sigma Theta Sorority Incorporated. Furthermore, while studying for her undergraduate degree, Felicia founded divas div a s in 2009 with the intention to share motivate and enlightened teams about life’s realities through mentoring initiatives. In 2013, Felicia graduated Alberni State University with a bachelor’s degree in middle grade education. And in 2015, Felicia received her master’s in special education from her beloved alma mater, Felicia has been featured on Fox 31 News, and w AC love 860 am for her philanthropic efforts. And that’s we’re excited to talk to her today. This amazing wife, mother of three continues to strive to bridge the gap between the community and the schools located within the community. And we’re going to share her website where you can visit to learn more about her services that she provides. And we are so excited to welcome to the screen today. Felecia, how are ya? Great. We are excited to have this conversation with you.

Felecia Frayall 19:04

Yeah, I’m excited to be here. And yes, of course, the beginning of the show. I know it is very tough to kind of get through everything that our world is going through currently. But today, we’re gonna talk a little bit about that, that wellness that we really need to discuss financially ready.

Christine Gautreaux 19:25

Yeah, so you have an incredible story. And you were so delighted to talk to you about this about. You’re mentoring young girls and teens and kids. And I know you do a lot of that work in nonprofits around financial wellness. So tell us more like tell us more about what your personal purpose is.

Felecia Frayall 19:54

Absolutely. Well, first of all, I want to say that I wrote down a few words as you guys were speaking Um, two words that came to mind. And really as you guys discuss just financial wellness was accountability and passion. I think those two words go hand in hand. Shannon, I listen to you talk about how sometimes you just need someone that can get you back on track. That literally is that accountability piece. And what I bring to the table is passion. So deep was mentor. And program as stated, I started in 2009, at the unsinkable Albany State University, I literally wanted to create a program that could change the lives. At the age of 15, I gave birth to my daughter, I was pregnant at the age of 14. And at that time, I was pretty much told everything that I couldn’t do. No one really reared me in the direction of where I could be, or saw my potential in general. So this was a platform for me to be able to reach back out to those young ladies, not just parents, or a teen moms or anything like that, but literally people who cared enough to really help our youth, because the passion for me lies there. So here I am today with this program that I started that literally started with a seed of vision $0. And I’m saying this, because we’re talking about that financial wellness. And sometimes a lot of people think in order to start, you know, your dream or your passion, you have to have all of this money. And you have to have a real plan. Yes, you need a plan. But sometimes that seed that seed money is love. Its passion. And that’s exactly what I started this program with. Like I said, it literally started with a vision, me just wanting to bridge that gap between the community and the schools located within a community, me being a teen mom and not wanting anyone else to ever feel the way that people made me feel. So with that being said, I went ahead and I started this program, like I said, with $0, but I had $100 million in passion.

Christine Gautreaux 22:02

So tell us for our listeners that are listening, how do you do that? How do you start a program like that? How do you start a nonprofit? was the $0? Like, what do you do?

Felecia Frayall 22:15

Okay, so in order to start a program, first and foremost, a nonprofit is really geared towards providing a service, a much needed service to a community, or a body of people. So the first thing is to do your research, what is lacking in that community that you could provide.

So as a student at Albany State University, I noticed that Albany State is known I’m talking about literally known for Albany State is so small, it’s only a college that really is the reason why it is known as much as it is. So I knew that I wanted to kind of like bridge a gap. I mean, if people knew Albany State, but Albany State wasn’t doing much for the community, that means that I can bridge that gap. So when you’re developing your nonprofit or that passion, you’re trying to figure out how can you fit it in? First, do that research? What is it that the community needs? What can I offer it free to little cost? That’s where that nonprofit comes in that it literally is that passion to give back to your community? So that’s exactly what I did. I saw that our community needed more community engagement. So we started out with doing community block parties where we provided free services to the community. We did haircuts, we did free DJ to come out free food, we connect it with community partners to just provide free information for that day. It doesn’t always cost to be the boss. We hear that saying a lot. You know, it costs to be the boss. Yes, some sacrifices must be made. But at the end of the day, you can really start this program offers sheer passion, and a plan.

I knew from the very beginning what I wanted to do, how I wanted to do it. And of course, I had learning curves along the way. But nonetheless, I was still able to, you know, create this vision and make this vision a reality for myself.

Christine Gautreaux 24:16

I’m gonna guess I might be wrong, but I bet you had some good partnership power along the way, with collaborations with people and community partners. Are they still in the well?

Felecia Frayall 24:30

Initially know, I knew nothing. Once again, I was a college baby. So to see how far my program has grown, and this is why I do consulting now. Because a lot of the steps that I took in the past, I would never make those common mistakes today. And I do mean never.

Christine Gautreaux 24:50

So that’s a good like right now, if you were to go back and talk to that college baby cell would be what would be the top three things or where advice you would give her

Felecia Frayall 25:03

I would definitely say continue to collaborate. That’s something I learned later in life. A lot of people think they want their name in the spotlight. But collaboration is the key to success, you know, working with other people, because sometimes you don’t have all of the resources that you need, but someone else may have those resources. So I would definitely say that, I would say before launching your business and going public, have the plan all the way planned out. Have it all the way planned out, don’t be so anxious, I know, this generation seems to be more of that, you know, instant result generation. But some things truly take time. And if you build that foundation, you will build it on solid ground. Therefore, your organization can last a very, very, very, very long time. And the third thing I would say is to secure sponsors. I always felt like I had to do everything. Now. No, I started with $0, which I did. I mean, other than the cost of actually starting your nonprofit, everything else was penny pinching here. They’re taking donations. But one thing about donors that, you know, they’re very supportive at the very beginning. They’re like, Oh, yeah, you got a great vision. And let me go ahead and give you some of these coins. And then when you x again, it’s like, all right now you asked me last week, you asked me last month, you know, so those wills begin to dry up. So do like, create yourself a large network of supporters. And don’t use everyone for everything. If they’re very passionate about one part of your organization, for instance, we have a scholarship fund that we do, which is called Project Strive with my mentoring program, I only ask certain sponsors to donate to Projects Drive, as opposed to asking them to support every initiative that I that I do. You know, therefore, I’m not veering out my supporters and not feeling like every time I come around, I have my handout. But if I decide that, hey, you know, I’m going to target this towards this organization, because I know they support teen pregnancy prevention. This organization supports Drug and Alcohol Awareness, then I can be more strategic with whom I’m asking to support me during that timeframe. I hope that makes sense.

Shannon M. 27:34

Absolutely. And I love that you do that specifically, because we were talking about on one of our- excuse me, financial wellness episodes, sparking joy with the money and putting it intentionally in certain places, right. So I, as an investor, be more than happy if I had the cash flow that I wanted to invest or do whatever with to, to give it to a company that aligned with me in a certain place instead of this person that I know, of course, I want to support you. But that’s not necessarily in line with my projects that I have going on. Right now, it might not be the best fit. So I love what you said, we’re building women connected in wisdom and going through all the foundation stuff, right. And one thing we talk about is collaboration versus competition. And what you just said is something that somebody might not tell you, they’re not going to tell you to get a whole list of people and be strategic about how you reach out. And also it might be that might be sometimes because it could sound manipulative, but it’s not it’s again, being strategic and making sure that you’re aligned with the right type of person for the right type of project so that those in the community that you’re trying to help get help from the person that’s most aligned with exactly what they need. So I love that you do that.

Felecia Frayall 28:50

And I must agree with you 200%. Because what I’ve noticed, just from doing this for so long, is that people they want to support you. Not everyone can support you in the same means. And what I mean by that is sometimes we look at support as only being financial. That may not be what people are able to give that very moment. But they may be able to support you by reposting something that you post on your social media platform, they may be able to support you by speaking to your mentees or something of that sort. So support comes in different ways, but definitely aligning different people. It’s kind of like, I like to think of as like my friend group. I don’t put my friends in all of the same categories. I know I have the friends that I can call and boohoo to. I have the friends that I can call if I want to take a trip. And I have to do the same thing when it comes down to looking at my sponsors and people who support my program because although they love me and love what I’m doing, they may not love every initiative enough to support it financially. Absolutely.

Christine Gautreaux 29:58

I think what I’m hearing you say A Felicia is the key is relationship building. That knowing like building these relationships, knowing that network of support, I think were the words you use that I really liked that like, you know, we love that channel and I hear it women connecting with we’re all about, like, let’s connect and let’s network let’s support. I mean, that’s how we got you here, right? Cuz she was like oh my gosh, Felicia Felicia is one of our authors and so like, connection, right? It is. How do we build these relationships? Which often, you know, because I heard both of you and Shannon say it. People want to support us. People want to support our visions and our dreams. I mean, we can’t support everybody, right. But there’s plenty of people out there. They’ll be like, I love what you’re doing. Let me let me help you.

Shannon M. 30:57

Absolutely. And for me it. Absolutely. Oh, go ahead. Go ahead. Well, you’re gonna say, Felicia,

Felecia Frayall 31:04

I was just gonna say just thinking about once again, all of the things that I probably would have gone back and told myself, in addition to like collaborating, it is not a competition, I heard you guys say that. It’s not a competition. If you have to tell yourself that 200 times it is not a competition. It is not a competition, there is enough room for all of us here. If there wasn’t, then the government would no longer be given out 501 C threes. It is not a competition. When I look at the Georgia’s Secretary of State website, literally Georgia has over a million LLCs nonprofits fall in the lowest sector, it was about 88,000. Out of that million, there’s enough room for all of us if there is. So don’t be afraid to collaborate. Don’t be afraid to if you’re unable to do those resources, because I know you guys mentioned earlier, or a tad bit earlier, about like, just working with other organizations. That’s really, really, really important, especially when you’re looking at getting grants. Because what grants tend to do is they look at if you’re unable to fulfill the whole grant, they’re looking at contractors who can come in and do the parts that you may not be able to do. So they won’t deny you for the full grant. But they’re going to give you that responsibility to say, Hey, if you don’t have someone to do self confidence in your program is still a part of the grant. So it still needs to be fulfilled. So how about you reach out to another nonprofit organization that you can contract and to do that portion of it so that you could still receive the full grant? So collab, collab, collab, there’s enough space for all of us.

Shannon M. 33:01

Yes, yes. So Felicia, when you think about nonprofits and financial wellness, I know there’s different strategies, then, let’s say for my company, Shilo glow, right? Because it’s not filed as a 501. C three. So how do you walk them through that process of making sure that they’re stable and thinking about things the way they should with where they are in their nonprofit?

Felecia Frayall 33:23

Okay, so the first thing, when you’re getting ready to start your nonprofit, please think about your startup costs. Okay, and these are just your legal fees to getting things started. And of course, this does vary state by state. So I am most fluent with the state of Georgia, because that’s where I found most of my clients information. So with that state of Georgia, the first thing that you’re going to do is get your articles of incorporation. That cost is $100, from what I’ve seen in multiple states is pretty steady across the board. So your Articles of Incorporation makes you a legal entity in your state. Now, what does it mean to be a legal entity that means that now you’re a business, okay? You’re a business is recognized about that state. So a lot of people, they get that confused because they think they start this business and then they see another business with the same name and a different state. Once again, you’re a business in the state that you’re registered in. If you want to do anything other than that, you may want to get a trademark so that no one else can use it in their state. So those are two different things. I have to explain that a lot. I want to make sure that you guys get that two completely different thing to be trademarked and then to be identified as a business entity within your state. The next cost that you will definitely want to consider is the mounts Val your 501 C three. Now this cost does vary. So I will not give you a flat number I would say look on your Georgia Secretary of State are not Georgia, but you’re a secretary of state based on the state that you’re currently located in. Because they’re going to give you the flat rate. Now there are people such as myself, who do like consulting and will actually file your paperwork, of course, we charge additional fees, in addition to whatever that filing fee may actually be. For me, I do include your filing fee within my services. So it’s not extra extra on top of extra. So you may want to consider that. Another thing after that 501, c three is filed, you’re pretty good until the following year, where you have to do your annual registration. Okay, for nonprofits, that annual registration is only $30. Okay, so you could pay or for up to three years. Or you could just pay it year by year, which once again, is only $30. For my people out there who are filing an LLC, this is exact same process, you’re getting your articles of incorporation, there, you will be listed as an LLC as, as opposed to a corporation. Okay, your annual filing fees each year $50. Once again, I’m giving you the state of Georgia. So please check with your state, make sure I make that clear for you guys. But those are all of the fees that that should be associated with starting your business. Okay, if your LLC and you’re trying to get and you’re trying to get like a building that you may need to do a business license as well, which will incur additional fees. But for the most part, it really is just that simple. receiving your LLC, your EIN is pretty much it is free, that is free to receive. And that is your employee identification number. So that when you begin to have employees, or when you’re opening up your bank account, that is the number that you will use, as opposed to using your social security number. So it’s basically a social for your business. Okay,

I just want to draw your handle, I just want to jump in real quick, with a little bit of wisdom on that one, it is free. And then there are services that pop up like it’s paid when you go to search it online, that will try to get you to pay them a lot of money to file it for you. And y’all, it’s quick and free. And you’vegot people

it’s free go to irs.gov.

Christine Gautreaux 37:26

Right. But that, you know, we’re all about tips, tools and resources on this show, Felicia, so I just wanted to tell you all be careful, because there’s people yes, that will file it for you for a couple 100 bucks, but you can do it in five minutes for yourself,

Felecia Frayall 37:40

you can do it in two minutes for yourself, it literally takes a second. So I highly suggest now the only thing is in order for you to file that file for your EIN number, you need to do it on irs.gov. And it has to be between the hours of nine to five. So if you try to file it after that, that’s when you’re gonna get those different websites that are charging you $275 To get an EIN number that costs free. 99

Christine Gautreaux 38:09

right. I love that free 99. Absolutely, I can tell why you’re such a good mentor. Like I love that you go straight to the practical like you tell people like this is how you do it. 1234. And I think people I mean, we talk you know, we talk every season about financial wellness. And we always talk about budgeting we think we talked about, you know, I don’t want to say simple things, because they’re they’re often not simple if you don’t understand them, right. But I we were as we were prepping for our book coming out this fall. You know, one of the quotes that I ran across was about how we need to change the system of how we educate people on finances, because it’s not taught in our public schools. It’s not, if you don’t come from a family that talks about money or knows how to deal with money. It is it can be a challenge. So it sounds like divas does a lot of this for the community.

Felecia Frayall 39:13

Absolutely. We share financial literacy. Financial literacy is very, very important to me. And we talk a lot of about it with our young ladies, we actually do a whole six week session with them just on like you said, what seems to some people as simple such as budgeting, credit, all of those things our girls are exposed to at a very early age because the decisions that you make today financially, will impact the rest of your life. And I have to get on myself about that because I’m nowhere near perfect. And sometimes when I get that that email or that text message saying that there’s a sale going on, I have to check myself and I have to figure out is this a need? Or is this a what? You know, and I think that if we can even though some Sounds like you need it because the summer is coming up. Nevermind. Okay. No, but I’m serious. You know, it’s really hard sometimes to show that discipline financially. But the decisions that we make could really impact us in a long run,

Christine Gautreaux 40:17

right? Like, we’re, I think just looking at our faces. And if you’re listening like we are of different ages on the show today, and at different stages in our life, and my husband and I are at that age that we’re starting to talk to retirement planners, like, yeah, we think decisions we made in our 20s are definitely coming back to be like, yeah, if we can go back and talk to that younger self. So

Felecia Frayall 40:48

hello, if I would have did my Roth, when I was first introduced to it, and my early 20s.

Shannon M. 40:55

Guy, right. Wait a minute, I’m sorry. I’m gonna have to pause the conversation since I don’t want to wait till next season. Okay, so let’s talk about it. Let’s take a second. So your retirement conversations, Christine, what is it that you would do differently? And then Felicia, what? Are you talking about a Roth IRA?

Felecia Frayall 41:12

Correct.

Shannon M. 41:13

Okay.

Felecia Frayall 41:14

Yes, ma’am. I just wish I would have started just a tad bit earlier, you know, and really, it only takes like, $25 a month that you guys can and I spend that easily. I just did that like on a salad. Luckily, it was a salad. But a salad with fries. Okay. But that was something I could have invested in myself. And I think sometimes we look at money. And we think, hey, you know, when it comes to spending money on the things that we truly need to spend it on, we neglect the things that we need to be investing in life insurance. investment accounts, those are all things that we look in and say, Oh, we don’t have enough money for that. But yet we spend those same coins going to whatever our favorite store is, that is not okay. It’s not okay. And it’s not setting us up for the future that we want. As we talk about retirement. So I’m gonna turn that over to you baby, what you got going?

Christine Gautreaux 42:14

Well, you know, the same thing is just really looking at if we would have invested earlier, it would have been so much less, you know, we wouldn’t have to play catch up, or we wouldn’t have to, you know, and, and I had the privilege of a lot of time working part time jobs, or working from home or taking care of my kids growing up, which I know was a complete privilege, right. But my retirement account does not look the same as my husband’s retirement account. And y’all know, like, I am a strong believer in equality and women’s rights, and I’m looking at these numbers going

Felecia Frayall 42:56

That isn’t happening.

Christine Gautreaux 42:58

And I think as women like we had Laurie on the show. She’s a financial coach, a couple of seasons ago, and she was talking, I can’t remember if she talked on the show or talk to me about this, because I hired her as my money coach. And I’ll put her link in our in our show notes. But she was talking about having conversations with your partner, if you are staying home and taking care of the kid, like having financial conversations and commitment to where a part of the household income is going towards your retirement. And if you’re doing that unpaid labor, that it’s not unpaid, that it’s being tucked away and invested for retirement in your name. And you’ll when I was in my 20s, we didn’t have these discussions. We didn’t talk about this stuff. And I think it is important to talk about and I do think young women are a lot more savvy about it now and how you know, we there’s access to resources that weren’t available when we were growing up. Uh, when I was grilling me speak for myself when I’m going up, you know, I’m in my 50s Now you’ll, I mean, I’m gonna date myself, but I got to type on my first computer. I think I was a junior or senior in high school. So you know, now we can get on our mobile devices or computers, and listen to me date myself with mobile device

and we can access like udimi and like basic financial literature, literacy and literature to but you know, that we can teach ourselves or be taught about it in a way that that we didn’t know before, you know?

Shannon M. 44:45

Absolutely. And I love that. I can tell you, Christine, almost 100% I don’t think we talked about it on the show. That’s I thought that I would remember that and that’s a great point. You know, especially when we talk about women in business. And in general, you know, with our with the way that we earn money, I think was at the beginning of this year, Christine, the research show that last year, a black woman would have had to work till August of the following year to make the same amount that a man would make. So we’re working part time on top of that. Thank you. There’s a theory, right? So when we look at, again, how we get paid, and then the time that we take out of the workforce, we look at life expectancy, and what everyday operations look like when we get older. That’s why I think it’s so important to talk about no matter what the age is. So Felicia, with your divas, and the six week program that you have, what age range do you advise, take that program.

Felecia Frayall 45:47

So we offer it to our young ladies sixth through 12th grade. So we literally do it every single year. We’ve used je a finance, I absolutely love them. They’re located here in the state of Georgia, but they do have virtual programs. COVID did a lot. By the way. COVID opened a whole new world when it comes down to programming, and still being able to reach people from home apps literally. So we actually started that program. And it was a huge success. They offer curriculum, there are so many resources out here, and I don’t have them all off the top of my head that you can definitely begin speaking to your children about now, because I’m one of those people who my husband knows, and I’m so fortunate, I will leave a job in a second. Okay? Not because I’m not dedicated, but because I’m dedicated to my self worth, okay. And because of that, sometimes I take a year off to recalibrate, re energize, because what I bring to the table is so magnificent, that I have to make sure that I’m full enough to empty out again, you know, and just like you said, looking at my retirement versus his retirement, it’s a big difference. Luckily, I am a saver though. That’s one thing, even when I was working, the only thing that gets me tripped up every time guys, and I’m not going to tell you a story is buying buying clothes. Sometimes I see those sales, and vacations, those two things, like for some reason, I just can’t, I have to have a little more discipline in those areas. But I can honestly say that when it comes down to truly saving, and putting money away and my Roth and putting money away into my savings and investing, that’s me all day. My husband, he doesn’t make the same financial plans I do. But he does have his stuff taken out of his check, you know, but it’s a little different. But for those people who take off, like Christine said, definitely figure out a way that those funds can still be being saved under your name, because that’s where that difference is going to come from. So expose them early was a key to what you action, and early as you possibly can. I’m not going around a circle on that one. But sixth grade.

Suppose I’m earlier than that, I have a six year old who is so invested in saving, like he literally goes around the house, he’ll find $1, he’ll put it away, he’ll tell you what not to spend it on. He’s one of those kids. And if we start them off early by saying, Hey, baby, this is a budget, mommy isn’t made of money. And I’ve heard that my whole life is not made of money. We’re not made of money. But guess what we can secure money if we if we teach each other how to do that. And if we’re more transparent with our children, about what we’re actually spending, sometimes as parents, like we try to shield that from our children. And we you know, we don’t share with them how much it actually costs to live in the house that they’re not grateful for. We don’t share with them. You know how much it actually costs to get them back and forth to school. If we’re filling up twice a week, you know, those things they actually need to see expose them earlier. And I promise you the financial mistakes you made, they won’t, because they’ll see what you actually had to do. And they won’t see it as an adult because I didn’t see it until I was an adult, which is a problem. We don’t see it until later. Oh, I didn’t realize how much my mom went through, you know, to make sure that she provided for us. But if we are transparent right now, baby, this is how much this costs. I need for you to appreciate the things that you have, you know, then I think it would really make a difference and steering us to the right direction financially.

Christine Gautreaux 49:50

I agree with you, Felicia. And I think that’s part of financial wellness, right? It’s a part of having the conversations are there and to not shame yourself or anyone else if you did don’t have those conversations, if that’s not where you came from, just to take a deep breath, do a little self care. And it’s never too late to start. If you can start today, we’re gonna have some resources in our show notes, including how to connect with Felicia. And you reach out have some partnership power around this and some accountability. And, and you won’t I don’t think you’ll regret it. So not at all. Y’all, I am paying attention to time. And I hate that we’re already almost at that time. But

Felecia Frayall 50:39

great, though.

Shannon M. 50:43

Yeah, so you gotta go to this graduation, though, because we’re celebrating. Okay. Yeah. But I love what you said too. Before we go into the wisdom of action action. I think that’s really, in every dimension of wellness, you know, how much does it cost? We started talking about what’s going on in the world. It costs emotionally, mentally, something’s cost spiritually, you know, so, again, all the dimensions so us as women, sharing our stories with our families with each other, saying, hey, it helps us set realistic boundaries and expectations so we can set realistic goals to get that life. I would love to be able to take off a year and read you absolutely, because what I bring to the table is magnificent. I love how you said it.

Felecia Frayall 51:27

Give yourself credit for that.

Shannon M. 51:29

Yes. Okay. And I can tell you, you do show up magnificent. And that’s why I came from the third floor to the second floor. I said, Felicia, I got a question. Let’s talk real quick. Okay, so thank you so much for your time. But before we go, we always ask our experts a question about what you’re doing in this dimension of wellness for this week. So for financial wellness, what are you doing as your wisdom in action?

Felecia Frayall 51:56

You know, what I’m doing this week, I’m actually preparing for next month, as we’re coming to the end of this month. My daughter just graduated, I’m going to my menses graduation today. But there are a lot of extra spending that I’m doing right now that I need to really focus on and decide whether one moment is worth a financial setback. Okay, so this week, I’m going to be going through and looking at my budget and seeing what I can afford to actually do versus what I would like to do and make myself okay with that. I’m going to be well whether or not I spent a lot I spend a little so that’s what I’m gonna be doing for this week.

Shannon M. 52:45

I love that

Christine Gautreaux 52:47

sound advice? What you do and Shannon? Yes.

Shannon M. 52:49

Oh, I’m gonna do one of my wins as a hashtag. We’re gonna go ahead and say a hashtag paying off student loans paid off a student loan today. Yes. Oh,

Christine Gautreaux 53:01

Right?

Felecia Frayall 53:05

Yes, I will mail you mine.

Shannon M. 53:09

I will mail it back.

Christine Gautreaux 53:19

Action for today is I am going to audit my electronic payments. You know how often I have kids that use my account, my Apple account and things like that. So it’s time on a regular I go back and I audit those to see, are we using the programs that we are automatically signed up for? Because you know, a lot of them are like $1.99 or 290. You know, their quote unquote, little but boy, that adds up, especially if you have more than one person doing it. So it is that time for me to, to audit the accounts is what I call it. So that’s my hashtag.

Shannon M. 53:57

I like the hashtag audit the accounts. Okay. Well, thank you, lady so much again, Felicia, thank you for being our expert today and your sound advice on collaboration and sponsors and nonprofits.

Christine Gautreaux 54:13

Yeah. And we look forward to hearing more from you. And we know we will is one of our authors in Yeah, thank you and have fun at that graduation tonight. By such a fun conversation. It always shocks me when our financial wellness conversations go this long, because you know, I always think are we gonna have enough to talk about and boy do we ever

Shannon M. 54:37

seen with this book, I’m telling you about it. You don’t have millions to talk about, okay, you better get ready, get the accounts ready, because every time you know it’s Profit First day, that’s why I’m so excited. That’s why I was diggin on a song and because it’s the 25th and if you listen to the podcast, you know that we move money based off the Profit First system on the 10th and the 25th. So to me going to the The Bank and looking at my accounts and paying stuff off and talking about financial wellness. I feel like everything’s in place. Yeah,

Christine Gautreaux 55:08

I love how excited you get about it. Well, we’re at time but before we go I want to give a shout out to our sponsor Shayla glow. And in the show notes folks can find you they can go and order products and know that

Shannon M. 55:22

and actually right now we are sold out. We have been booming everybody has been needing it for their trips in their gifts, which is amazing. But get on your get on the presale list if you’re interested. And you know that you’re going to need some soon, we’re going to these dropper bottles and the glass containers. So I’m so excited for oh, man, I love the application, like instead of the sprayer spraying or clothes or might get on something now it’s really easy to apply. It’s faster, so it’s gonna be great. I love it.

Christine Gautreaux 55:51

Yeah. And I also want to give a quick shout out. I’m starting a program next week, Interplay life practice program for helping professionals that I’m going to drop a link in to the show notes if folks want to join us because it’s a it’s a fun way to get see us and to take care of yourself as a helping professional. And I know a lot of our listeners and women out there are so I just want to put that out there in case they want to join me so absolutely. Thank you so much for our conversation today, my friend.

Shannon M. 56:22

Absolutely, absolutely. I’m looking forward to it all. I was looking forward to it. I’m grateful for it as well. Episode 69. Is it a wrap so we will officially be in our 70 Does that make us old if we’re in our 70s What’s your podcast?

Christine Gautreaux 56:38

Here’s the deal. 70s looking younger and younger to me every day. It’s almost

Shannon M. 56:43

Okay. Let’s wait a few. Wait a few weeks and see for over 100 All right, right. That’ll be sooner than later. Okay, ladies, we’ll be back Live at Five next week. Thank you for joining us. And don’t forget, be well be wise and we hope to talk to you soon.

Unknown Speaker 57:09

Thanks for listening. This has been the women connected and wisdom podcast on air live on Wednesdays at 5 pm. Eastern via Facebook and YouTube. Be sure to like share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment