Show notes –

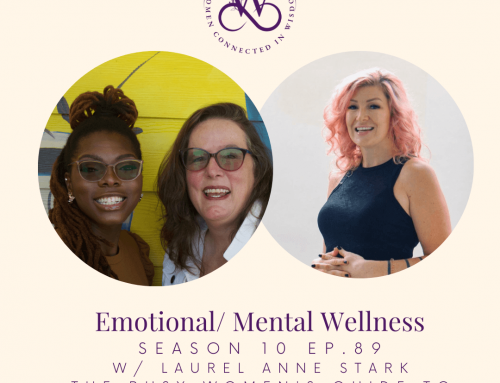

Join Christine & Shannon as they chat about financial wellness this week on the women connected in wisdom podcast.

Shealo Glo – www.shealoglo.com Now offering Subscriptions * Delivered on the 1st & 15th!

Discount Code – WISE5

Nominate your Shearo by emailing subject “My Shearo” to shealoglo@gmail.com

Stillpoint – https://www.amazon.com/Stillpoint-Self-Care-Playbook-Caregivers-Breathe/dp/1732370400

Book a private coaching session with Christine at: https://www.christinegautreaux.com

Join us in community: https://women-connected-in-wisdom.mn.co/feed

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Like & Subscribe to get notifications when we are live

Instagram @womenconnectedinwisdompodcast – https://www.instagram.com/womenconnectedinwisdompodcast/

Facebook page Women Connected in Wisdom Podcast – https://www.facebook.com/womenconnectedinwisdompodcast

https://www.greenpath.com/the-budgetnista-talks-next-level-adulting/

https://wisetransformation.com/sovereign-women-2022/

https://scottscheapflights.com/

https://www.cnn.com/2021/11/03/politics/paid-leave-pelosi-add/index.html

https://www.instagram.com/letslivelifeunlimited/

https://www.house.gov/representatives/find-your-representative

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Shannon M. 0:08

Let’s do this. Okay, ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of shallow glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness.

Christine G. she/hers 0:25

And I am Christine Gautreaux, a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself in community care.

Shannon M. 0:35

Yes. And together we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness. Welcome, welcome to our show.

Christine G. she/hers 0:44

We like to get together every week and chat about how do we do this? The you know, how do we cut together all our, our wellness and our wisdom for business and relationships in life? Right? Yeah, because life happens every day. Right? So how are you my friend? Let’s check in and say hey, and and before we jump into our topic today, because I know it’s one of your favorite topics. So

Shannon M. 1:10

yes, I’m good, like you said, glad to be here. You know, I constantly think about the relationship between or how we say holding both grief and gratitude. And every week this year since we’ve been here, it’s five seasons of it, you know, there’s been so every week, so I am so thankful for everything I have going on. I’m tired, but I am so excited about the things that I’m doing that are making me tired. So it’s a great place to be.

Christine G. she/hers 1:41

Oh, I so resonate with that. I’m tired today, too. I just came back from a vacation, which we talked about on the last show. It was wonderful. And, you know, I know this is gonna sound funny, but one of my favorite things about vacation is coming home. Like I love going places I love experiencing and having adventure. But I also love coming home. That may be my sign because I’m a cancer. And I love my space and I love my things. And of course I love my puppy, you know who has grown oh my gosh, I have to send a picture.

Shannon M. 2:16

So he

Christine G. she/hers 2:20

will have to put a picture up on women connected in wisdom because Monty is a half. Scottie half Corgi he’s a score ghee looks like a he looks like a corgi wearing a Scottish Terrier costume. Like that’s really like what? But he was so happy to see us. And of course, I bought him a souvenir. And he was I bought him this new color. And he is just looking so handsome. We’ll have to take a picture of it and put it up on our social media so folks can see Monty. But yeah, but I’m tired. Because you know how when you try it? Well, yes, I have an early bird usually, right? I’m an early bird. And so I picked an early flight home. Because I would rather get home and sleep in my own bed. And I would rather get home earlier than later. But that meant a 3am Wake up call to make a 6am flight. And I still little early even for me, you know and then travel all day and make it home. But there’s nothing better to me than sleeping in my own bed. Now I’m privileged because I have made my bedroom. Like, to me I have the perfect bedroom. I have blackout curtains, you know. And I have a comfy bed and I have my comfy pillows. And you know, and I got back to this beautiful fall weather in Georgia. So it was perfect temperature for sleeping last night. It was It was delicious. So that’s I mean, and my body is rebelling a little bit from all the lack of sleep and travel but grateful. Grateful I got to spend a week with my sister and my siblings. And can I tell you? I just don’t think there are any smarter cuter kids out there. Somebody may disagree with me but ridiculous, Shannon ridiculous and how much of my spirit is full from getting to spend time with them? And yeah, it was good. Good.

Shannon M. 4:25

Yeah, I can’t wait to go to Mexico. I’ve been thinking about how you pronounce it to them. I’ve been thinking about there but I’m open. I love it. Yeah,

Christine G. she/hers 4:35

I don’t did we announced last week that I was in Mexico but that’s where I was. Now okay, well, I was gonna tell a story and I kind of added myself but I will tell the story. So today when I FaceTime with my siblings who are two for our listeners that don’t know their two year old twin boys and we were in Mexico to celebrate their my sister’s birthday and their life because that is the My sister went to a fertility clinic down in Mexico and that is where her babies come from. And so I got on with them FaceTiming this morning and said hello. I said I can’t even remember if I said hello or Hola, but one of them was like oh Lottie so they have called me Tia from the beginning to differentiate me because I am their one biological aunt. But they have such they have such community and have created such community that they’ve got a lot of Auntie’s. So to differentiate me is their one true and they call me Tia. And so it was super fun to be in Mexico with them. And you know, it was just such a joy. But yeah, they got on today just on that Tia. And my heart I just melted, right. I know. We’re not talking about emotional wellness today, but it does my heart good to have a

Shannon M. 5:58

space in my life. Still, you know, to be able to when I think about chips, I think about being able to afford the trip. One. Yes. My brother last night how much he wants to spend. He was talking about going to UCLA and going to Miami. I said, Okay, starts in how much do you want to spend on each trip? He said, I’m sorry, parents. I’m gonna have to break the bank. I started laughing. Now he’s had so funny six. Yeah, okay, he needs $10,000 for each trip.

Unknown Speaker 6:28

Okay. 10,000, cuz I did not spend that much on this trip. Everybody, including on this trip.

Shannon M. 6:40

I’m trying to take but I like it, you know, but you got to be able to afford the trip, and then afford to not to work, not have to work. And that’s what we talked about last week with the different policies and things that are changing right now. And things that we try to pay attention to and stay abreast on is how how does the work environment change our financial position? And how does our financial position change the amount of breaks that we can take? All

Christine G. she/hers 7:07

right, so we’re talking about financial wellness today and I want to do we want to give you the definition before I give up on financial wellness because alright, you get the definition and then I’m gonna give you one of my best financial tips for travel.

Shannon M. 7:22

I got my pen ready cuz I plan on taking a lot of trips. Let’s do So capturing a complete definition of financial wellness is tricky because it means different things to different people. At its most basic level, financial wellness is a holistic approach to counter financial illness. This holistic approach includes a combination of factors such as satisfaction with current finance, finances, increasing positive financial behaviors, like saving reducing debt and budgeting, finding some knowledge that helps to change behavior, reduce financial stress, and creation of a financial plan to reach desired financial goals. All that? Yeah. And more. All

Christine G. she/hers 8:06

right. It’s so complicated sometimes. But since we’re talking vacation, and since we’re talking that, let me tell you about one of my fate now, you know, I’m frugal. Some people even say cheap, just to be honest. I like speaking about being frugal. She said you call me cheap, because I’m just like you was one of my favorite travel and financial wellness tips is Scott’s cheap flights.com You can get a free membership. Or you can pay I want to say it’s 40 or 50 bucks a year. And you they do amazing deals to the best destinations. And you can save up to 90% on flights. So what they do is they search for crazy good deals, and you’re kind of on their email list. So they will tell you, and if you’re on their pro account, you put in the destinations that you’re interested in going to and like when a mistake fair happens because sometimes airlines make mistakes and so you can get it while it’s posted. Right. So I joined them a couple of years ago, a friend of mine turned me on to them. And so what I started doing is saving a little money in a travel account. So if one of my destinations pops up like at a ridiculously good deal, I can snag it because you really can’t save that much money. You know and I know it’s a little tricky because of the pandemic right now. So I also buy travel insurance because it’s it’s usually worth it for sure. But you get free flight alerts so they tell you like it also if you have a job or a way that you can have the weekend off. There’s a lot of times last minute deals where If you can jump on a plane and go somewhere, you might be able to have a cheaper experience doing that than having a night on the town where you live. Love it. So, you know, so there’s things like there’s way and of course some of this is freedom, right? It’s freedom from job. For me. I haven’t had that freedom because I’ve been raising kids. Until right now. Yeah. Yeah. So I’m a little excited about this, about having the freedom that if like, a crazy good deal pops up. I might be able to go somewhere, right. I

Shannon M. 10:31

love it. Yeah. So this post earlier on, on Instagram, this woman went to Iceland by herself. She was like, Yep, I decided I want to go. I wanted to go. And by that night, I was in Iceland.

Christine G. she/hers 10:42

Right? Oh, Iceland pops up all the time on this thing like that. And I’ve had friends go to Iceland, because it’s so cheap. They say the food is expensive, though. So have a food budget, because so many things have to be imported in. But if you are going for the weekend, you could probably let’s do it. You know, I had actually made that a reward for myself with another friend a couple of years ago, if we met a certain weight goal, but it has not been met yet. So I have not gone to Iceland

Shannon M. 11:13

that you’re going to Iceland. That’s where yes, yes. This was

Christine G. she/hers 11:17

a pre pandemic weight goal. So I’m giving myself a little a little grace, right? Yeah, but yes, Iceland is on the list. For sure. Definitely. What’s on your what else is on your list? Oh,

Shannon M. 11:28

so Africa, of course, multiple places in Africa would love to go. I would love to go to all 50 states. I would love to go to Thailand, Dubai. Iceland, definitely Greenland as well. You know, I want to go to the colder

Christine G. she/hers 11:43

climate. I think I should have asked you where do you not want to go? Is there any place?

Shannon M. 11:49

I don’t think I would be heartbroken. And I might be wrong. But I don’t think I will be heartbroken if I don’t go to North Korea. Right? Or if I do not go to I don’t know, is London and Great Britain. I do want to go to London, but I wouldn’t be heartbroken if I don’t go to all of the different European countries. I’m okay, you know, but I’m definitely still interested. That I don’t know, that’s definitely a shorter list.

Christine G. she/hers 12:17

Because you i You are an adventurous spirit like we are willing to go I’m willing to go and check something out. Now might not be willing to go back to a place twice. That’s important. Yes, right. Now there are some places I would go back to over and over again. Yeah, like there are some places that you know, have a special place in my heart. But what do you look for? We’re off the topic of financial wellness, but I’m gonna ask this question before we get back to it. What do you look for when you go on vacation? Like are there certain cats? Like because some people say like, you take a food vacation or you take an activity vacation or like I realized I look for beauty, most of the time natural beauty for artwork. Like I want to see the local art. Oh, and I’m definitely food. I mean, some things and you must really good food while you’re some Yes, but So those are the things that I budget for when I’m going on vacation. Like if I’m Yeah, I brought home a little bit of art. Not much because I was packing light but I love local art and, and my sister taught me this years ago to she’s like when you’re going someplace buy yourself a piece of clothing or something like it doesn’t like I don’t bring home traditional souvenirs. But like I needed a hat while we were there because the sun was ridiculous. And so I bought this gorgeous hat. That was my souvenir because I’m like, it was local. It was gorgeous. And I can use it again because I’m all about functional art. It’s my thing if I stack things on top of each other, you know so look local arts, and it’s usable. supporting artists, right, right. Oh, love it.

Shannon M. 14:08

I love when I like that win win win situations. situations. Yeah, what do you look for? Definitely natural beauty. I loved watching the monkeys run across the telephone line in Costa Rica and the zip lining upside down in the rainforest is like still unmatched. Okay. I love good food, even though I won’t always do the due diligence it meticulously searching restaurants in their area. I’m not going to do that. But I’m also invested in we’re going to eat good food and I know there’s going to be places for us to find outside of that I really tried to have the organic and the natural experience so that’s one of like Airbnb definitely has me on the whole be at home no matter where you are type of genuine experience of the area. I love that. So the first time I went to New Orleans, I went with my friend that I was living with at the time senior year in college, and we stayed with her friend, and it was definitely like an authentic experience in the house that her grandfather built right down the street from the French Quarter. Get a poboy at a gas station or something. It was amazing.

Christine G. she/hers 15:17

I pretty much know that guess they should do that. Did you? Did you remember that? We were in New Orleans before we left. Yes. So yeah, our listeners probably don’t know it, because I was keeping it on the download. But I had to go to get my passport renewed. Cuz y’all I went and it was not a last minute thing. I had gone weeks ago to get my passport renewed planning for this because this was a celebration of life. And um, so I mean, I we’ve been planning this trip for six months, not knowing if it was gonna happen with the pandemic or not. And we were watching the numbers and everybody got tested, it was all you know, we were really as safe as we can be in this environment. And I had gone months ago to get my passport renewed. And they said, the passport office is backed up, it’s not going to happen in time, or you could put spend all this money and you still may not get in time. So what we need you to do is just wait until two weeks before your travel date and go and do the overnight and pay to express and that like alright, I didn’t even think about no worries, we’re here in Atlanta, we can run down there and get it. And I feel like I’ve told the story before. So if I have online and we’ve got repeat listeners, my apologies. But so we go, I couldn’t get a hold of them, I finally get a hold of them. And they say the closest place to get your passport is in New Orleans. The day before you fly out. I was like, all right forced me to go to New Orleans and have some fun to leave on vacation. So got there. And you know, my last name is Gautreaux. Y’all. This were my families, my family, my husband’s family is from this is where our people are from. And we love the culture. We love the food. So we get there. I check in with my alternate routes, family that I have there that are artists and activist. And there just happened to be an opening of a show that I had seen when it was under development at a conference years ago. And they were opening it in New Orleans for the first time. And I got to snag the last two tickets. So we got our passports. And can I recommend anybody? The New Orleans passport office like those folks were lovely. We got there 20 minutes early for our appointment, they got to send they said, well give us your phone number. We’ll call you when it’s ready. It was ready in two hours. And then we got to go see the opening of the show. That was an eco experience. So it was on the Mississippi River. It was gorgeous. I’ll put a link to that show. It was it was phenomenal. Yeah, I just couldn’t have asked for better food family friends. Like what like, yes. I’m about y’all, but my soul needs adventure. Like I have an adventuring soul. And so, so when we talk about that in regards to financial wellness, like how do we do that? Right. And that’s about having the budget to budget in those adventures,

Shannon M. 18:28

but it’s also about everything that you just said you know, and I think that’s the beautiful thing about wellness and how it weaves into all of our situations. What do you said planned you know so you plan things you had a travel traveling money that you’ve been putting aside that also means that you were making money and you were intentional about how much you needed to make so that you could put it aside you know

Christine G. she/hers 18:50

side note their plan for more

Shannon M. 18:54

God in both the budget cuz I need to but also anybody’s budget you know what about traveling and traveling to all these places that you thought you could never go? What if you go to Scott’s cheap flights and now you’re good and so that that money for your flights to go go to your souvenir and now you can have a great time.

Christine G. she/hers 19:15

You know, you bringing that up Shannon is something I talk about with my private coaching clients. Cuz you know, we talk when we talk financial wellness about a budget, right? Yeah. So sometimes and this sounds the sounds overwhelming. I don’t want people to get overwhelmed, but it’s a fun exercise. Sometimes I have people do three budgets, and they don’t have to be full on out budgets, but like I have people do your survival budget. Like what do you need to what do you need to survive? What do you need to bring in every month and how are we going to get you there? I have a budget that is your comfortable budget. Like you are not only you’re surviving but you’re thriving, you’re comfortable. And then I have your manifesting opulent this If you win the lottery, or you, you know, you’re an overnight success, which most people who are overnight successes have worked for 10 to 20 years without blinking. You know, that budget, like what’s on that dream vision, and creating that vision board, or creating the budget, you can do it, it depends on who I’m working with, if they’re analytical or visual, or you know how they look at things, but we can create and manifest in different stages also, right, and be grateful for what we have, and also talk about what else we want to bring in.

Shannon M. 20:38

I love that. And it’s really important, you know, like I it’s who said, it might have been Dave Ramsey, they was talking about how people get so anxious about looking at their bank account, like people do with their report cards. And I said, Oh, I get it. Because again, I was an honor student. So report card, I was fine. I knew I did the work. I knew what my scores were, I wasn’t worried about it. The bank account. The first time I was salaried, I couldn’t tell you how often I looked at that, you know. So now knowing that that’s one of my self sabotaging habits, I’ve been very intentional about not doing, check your bank account, know where the numbers are. And I’m so glad that I’ve been doing that because subscriptions hit, they might be about to end and I need this program, or I actually have now I actually have a little bit more money. What do I want to spend it on? Where do I want to put it? You know, and especially when we talk about the Oculus budget, and I call it I think we talked about it before the what is it called lower, when you have a the abundance budget, you know, is this is how much you have, where is your money going, you still need the skill to be able to tell it what to do, or you’re gonna lose the amount of money that you make, you’re not going to make as much or it’s not going to be used effectively. And that’s not well.

Christine G. she/hers 21:51

And I also think our priorities change, right? As our lives change, or as we grow, or as we, you know, really had a travel budget, because I’ve been busy raising kids. And now that or sometimes I have a work travel budget, because I’m going to work I’m not. We weren’t a family that took vacations growing up. Like we, I my husband and I were just having this discussion. And I’d be curious about our listeners, like what their family patterns of behavior are. Because our family pattern of behavior, we grew up in Texas, and we would drive places we didn’t I don’t remember flying until I was for my senior trip, where I’ve actually it was my graduation present that my aunt gave me. And she lived in California and flew me out there. But I we drove places. And when we went on, quote unquote, vacation, we went to family members houses to help them. So like we would go to my grandfather’s farm, and it would be a vacation from my regular life. But it wasn’t like what you see is a vacate, it wasn’t what I just had, right? It was you were working, like we built the house, we

we would get to go fishing, and we would usually take the leg day and we might even do a little camping. But there was always there was always an element of work attached to it. And, you know, I think that’s growing up. I mean, I think it’s different cultures, you know, part of it was is is we work we had a family that needed help. And so that was we would do big projects together as families, we would support each other. And I don’t think there was a lot of money in the budget for going different places. But I was married several years. And my husband looked at me and said, we’re not doing that. And I’m like we’re not doing what he’s like we’re not working every vacation. That’s not a vacation.

Shannon M. 23:54

Yeah. Good job. Joe said.

Unknown Speaker 23:59

I’m still not very good at it. Sometimes I have to tell you,

Shannon M. 24:02

I have to work on it too. Right? Yeah, I get it. And that makes a lot of sense. How What did you say? How did you say you said families pattern of behavior? Yeah, I definitely saw trips for work. I thought trips for school when my dad was sick. my step mom at the time was in her doctor’s program. So we were driving to Fort Lauderdale four times a year so she could be there in person for her checkpoints and things she needed to do. But I also was going on church trips are learning stuff and going to the beach and socializing and disconnecting from technology and being out in nature, you know, so I think I realized early on, like, I need to take at least one trip a year, at least why and I will love more than that. And so far. Honestly, I think I’ve done a pretty good job, especially my 20s at taking trips. Now what I look forward to is already having the money aside and being able to do it in a wise way and not genuinely not worrying about anything and not trying to move money over figure out how I need to be able to do it and do it in a healthy way, is what I’m working on now.

Christine G. she/hers 25:09

Right? Yeah, that’s a good idea. That’s a good idea. Yeah. I mean, I think I think it’s challenging sometimes when you didn’t grow up with it, to be able to vision it. Right. And so I’m always grateful, the further people have showed me how to do that along the way, who have said, Oh, this is what a vacation looks like, or this, you know, I’m embarrassed to say to folks, but like, Joe, and I really haven’t ever taken a vacation vacation, like it’s always been attached to work, or it’s been attached to a family event, or, you know, we’ve always had fun along the way. And even this was attached to a family event, because it was for my sister’s birthday. So that’s the next goal is just a vacation for the sake of a vacation of it. You know, it’s, I think it’s my papa, even as I said that, I saw my papa, who is my paternal grandfather that was so frugal. He, you know, he would take us out to eat once a year as a family.

Shannon M. 26:29

I think I remember you saying that.

Christine G. she/hers 26:31

That man did not talk about financial wellness. Now, there were so many positives because he could save money like it was nobody’s business. But we also got the message that you don’t talk about money. He did not talk about money. He did not spend money. He like he saved his money. And he was very frugal, and he would take us out as a family once a year. I would say this is probably why I love Mexican food. Because it was always to a Mexican restaurant. I didn’t think about it until I was grown. And I realized Mexican restaurants were usually cheaper. I adored my Baba. And yeah, it was interesting. He was a saver and my grandmother was a spender. And you know, when we had our guest, Laurie, on, you remember the money coach? She talked about that? There were two types of people savers or spenders. Yeah. And I find it interesting. Like how many people are married to their opposite sometimes. Yeah. And I shared with somebody.

Shannon M. 27:35

And I think it’s important, especially now, last week, we talked about occupational wellness, how much we work, especially in America, the culture of having to go get in and hustling and constantly working from a place of, in my mind, I think about a scarcity, right? Oh, I need this. This is what I don’t have let me run and get it instead of from a place of rest. So in order to have both, I think it reminds you to keep the whole picture front of mind. You know, like, yes, we can go on vacation. Of course, sometimes it’s for family, but bad. Sometimes I need us to do nothing thing like nothing together. And yeah, so we have this article that we were talking about before the show. And it talks about putting a budget together and having it be a family activity. And as I go through, it reminded me of the Financial Peace program that I’m working through with Dave Ramsey. And that’s literally what it says, you know, sit down with your spouse, sit down with your partner, and have the person that’s the saver make the budget, because they’re you know, they know where to go know how much the expenses are usually they’re on top of the numbers. But then the spender has to change something so that they can use their voice. Right. And you guys are genuinely working together. And just change it a little bit change one thing, you know, I just needed to, I needed to add more money to my gas budget. Last month, I said I was going to be $75 It was a little bit more. I’m driving more now, you know. So as I stepped into a position of driving more, like you said, what the budget need changes with the budget? Yeah, I think I said that, what it needed change. So I just adjusted it. And doing that together can help you both feel like you’re part of the decision making. We’re doing this together and get you on the same page to really work towards the financial wellness, because when you have a hole in the boat, we’re trying to fill it up and get somewhere. That’s why couples and households tear apart with different prioritization based on different points of life. And now we have this whole thing.

Christine G. she/hers 29:36

Yeah, well, they talk about financial stress is one of the number one things couples argue about his spending habits. But yeah, that article you referenced is that greenpath.com And I put the link in our comments, but we’ll also put it in the show notes and the budget nice is she’s an author, a New York Times bestseller of getting good with money, which wants to talk about that on the next financial wellness show, because you and I both just got the book, and we follow her on Instagram. So she has helped over 1 million women collectively save more than $250 million and pay off over $200 million in debt. So we’re gonna invite her to come on women connected in wisdom and have a conversation with us because she was instrumental in getting the budget nice to law passed in New Jersey, that makes financial education mandatory for all medical middle school students in the state. How powerful is that? Talking about women making a difference? Yeah. Yeah, her name is Tiffany. And she’s the budget ISA and I look forward to hopefully having a having a conversation with her. Yeah.

Shannon M. 30:57

And what I what I love about the medical students is when you first told me that I think about how managers are in restaurants, right. And I think sometimes the way that the staff works together is because of the stress because of the financial stress of these individuals. So I’m working so hard, I’m working all these hours, but I don’t have time with my family, or I don’t have time with my parents. So I don’t have time to do what I want to in my life. But you’re thinking about constantly, every step you take the effort that you’re putting out, and the things that you’re not getting back. So it affects your workplace, which you do and the people that you do it with. So I can only imagine our health professionals and all the work that they’ve put in the years of study in the long hours taking care of people. And we talk about how caretakers are in jeopardy and in danger not only because of their immune system, but because of the stress and how everything goes into each other. So I think it’s great that she did well. And you

Christine G. she/hers 31:57

know, the financial piece of caretaking too, like there’s a lot, you know, most caregivers in the United States are not paid caregivers, their family caregivers. And so a lot of times they are taking care of people that you know, there’s extra mouths to feed or there’s extra. You know, we’ve had this conversation on the show before how our health care system is broken. And oh, I wanted to do follow up from what we talked about last week on the show. So it just came out today that Nancy Pelosi added four weeks of paid family and medical leave back into the social spending bill. So thank you for everybody who reached out and call their legislators. And I think we continue to do so if you haven’t had a chance to, to say that we support the build back better plan, because they need to hear from us. It is it is an important piece of legislation for women and children especially. And it’s called build back better act. And it still needs our support in the House in the Senate for getting it passed. So yeah, so let’s I’ll put a link again, to reach out to our legislatures in our show notes.

Shannon M. 33:16

So we had an election day yesterday. Do we know when the next election date is?

Christine G. she/hers 33:20

Um, well, it’ll depend on where folks live, you know, it will depend on where folks live, because sometimes there’s municipal elections. Yeah, our next big election is probably not for another year. But there’s different county elections sometimes. And there’s some run offs come into Atlanta, that from the elections yesterday, there’ll be some run offs. And that’s what I encourage everybody, I don’t want to speak to it like specifically because it can get confusing. But Google, because a lot of times what will happen is the elections that happened yesterday, look up your county results or your local municipal results. And they’ll let you know if there’s another election because oftentimes folks miss that. And you know, that goes right with financial wellness and what we’re talking about because especially the local elections directly impact us, because like we were having city council elections, and one of the things that was to me that was on the ballot, one of the candidates I voted for was talking about affordable housing. And what goes into that is also like local laws and legislation about can you have a mother in law suite? Can you do an Airbnb? Can you do a share driveway? All of those decisions come from the local ordinances? And so yeah, it made great me great financial wellness to run an Airbnb, or at least it was before the pandemic, but if your local laws say that you can’t, that directly impacts you, right. So all that stuff. You know, sometimes when folks say, oh, politics don’t matter. Oh, then matter in our everyday lives, especially our local politics, which is our city council’s in our county commissioners and you know Gwinnett County right now is I was just reading an article about them trying to decriminalize marijuana, and they’re in a gridlock about it right now. I think we’ve just lost Shannon for our listeners that are watching live hopefully she’ll be back with us and our for our listeners that are are in audio it may just be my voice for the next few minutes. So today we are talking about financial wellness and here she comes. We were talking about financial wellness, I was just giving our listeners the update that we lost you for a second little tech issue. So glad you’re back welcome back. This is a good time since you just pop back on. For our listeners that are watching that are watching live or might be watching our Replay on Facebook or YouTube. We you stand up just a little so they can see the awesome shirt that y’all have on. And for our listeners that are listening, I’m going to describe this shirt to you. It is a beautiful light gray shirt with a gold bird on the front of it which is the shallow glow logo. And on the back can can you show everybody your back? Yes, on the back it says Subscribe and Save it Shayla glow.com It is such a fun. Talk about financial wellness you are wearing you are wearing art and your business at the same time. Yes,

Shannon M. 36:37

our love it. But business my friends brand. Live let’s live life unlimited. Right? So if I’m going to give money to these big brands, of course I’m going to give it to the brands of the people that I know. And that’s what make connected and wisdom they can these businesses collaborate and work together.

Christine G. she/hers 36:56

Right? Well, you put your friends grant in our under the post under the comments. So folks can get that and I will also put it in the show notes. So she made that shirt for you for Shayla. She

Shannon M. 37:09

did. Yeah, she made shirts and for birthday parties and mask and all different types of stuff.

Christine G. she/hers 37:15

Wow. Yeah, that’s awesome. What is happening over at Shiloh glow, talking about financial wellness, what are you up to these days?

Shannon M. 37:24

Oh my goodness, so much stuff. So right now, can you still see me while I type this? Okay, yeah. So right now we are releasing five new products. So this is mine you see is not labeled or anything I’ve been using it. This is the four ounce instead of the four ounce, I double the size. So we’re going to bigger sizes for the home row kits are going to have eight ounces for the sugar scrub, eight ounces for the shea butter, and four ounces for the oil. And for the traveling glow. For the smaller sizes. We had two ounces before. Now again, we’re given more products. So now we have three ounces. That way you know you’re safe for the TSA requirement of no bigger than 3.4. But you’re getting as much product as possible. We have the two ounce oil. And we have the three ounce shea butter. So the traveling Glow Kit, the home Glow Kit, both in three ounces, eight ounces, and Mingo madness, and Lavender Vanilla. So we’re doing a lot the ladies asked for sizes since and what else? Those two things and we’re doing all of it at the same time.

Christine G. she/hers 38:31

Yeah, um, that sounds amazing, my friend.

Shannon M. 38:35

Thank you so much. It’s been really good people have been in getting both the oils, they begin in different sizes and different things based on if they’re about to go on a trip or if they’ve been waiting for the eight ounce. So I’m really excited about it. Oh, and we rebranded so we have new labels and new product names. So the scrubbing glow, the glow oil, and the glow butter are what they’re called, so we can tie the brand together. And so the guys can be incorporated Of course it’s important that our ladies take care of ourselves, but it’s the whole family and that’s really the vision of shallow glow. So whole family intentionally taking care of every day. And I love being able to

Christine G. she/hers 39:13

going from head to toe right from head to toe. Yes.

Shannon M. 39:17

entirely taken care of just like the eight dimensions of wellness we got to be well rounded and completely taken care of.

Christine G. she/hers 39:25

Right Yeah, I have been listening I’m I’m participating in but I’ve also been listening to some talks over at the hearts wide open teleconference. We’ve got some friends of ours that have been guests on the show that are talking over there to seal Armstrong Tracy Reese and it is a global conference that’s happening today. It was started on the first is going through the fifth and it’s called with hearts wide open calm and they I’m gonna put that in the show notes so folks can find it because I think you can you can And listen, it’s free to listen live. And I think there’s a small fee if you want to if you miss something and you want to check in, but I think it goes with what we’re talking about what popped into my brain is because when you talk about Shayla glow, which is part of your financial wellness, it’s your company, it’s things like that. I just see your heart experience, like I see you, shining and glowing from head to toe. So it’s it made me just think about that. It was like, oh, yeah, she’s living her best life. So

Shannon M. 40:30

and that’s what I love. And that’s what, what I think about when I think about financial wellness, because it’s really not just about the money. There’s a lot of things I could do for just money, you know, but I love making sure that people are okay, that they’re taking care of. That’s what I do as a manager, how are you doing today checking in with people’s family and checking in on whatever they need for work. But I don’t really care about the sugar packets, and I don’t really care about sugar packets, you know about you in your life. And so I love being able to do that and do this podcast is great.

Christine G. she/hers 41:01

Right? Well, I love that to my friends. I love chatting with you about wellness and chatting about how do we do it that you know, when I teach my class on Tuesday mornings, my co author and I Sheila K Collins, we have a class on Tuesday mornings for radical self and community care. And one of the things one of our taglines are one of the things we always say is, well, I’ll just give you a little hint of what we do every week, one of the things we close it out is with a ritual where we type in the chat books, one thing we’re committing to for self care, and one thing we’re committing to for Community Care. And the reason we do that is because we say you don’t have to do self care by yourself. It seems like the opposite because it’s titled self care. But we can do this in community. And that’s how I feel about women connected wisdom podcast, and the community is that together, together, we can help each other be accountable, we can help support each other. You know, with financial wellness, it’s one of those things that’s hard to talk about. Because a lot of times there’s a lot of shame around it. But if you don’t like I didn’t know a lot about it, so I feel like I really ignorant about this. And but there’s experts that help us and there are people that we can read books by you know, you and I just ordered our book from the budget Nisa. So we’re gonna talk about that on another podcast, and we’re gonna hopefully have her come on. So. So yeah.

Shannon M. 42:27

And can I say that it makes sense why we don’t know a lot about it, you know, that only like, what what we said our parents behaviors in the way that the other generations were set up other generations had pensions, they had people taking care of their retirement for them. So it’s kind of sold as a thing that you didn’t have to worry about. So now when pensions aren’t in place, and 401 K’s have been the way that they are people don’t know how their money is invested or even how to be strategic about it. Of course, it’s going to leave a whole generation and especially people who will lift out of the education part of it left feeling that way, you know, so a few decades ago, women weren’t even able to have a credit card without a male cosigner. I wouldn’t have been able to start a business me start a business online 150 years ago, no, would have been completely different. Okay, so it makes sense a while when you look at that, especially if the difference between personal finance and business finances attack strategies and liabilities versus assets. It’s all like, I don’t know what you’re talking about, you know, saying you have to be intentional about our education on it. But together, me and my best friend, we’re going to have a tax day, I want to get ahead of the tax numbers. We’re going to sit down in a room together and go through our expenses go through our revenue, we get everything organized.

Christine G. she/hers 43:46

Oh, I love that so much. Yeah. Well done. Well done, my friend.

Shannon M. 43:52

Thank you. And I had actually put it on the day to celebrate my mom’s life yes, because that was coming up. So I changed it though, because of boundaries and said you know what, maybe I don’t need to mix these two together, I know I’m off but I don’t need to operate again from a place of you got to get this done at a certain time No, let stuff have the space that it needs. And then you can completely focus on the numbers in heavier mind. So that’s my wisdom and action this week while we’re talking about financial wellness is updating my my expenses I have some stuff to organize from this huge alliance that we’re having all this production that we’ve been doing putting some money into the economy I need to organize my and get ready to get these texts members organized. That’s what I’m working on.

Christine G. she/hers 44:39

My wisdom and action is I’m gonna call Laurie my money coach because I think I have a session with her that I need to finish that I had to cancel talking about holding grief and gratitude. I had lost somebody and so I’m going to circle back around as we’re coming into November. How the heck did that happen? I’m looking at wrapping up the end of the with finances and my business and things like that, so I’m gonna call and make an appointment and get some support on that and finish out the year strong with you know, what do I I want to be in the present and wrap this year but I also want to be looking towards next year about what do I want to create. So you and I next year can go to Boosey address and and celebrate women connected wisdom, maybe even having a retreat there like that would be that would be delightful. So well. We’ll be we’ll be in the same room.

Shannon M. 45:36

Maybe we have some tea and chocolate like you always talk about that a lot of ideas.

Christine G. she/hers 45:41

Oh, those gift baskets would be off the chart as far as kids, you know.

I love it, my friend. I am so delighted to have this conversation with you. I look forward to next week. I think we’re having a guest co host next week. We will see you in two weeks. But in the meantime,

Shannon M. 46:10

yes, in-between time. Don’t forget, be well be wise. We’ll be back next time.

Unknown Speaker 46:25

Thanks for listening. This has been the women connected and wisdom podcast on-air live on Wednesdays at 5 pm. Eastern via Facebook and YouTube. Be sure to like share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment