Show notes –

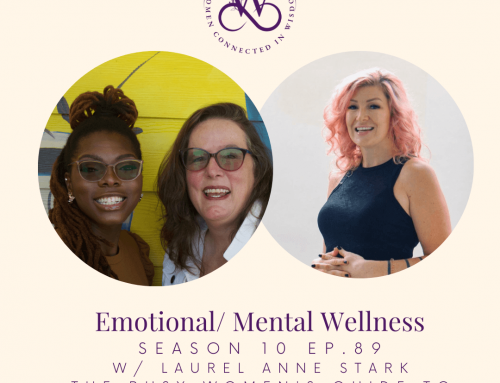

Join Shannon & Christine as they talk about Financial Wellness with special guest Terri Stigler.

Capturing a complete definition of financial wellness is tricky because it can mean different things to different people. At its most basic level, financial wellness is a holistic approach to counter financial illness. This includes a combination of factors such as:

- Satisfaction with current finances

- Increasing positive financial behaviors like saving, reducing debt, and budgeting

- Financial knowledge that helps to change behavior

- Reduced financial stress

What resources have you used to increase your financial wellness this year?

Share your thoughts and plug into our community by joining us on Mighty Networks as we support each other personally and professionally through intentional conversations, collaborations, and classes.

This week’s resources and references:

Contact Terri Stigler at: 215-218-8001 or TerriStigler@verizon.net

Secrets of a Millionaire Mind by T. Harv Eker

Secrets of Six-Figure Women by Barbara Stanny

Second Chance by Robert Kioysaki

Submit your Shearo Nominations with subject “My Shearo” to shealoglo@gmail.com

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Christine Gautreaux 0:08

Let’s do this.

Shannon M. 0:08

Okay, ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of shallow glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness.

Christine Gautreaux 0:25

And I am Christine Gautreaux, a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself in community care.

Shannon M. 0:35

Yes. And together we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness. Welcome, welcome to our show. Today you’re talking about financial wellness.

Christine Gautreaux 0:46

Oh, I, every time we talk about financial wellness, I’m like, oh, I need to talk about this every week.

Shannon M. 0:55

You Yeah, it’s true.

Christine Gautreaux 0:57

Well, and you know, tomorrow is April 1. So even though folks keep trying to tell me I have an extension on my taxes. I keep putting my hands over my ears ago. Because I’m getting it done.

Shannon M. 1:10

It’ll be July and we’ll be right. Yeah, no, it’s still April 15. For me to write. It’s

Christine Gautreaux 1:17

like no, it’s on the planner is getting done.

Shannon M. 1:23

Yeah, it’s got to end Why push it back. You know, if everything can be organized, and ready for this coming up here. That’s where I prefer to be anyways.

Christine Gautreaux 1:32

Right? Yeah, I’m trying to do a little bit of a deeper dive with at this time, as I as I do them, like really look kind of like a spring cleaning. What subscriptions do I have that I’m no longer using? Or I’m not getting as much of a return on an investment from them. Like, even like, cuz I feel like I nickel and dime myself, like just all over the place. Like, you know, oh, that’s just $10 or Oh, that’s just $15. And you know, you and I talked about before when you read the book, the latte factor? And how much the difference that that makes? So I yeah, I think, and I am so guilty. I can’t wait to see what our guest has to say about this, because she’s been a financial professional for over 20 years. But you know, I am so guilty of kind of closing my eyes and not looking, right. Yeah, no better than that. Right? Yes, yes, yeah.

Shannon M. 2:27

I was listening to this audio book. And it was talking about how it’s kind of like kids looking at the report cards and how they don’t want to know what it is. And I was an honor student. So I always knew I wasn’t worried about it, you know, but the finances I said, Oh, that makes sense. Now, it makes sense. I don’t want to look, I want to change the grade. And I like the scores never happened.

Christine Gautreaux 2:52

Well, and I was realizing the other day, because I like to play games. Like I grew up in a family, we played dominoes, we played cards, we played board games, we you know, and I am like, I want to get into the mindset where my credit score my financial numbers, all of that is like a fun game to play, like this game. But it’s like, Ooh, look at this number, or Ooh, you’re doing this. There’s so many apps out there now, to do that, that it’s like, Okay. I think you know, I think that there’s probably some tools and strategies, that would be fun. Because yeah, you know, we talked about I think it was the last podcast where we talked about the app mint. And we talked about really looking at your numbers that way. And I don’t know if you saw this, but did you see like they had a Betta contest, if you were working in your meant that you automatically got entered for like, $10,000 Oh, wow. That’s a no. I was motivation to be logging on and checking my numbers. Like I’m in

Shannon M. 3:59

just for doing it. Yeah. I love it. Yeah. And that’s incentivizing people like that is important. And I try to think about ways to do that for myself, too. So it’s not always work and adulting and having to be so serious about everything, even though it’s important. How do you stay focused so that you actually do it and get it done? Right.

Christine Gautreaux 4:18

Yeah. Well tell us about our definition, because I know what what definition are we talking about today? Shannon, when we talk about financial wellness?

Shannon M. 4:26

Yes. And you know, catching a definition can be difficult, especially four categories of wellness right when they’re all encompassing. So the one that we’re working with says that it’s tricky because it means different things to different people. Right. I love that because that’s true. At its most basic level, financial wellness is a holistic approach to counter financial illness. This holistic approach includes a combination of factors, such as satisfaction with current finances, increasing positive financial behaviors like saving, reducing content and budgeting, financial knowledge that helps to change behavior and reduced financial stress. So, it actually there’s one more creation of a financial plan to reach desired financial goals. And that’s part of what we’re going to talk about with our guest. Right. And you know, when we first read this, this definition, the reason that I didn’t like it was because I like stuff to be really specific, you know, who I am, and satisfaction with current finances. For me, one, at one time in, in my life, I was at one place and I was happy with my finances, I didn’t know all the stuff that I didn’t know that I wasn’t keeping my receipts. I wasn’t keeping track of expenses and income and all this stuff. But then the last point is to set a goal and set a plan. And I feel like with financial wellness, what I see is that a lot of people are in there where we were right trying not to look at it not having a plan. And so they can say, oh, yeah, I’m happy with it. I don’t I don’t need to set goals. But I love what are our guests, and we’ll talk to her the first time she said some people want to retire by 50. And they’re on track to never retire. I said, Wow, I can’t talk about it.

Christine Gautreaux 6:11

I feel like my husband and I were really late bloomers was finances. Yes. raised in a family that you didn’t talk about money, I think really said was, Oh, we don’t have enough money. Well, that whole mindset of we don’t have your money and you don’t talk about it. Like we may go from that place.

Shannon M. 6:29

Right. And you know what’s so interesting? I’ve been thinking about what is the thing that was said in my house. I know what Christine says was said, and I realized my dad used to always say it’s been already like this money that we’re making that you see right now, it’s in your hand, but it’s been already. And so that also speaks to the goal and the way I am intentional about my finances now, before you have it. And you’re already behind. Instead, I looked I like to think about what I want to track make my plan, how much do I need to make and make a goal for it, and I guess an action plan for my money before I get it. So when I get this $100,000 This year, this is what I’m doing with it.

Christine Gautreaux 7:09

You know, I love that. And I know that our guest has some strategies and tools for folks around this. And I’m also has a way to assess where we are. And so I’m really quick to talk to her more. Are you ready to bring her on?

Shannon M. 7:26

Yeah, let’s bring her on.

Christine Gautreaux 7:27

Alright, let’s do it. I’ll read the bios and we make sure we get it right. Okay. Because I like to do you know me and that’s that’s about me, not ad libbing about somebody. So here we go. I’m Terry Stigler is a person that loves life and people and lives her life to the fullest believing that life’s life is a gift and should not be taken for granted. She loves the Lord with all her heart and would say she is blessed and highly favored. Terry believes in forgiveness and always sees the best in people. Terry is a die hard optimist, dreamer and entrepreneur. She’s our people Shannon. Learned early that when you choose a career you love you will never work a day in your life. Terry has worked with young adults for a good portion of her career and has always poured into her young sisters and encourage them to dream big respect yourself and others and know your worth. Oh, yeah, I’m gonna say that again. to dream big, respect yourself and others and know your worth. She mentored young women in her girl talk group, sisters and transformation has allowed Terry to continue her passion for impacting black and brown women to live up to their potential. She wants young girls and women to know that they are special, important and loved by other sisters. She wants sisters to step up and each one reach many. He one reach many terian vision sisters in transformation going national and then global, touching the lives of sisters around the world. Assuring sisters know that black women matter. We must take care of each other and we must be our sister’s keeper. Terry Miller is a financial professional. She has over 20 years of marketing and business development experience. She studied African American studies with an emphasis on society at the University of Wisconsin. She also has a 22 year old daughter named Christina Stigler who’s in college. We are so welcome and delighted. Well, we’re so delighted I screwed them. And I didn’t do welcome Terry to the stage today.

Shannon M. 9:47

Hey, Terry. Hi, how are you? Great. How are you doing tonight?

Terri Stigler 9:53

I’m great. It’s so great to be here. It’s a rainy day here in Philadelphia. Pennsylvania and but I love the rain. You know, I always tell people you know, you won’t milk someone

Christine Gautreaux 10:10

we’re so grateful today in Atlanta because the pollen has been out of control and literally tearing when it rains right now rivers of yellow pollen run down. And we we as much as we fuss about it not being sunshiny we really enjoy the fact that it kind of washes away all the stuff that’s trying to take us out right now.

Terri Stigler 10:33

Oh, okay. What’s the temperature though?

Shannon M. 10:40

Yeah, it’s actually pretty comfortable.

Christine Gautreaux 10:42

It’s beautiful.

Terri Stigler 10:43

Okay. I was just in Atlanta. For my birthday. March 6 was my birthday. And I have friends there. So I was there celebrating.

Christine Gautreaux 10:54

Happy birthday. Yeah, Atlanta’s a fun town to come play in. You have to get together.

Terri Stigler 11:02

Okay, definitely.

Shannon M. 11:05

Love that. will love that. Okay, so Terry, today we are talking about financial wellness, right, then you’ve worked in this space for decades. So working with the youth working with systems and transformation? What do you think about? And what do you see that women that are trying to be wise in their wellness? What can we do to start doing that for our financial wellness?

Terri Stigler 11:30

Well, we need to really put finances in the same way we put our whole the holistic approach. So if you’re conscious of your health, and eating, right, and things like that, you’re conscious of your spirituality, you know, your mental health, all those things. Finances fits, right in that because we know that divorces are caused by finances, you know, that gone wrong or not enough of arguments and things like that, or you don’t have the same thinking about money. And so we need to put it in the exactly what it says wellness, we need to be you know, because I feel like in my profession, I’m a financial doctor almost sometimes, you know, and, you know, just, of course, it’s not the same, but you know, where you really you’re fixing you’re fixing people’s finances or helping them fix it. And so we just really need to look at it like that. Embrace it, just like you like, I want to go to the gym today. Oh, do I want to do my finances? Do I want to keep up on them today? Do I want to look at John want to talk about it? Do I have an account? Do I you know, all the things that you need for your finances? Do I have life insurance? Do I have a will? You know, you know, am I do I have investments and things that are gonna make me well, and feel good financially.

Christine Gautreaux 13:02

I love and I love that you say Doctor means there’s help.

Terri Stigler 13:10

Yes, yes. Yes.

Shannon M. 13:15

That’s true. And I like it. Especially because, like this definition, right. This definition talks about saving. It talks about reducing debt. It talks about budgeting. Right. And a lot of people who might not be financially literate, I wouldn’t say I’m all the way financially literate yet. Right. I have an LLC, but as far as it’s like a language as far as speaking and reading and writing. I’m probably in elementary school right now. We’re doing pretty good. Maybe Middle School. I don’t know how to judge it. That’s why you’re here. You’re the expert. Right. But I know there’s different levels to it. But something that you said you said investing, you said Life Insurance, right? You said Will’s how are we proactive and making sure that our money is working for us? I think that’s the next step in the conversation. Because a lot of times people who don’t look at their stuff, they’ve heard of budgets, they’ve heard of savings, whether they do it or not, is another thing, but they’ve heard of these things. But an idea and a strategy that I recently heard of and it started implementing is making your money work for you. Right. So no, this app, Christina and I were talking about the apps we talked about last time I use this app, get upside so when I spend money on gas, I get money back. And I love the fact that I get some of my money back when I spend money. And that’s one of the ways that I’ve been doing it. So with you What is something that you would recommend for somebody to start on the path that they haven’t started? They’re not looking at their finances? Maybe they’re married, right? We’re talking about divorces and arguments in between companies. How do they start?

Terri Stigler 14:51

So you really just have this dark where you stand. It’s not too late. It’s not too early. And just to start with a camera. So if you’re not in a relationship, you know, or if you are, um, you know, I’m hoping that if you’re in a relationship as far as a marriage, where you do things together, that you start having conversations about what money means to you, and where you want to go, if you’re single, and you just know that you want to progress in any manner of where you are, I won’t tell you, I’m Shannon, where you say in infancy, most people are in infancy stages with money, I’m in their finances, even though and you look, you’ll see people who have high high income, but we find the same thing is going on low middle income, high income, because people are actually living above their means. So you could be, uh, you know, have an income of six, seven figures. But if your spending is right there, you’re no better off than someone making, you know, you know, 30,000 and below, and it’s the same thing, okay? So you have to start where you stand, started conversation, and then start writing down, you know, where you want to be, what you want to do, what did they what do you need? And so when you look at your financial portfolio, um, you know, like, we do a financial, I do a financial needs analysis, you start the conversation from, you know, from A to Z. And it’s not that long, no, it’s not as complicated as all the way to Z. But, um, so you want to assess, you know, the budget comes first, you know, what am I spending? Okay, but what’s coming in? Um, let’s kind of balance that, you know, it doesn’t have to be anything elaborate. You can google you know, a budget, a simple budget, that includes everything you’re spending, people find out that I did, this is so little, I was going to Dunkin Donuts, because, because it’s so convenient. And then, you know, oh, well, then I’m just getting coffee. Well, no, now I’m getting the wraps, oh, now I need the breakfast sandwich, no, coming back for the latte. So when I have it all that up, it was amazing. It was like a cell phone bill. You know, so I bought a Keurig. And so I make him one cup. You know, just so the budget, the budget is really a starting point. And only you know, so you have to assess that because you know what you spend it and just sit down. The next thing is to really look at where your family is, and everything. But people don’t realize life insurance is like a key factor in your budget. Or in your portfolio. Because any advisor, a financial professional, myself, or there’s financial advisors, um, they will tell you the life insurance, you know, is really the base, it’s like the crown. And because most people don’t understand that life insurance is,

is borrowing wealth. So you’re borrowing wealth, it is income protection, okay, and so the way life works and your younger years, you might not have a lot of money. But you, you have a family, you have debt, you have a mortgage, um, you know, things like that. And so, if someone, whether it’s single family or two parent family, if somebody doesn’t come home, the family is devastated. Because that income is gone now. So that’s why it’s income protection. So if we really do it, right, then the way that I, you know, teach it. And that’s another thing, when this really kind of a coach, too, and just the educator of it. So here’s your life insurance. And there’s a way to determine what you need. There’s a formula. If we’re doing the right thing for you. As you invest and we’re helping you invest for the future, you are building your portfolio and your investments. We’re suggesting you get rid of life insurance, why do you need it, you don’t need it for your whole life. Now you have a pot of money that you can use while you’re living, you’re going to have beneficiary so your family is getting it. Okay. And so, you know, one has to die to use the money. Okay, so that is the ideal way to do life insurance and you know, have it as you need it, build up your investments. So in between there though, um, let’s get out of debt. It is not the American dream that’s been sold to us, you know, to keep other people living their dreams because you’re in debt and people are making money. is really not the way to go. People are not retiring because they can’t get out of debt, the best way to be able to retire is we want you to be out of debt. So then because typically in retirement, our income goes down, okay? And so we need our debt to come way down, so that we can live off less amount because of your living on Social Security, a pension. And then hopefully, if we’re doing the right thing, we can get your investments up there. So you can live well, in retirement, I’ll tell you something that’s just as devastating as dying to sue. It’s outliving your money. You outlive your money, what do you do live, you know, live with your friends and family and, you know, things like that. So we really want to help people get to where they want to be with their money. And there’s, you know, so there’s a lot of things in between that we can talk about, but I’ll let you ask some other questions about it. And then we can go into details.

Christine Gautreaux 21:05

I love that. You know, one of the things I think we mentioned before the show was that finances are so intimate, like, people have a really hard time talking about finances often, I used to early in my career as a social worker, I did home studies for folks. And people would rather talk to me about their sex lives than they would about their financial budget. And they really would, it was because in in, you know, finances are one of those things that you may not have been taught to talk about them when you were growing up, or you may have some trauma around them. Yeah, you know, you are embarrassed by what you make or don’t make or what you think other people are should or, and there’s so much judgment around it like it is, it is very interesting to break it all down. So how do we take some of that emotion out of it? How do we start having these conversations from a place of wellness, and from a place of calm, not a place of reaction, but being being proactive instead of reactive to our finances.

Terri Stigler 22:22

Um, so I think it’s always gonna be emotional. I really think that, um, it’s a little, like, you know, we want things to not be emotional. But I think that is emotional, because it’s like, finances is kind of the is like an emotional roller coaster. But if you can stabilize and know how much you need to live off, and then know how much you want to make, you know, to increase your income, how much you need need for the retirement or that kind of thing. We talked about when do you want to retire earlier, you know, so again, we said that people say, Well, I want to retire at 50. And then when you do their whole financial needs analysis, which I can do for people complimentary is what I love. And then you find out, they’re not on track to retire at all, you know, um, so we really, really need to do that analysis. And once people do the analysis, they can see that it kind of demystifies it, it’s, it’s not taboo anymore, things like that. And then we can really start to heal, because it’s financial wellness work, we’re healing and it’s, um, it can now be emotional, but you know, it can be a good emotion. But you made a good point about the, the past and how, how it’s kind of like our blueprint of how we think about money I’m reading right now, um, the secrets of a Millionaire Mind. And it’s not about being a millionaire per se, although if you want to be taken that way, but it’s really about how we think about money. And so a lot of times, you get it from your parents, I’ll give you an example of a lady. She was a young girl, and her mother and father they were at dinner with the family. Okay, and so the, the all she always heard, you know, isn’t fighting about money. And so they were having dinner and her dad was mad, they got talking about money, he actually had a heart attack, um, you know, at the table, she knew CPR and all that so she she helped her dad died in in her arms. She in her whole life. Um, all she associated money with was pain. So anything She got money, she tried to get rid of it. So that wasn’t good because her husband was like, what’s going on? We, you know, like, you’re always wanna and we’re doing okay. But we always got to get rid of it. That was because it was so painful. We don’t even realize so that, you know, it’s just one. One way that you might think about money, you know, you might always have friends or hurt people, oh, well, you know, we’re gonna be broke, we’re always gonna be broke. So you don’t realize that you speak those things into existence. And I know some people don’t really believe that, but your brain is like a computer, you’re, when you tell your brain something, it has to make it happen. Okay, I’m, you know, I’m fat. I’m fat, I’m fat. Okay. All right, you know. So it’s the same with finance is the that core piece of how we think about our finances. And then so to demystify it, when you start showing people that it is not hard to get out of debt, it doesn’t mean you’re going to get out of debt in six weeks. But let’s do debt stacking. And if you’ve heard of

Suzy Orman, some of these financial gurus who teach debt stacking, so it’s gonna take a while. But guess what, let’s take it one, you know, debt at a time, pay it off. Okay, start with a small one, you’re paying $100. Let’s stack it on the next one after it’s paid off. Now this one, maybe you’re paying 200 all the way to the largest one of your mortgage. Now you have all this going on your mortgage, you can get out of debt, you unbelievable, you know, 10 years earlier, by doing some of those debt stacking. And now guess what? You didn’t have a lot of money to invest. But now that you’re out of debt, and you have this excess couple $1,000, because you’re out of debt, let’s start putting that away in an investment and watch that grow. So that’s why I say it doesn’t matter. If you start at, you know, later in life, it doesn’t matter. We need to free up some money somewhere, maybe right in your budget, let’s free it up. And then let’s put that away for investment. Not trying to go outside of your budget, like Oh, I’m going to do 500, we’re going to do 200, where you’re struggling. So how are you going to pull extra money to that’s why we don’t save and invest? Because we don’t have it but let’s find it. And that’ll really help you do like help people find that money.

Christine Gautreaux 27:45

Sorry, my sound response. I love that, Terry. I do a system called interplay, which uses movement and storytelling and voice and we have a thing where we talk about incremental steps. And our co founder, Phil Porter always says, we get into trouble in little steps and we can get out of trouble in little steps. Debt or weight gain or you know, whatever the trouble we got into it didn’t happen overnight. It many steps and, and it’ll probably take many steps to get out. But it’s doable. And I liked his, with what you were talking about. I heard that that it’s doable.

Terri Stigler 28:23

Yes, definitely, definitely. The smallest amount of income, you’d be surprised how we waste money. Like I said, the Dunkin Donuts, it’s so many different things where you shop, you know, the things that you feel like you need, we you know, everything is not essential. You know, I mean, we’ve learned about essential with this pandemic, um, but cutting out some things. And then instead of now, cutting out something, let’s say you have credit cards, and you pay them off, let’s not start new credit cards, let’s not run them up again, let’s cut them up. And now that money, let’s start our emergency fund. Let’s do some investments. We also have to know that banks are not where we do investment. Banks are holding their if you look you’re getting what, oh my gosh, and savings or something or you’re checking zero point percent. Even the you know, other things that they have are very, very low, very low in investment in banks, and most people have their money in banks. So that’s the first thing that we teach people is that that is not a real investment. That’s just a savings.

Christine Gautreaux 29:44

Well, Terry, one of our listeners heatherly. She said credit unions over banks, they’re willing to do free financial assessments. So there you go. Yeah.

Terri Stigler 29:56

So I what I will say is that excellent, especially that the analysis and things that they do anytime you can get a free analysis, but credit unions do not, they give a little more. But that’s not gone are the days when you could put your money in a bank and get 6%, our grand, great, great grandparents and did that. And when they finished work at 6065, they had a boatload of money. Okay, um, that’s not happening anymore, we have to learn how to be, you know, really do that for ourselves, even on our jobs, the pensions, they’re going away, if you have a good pension, you know, you’re blessed. Um, but the 401 case, there are matching them, but you have to go ahead and put money in them the 403 B’s, you know, with your companies, if you have a company that’s matching, that is excellent, because that’s free money. There’s nothing better than free money. Um, but we have to start funding these things, you know, and I will tell you that banks and credit unions, if you look at the percentage that you’re getting, it is not enough to have a good retirement.

Shannon M. 31:06

And what I would say to Terry is not even retirement, what I think about is, what is your money going to be worth? Right? Well, I know inflation might be a more advanced topic. But when we talk about what the US dollars worth, if you put your money in the bank, and you’re only getting certain amount, the buying power is actually not worth so let’s say you have $10,000 in the bank in the savings account, which you are pointing to is the fact that the interest that the bank is giving you is not as high as it would be somewhere else, right is not as high and doesn’t work as well for you as it used to. But also, that’s not the only thing you should look at, I would also look at inflation, inflation. I don’t know what it is today, but 3% is higher than a lot of these bank accounts are giving you. So if the rate that money is losing its value is faster than you’re saving it, you’re saving only to be negative, and then for expenses to exceed your income. So we’ve got to look at it. Absolutely.

Terri Stigler 32:08

That’s a great point. That’s a good point.

Christine Gautreaux 32:11

One of our listeners, Amanda has a great point, too. I want to pull up here. And she says I feel like a lot of women abdicate finances to the man and their lives like I’m no good at math or other such silliness. With more women getting married later in life and living longer than the men in their lives, we need to get women more financially independent. Oh my gosh. My Great Aunt Clara, I will never forget my this story makes me immediately think about my Great Aunt Clara. She was a minister’s wife. Her husband doted on her, did everything for her. It wrote the checks took care of everything. When he died. Not only was she devastated, she didn’t know how to do anything. She didn’t know, I groceries, because he took care of everything. No, that was a different error. But I think there’s still some of that I think to Amanda’s point, like, we think, Oh, this isn’t, you know, like, we’re making money. Let’s know what to do with it and make.

Shannon M. 33:16

Absolutely. Like Jerry said, at Papa Joe I was making, I was definitely salaried. And compared to what women were making on salary jobs in the 80s, I was making almost three times that, but again, it doesn’t matter if you’re making a lot, if you’re spending a lot, you’re not strategic, you don’t know where it’s going. So that’s why I love women connected in wisdom, specifically, because we’re here to talk about the intersectionality, of being a woman and dealing with life. And that’s a lot, right. And we are intentionally underdeveloped in the financial realm, so that we can cook and clean and do all this other stuff. And it’s been said to be a man’s position, in addition to certain subjects that go along with things to make it easier. But again, my sprint doesn’t care if I’m male or female, you know, Honda does not care, they’re still calling and they will call you back if you do not call them back. And so it’s not just about men versus women. That’s not what I’m saying. But what I’m saying is as an adult now it’s all of our responsibility to be completely well and the times are different. It’s no longer the times where a family marries off a daughter and there’s a dowry and to calf’s, you know, when you go off to the loo, and like, but But again, if the if grandma taught the the females in the family, then the females are going to know what grandma knew. And we have to close the gap. So that’s why I love conversations like these because all of the information is relevant to me. Yeah,

Terri Stigler 34:51

definitely.

Christine Gautreaux 34:53

Well, and I think the other thing you know, we like to talk on this show, Terry about the intersectionality of race. Gender and all of that. And, you know, we still women do not make the same as men do. And there’s some bills up for consideration for equal pay. And that that doesn’t, I want to I should have pulled up the stats about what the difference in pay is. But you know, there’s a difference in pay between white women and what males make, and then even a more significant difference between women of color and what they make compared to their male counterparts. And so getting involved in that for financial wellness, about speaking out about equal equal pay, and changing the policy on that is important.

Terri Stigler 35:42

Yes, yeah, definitely agree with that.

Shannon M. 35:45

Yes, yes. And it’s interesting on my journey for financial literacy and financial freedom, right? It made me realize why the conversation is the way it is around relationships, we can say, Oh, well, black women just want to be independent, and everybody’s a gold digger. But actually, if you look at it from this, it makes sense if black women are being paid less, but the black men are treated a certain type of way they make lists, the way the family is structured, we’re talking about wills and life insurance. This is a whole family strategy. So when it’s all affected, and we’re talking about financial wellness, and in the history of the United States, we know how a lot of these stories went right. When black families got to a certain point. Things were ransacked, burned, obliterated bombed in the United States, you know, so it makes sense why it’s so emotional to try to set goal was to, for it to be daunting and overwhelming for where people are biases, women are paid 17.7% less than men, and against my sprint bill is not 17.7% less, you know, right? And so that’s why, you know, starting where you are, like you said, I think it’s absolutely an advantage to start younger, of course, right, we can have compound interest on our investments. I’m trying to get everything as quickly as possible, like you said, to have your portfolio be healthy. But with anything with any of these categories of bonuses about where are you at? Where would you like to be to be healthy? And what do you need to get plugged into in order to do that, and especially with finances, I’m a person who takes initiative, I can do a lot of things that some people have fear around. But sometimes I need somebody to sit here with me and say, Okay, this is what you do next, go on mint, and download this mitt and look at this once a week or do this every month. And if this is an area where you need help, that’s why we’re connecting wisdom, Terry’s here, you know, you can plug in, get a free assessment, see where you are, get plugged into life insurance and wills. And if you’re part of a credit union, we can start today, you know, because being a woman is not going to change the fact that we want to retire, we want to go on vacation. Girls want to have fun, too. And we want to be well when we do that. And that worried about the credit card bill that we’re not looking at. Right,

Terri Stigler 38:17

right. Definitely. Definitely.

Christine Gautreaux 38:20

Yeah, airy? How do people reach you? Like how do people I know you’ve authored our listeners of free financial assessment, are in to start that conversation. And so how do you want people to reach out to you? How do you want them to find you?

Terri Stigler 38:38

Well, I love Conversations, I’m telling you, I know that the it’s the text world and and you know, social media hit me on Facebook, but the old fashioned phone call, how about that, just call me at 215-218-8001. And then we can have like a quick three to five minute phone call, just to see if there’s a mutual interest. If there’s anything that I am doing that would help you know, I have questions that I asked, you know, about everything to see what is the thing that is most pressing, you know, is it getting out of debt? Is it um, life insurance, you know, is it you know, saving, you know, for the future investments, you know, whatever it is, you know, we could see if we if there’s a mutual interest, and then also, you can email me I have no problem emailing you back, and then we can set an appointment, and it’s Terry Stigler at Verizon dotnet. And so I read my emails just just constantly and see. And so I promised that I do get back to people within 24 hours. Also, you can text me, texting is great. And then I can Back to you, immediately. Even if we can’t talk right, then I do always respond to a text, letting you know that I have received it. Um, so those three ways are really the best.

Christine Gautreaux 40:15

I love. I wanted to. And then I had another comment that I think was very insightful that I wanted to chat about before we get there. She says we have to encourage our young woman to go into fields that are higher paying, we traditionally choose the softer career, something happens in middle school to girls where they take their foot off the pedal in the STEM professions. So we create some of our own pay gaps. Yeah, that I know that more science and research around that, and that we’re doing a better job with STEM. I don’t know if y’all noticed with the latest Mars launch and NASA, almost every scientist that they had talking to the camera was a woman and Ally noticed. And it was powerful. Like for this little nerd girl who loves that stuff. I was like, it was so cool. Yeah, it’s really,

Terri Stigler 41:14

I’d love to talk about that a little bit. Because I really feel like a lot of times when we’re even teachers and things, they don’t really know that how biased they might be, you know, because they used to with black people not go into college, but move them into the trades and things like that, when I feel like it should have been both because trades are very can be very high pain. And so in college, I feel now is you is going into all this debt and bringing people out of debt, you don’t promise them any jobs. They can’t get it out. I think it’s it’s really, to me heartbreaking that college students come out with a degree, all this debt can’t get out of their parents home, because they’re at war. No offense, I’m going to Walmart, but Walmart target, um, you know, the Sam’s clubs, you know, all the places with a degree or you’re doing Uber and all this with a degree, you don’t need a degree to do those things. Okay. And so we need to be teaching. Again, they have going to move them towards, like you said, some of the higher level, but also what about business, I don’t think we’re teaching our people and pushing them towards business. A lot of people have talents that can be put into a business, they have, you know, just ideas, you know, gifts, that really, if they’re developed, they could go into a business, I will tell you, one thing that I’ve learned about being you know, in my own business is that you are the creator of work. Okay, working a job, you are processing work. Okay. And so I learned especially during this pandemic, look at how people lost their jobs, the different industries that went up and down, you know, if you were in food service, you didn’t know if you’re coming and going 50% 25% Nowhere close, only takeout. Oh, drive thru up, you know, but if you can find an area or a niche, to start your own business, even if it’s online to bringing in some income, um, you know, that can stabilize you. I’m not saying you have to quit your job, you can do both, most millionaires will tell you, they have eight streams of income. Okay, um, because it five go out. They can still eat, you know, with the other three. So I think also I love that is an Amanda saying that pushing towards higher paying industries, and also business, okay, pushing people to get involved in their own businesses is the highest paid people are really business owners.

Shannon M. 44:08

Yeah, I 100% agree with that, Terry. And again, that’s exactly where I was. I was in the restaurant industry for five years, right. I graduated with my psychology degree minored in Africa and African do sports studies. Thankfully, I was at a restaurant got promoted. And that’s where I was salaried. So that employment gap in the degree gap I didn’t have to worry about now I needed to be focused on my financial literacy, my financial strategy, I should have known how my 401k was invested. Right? That’s something I’m looking at things I could have done better. But watching the pandemic and the conversations that we’ve been having, it’s been really interesting that it’s either you’re employed or you’re unemployed. So what about the people who are starting businesses? Why are we telling everybody to go get a job and not to start businesses now again, Have a company, I need employees, the people who own companies need employees. So not everybody wants to be a business owner. And not everybody can be a business owner. And that’s fine. But I think that if the opportunity would have been more, excuse me more available when I was younger, I would have been interested in learning more. And it’s exactly actually what stabilized me during the quarantine is okay, what are my expenses? How much do I need to make? And it’s not exactly my expenses, you should make more than your expenses, right? Because you don’t want all of them to be wiped out. That’s what we’ve been talking about. So how much do I need to make? And then okay, what do I need to go? What do I need to do to do that? I was dropping off shea butter yesterday, because I have the shea butter company. And this young lady was a chef and a model. And I said way to use the female traits, you you’re beautiful, get paid for it. You can cook, get paid for it, you know, and those are two easy ways, right? low overhead companies that you could start and generate your own money and have teams of people working for you, if that’s what you prefer. Yeah, that’s the one thing to that. I will say, Amanda, is that reading secrets of the sixth finger women, I realized reading that book that I should ask for a raise every time they transferred me. I’ve been negotiating my salary. I just said, yeah, actually, yeah, I’ll take that money. But absolutely going for higher paying jobs. I think increasing how much we want to make a year. And like you said, Terry, thinking about ways that the skills and the talents and gifts you have already how to monetize those, and then be consistent. I’m for that all every day of the week.

Terri Stigler 46:43

Yeah, yeah. We can do both women, we can all we can. You know, when when we take care of ourselves, I know we believe in helping everyone women, we just, that’s what we do. But nurturers were helpers. So I believe in God first or whatever your higher power is. But we always say God family, no, I say God, me family business. Because if I’m not, okay, those people, I’m supposed to be helping my daughter. How do I, how do I help her, I always tell my daughter, if I, if I lose it, and I go, I can’t help you. I can’t help you. So we have to really as women take care of ourselves. First, you know, and that’s not, it doesn’t mean you’re selfish. It means you’re conscious of who you are, and the people who need you. And even if we’re not, we’re wives and all the things roles we play, who takes care of us? Okay, um, we have to do that. And then no, and then God, us first family, and then business and that border, and we can really do it all.

Shannon M. 48:02

Yes. 100% agree with

Christine Gautreaux 48:07

you are talking my language. I love this conversation. And Amanda says, Yes, you got to be the president of your own fan club. And then I love this one, do that all the time. And they don’t even think about it. Right. And Jerry, you may not know, I’m the co author of a book called Stillpoint, which is about self care. Good time to breathe and reclaim joy and all the things because as women, we often do put other people first and then we go down and go down with our health, we go down with our finances. I can’t tell you how many older women I’ve met, that poured all their finances into their kids and other people. And we’re left with nothing at the end. So, so appreciated this conversation. I am paying attention to our time and I hate to say goodbye. But I think it is about that time. Yeah. Carrie, we’re gonna have to have you back because we do talk about financial wellness on a regular basis. Because we know that it’s something that is not as often talked about in our circles. Write about it often on this show, because we feel like like you said earlier, we have to name it in order to to be able to work on it.

Terri Stigler 49:33

I work with a lot of women advisors. And so you know, we can actually have other other women involved, you know, so that you have a variety of people. So

Christine Gautreaux 49:49

all right, well, thank you so much for being with us today. Terry. We are so grateful to have met you and had this conversation and thank you and we will put in the show notes everybody we will put, how to reach Terry and how to get a free financial assessment. And so we are putting you back in the green room, Terry. I’m sorry, there’s not chocolate and wine in there if it wasn’t for

Shannon M. 50:16

this wine because it’s raining right? Now, today

Christine Gautreaux 50:21

was such a powerful conversation, my friend so good.

Shannon M. 50:25

This is why I like having it. You know how my mind has been on stuff like this, you know? You know, I love Robert Kiyosaki. And I listened to one of his book second chance. That was actually the book that I forgot I couldn’t remember the name on our show. It was called second chance. And it talks about when people reach financial emergencies, basically, which is what Corona pushed a lot of people including myself into and you have to do it differently. And on this other side of corporate, you have salary, no matter how high it is your salary, right, I’ve been there already and I see what it’s like I see the hours. I saw the quality of life. I saw me missing my mom’s doctor’s appointments at the end of her life and time and all the baby showers all this stuff I missed Right. Which of course which is Tory’s, but now I said I did this already let me do this. Let me be a business owner. Let me be what Attari call it. She called it that you are the creator of work right let me create jobs and work for other people so that we can take care of our ladies instead of taking care of everybody else and putting the priority of myself below the priority of everything else.

Christine Gautreaux 51:34

Well I am so grateful you have and that you’ve sponsored this podcast I want you to tell our listeners about your company Shayla globe because you are one of our sponsors. And while Yeah, I’m grabbing my I’m grabbing my Shayla and I can use

Shannon M. 51:52

yes so again Shayla glow is an all natural and organic handmade shea butter company. We have sugar scrub, we have a multi use oil and a multi use shea butter. But my favorite thing about it and it is the last day of the month is our cero nomination. So if you ladies know somebody that has hugely impacted your life, hugely impacted your community, email my Shay row to shallow, shallow glow@gmail.com. And tell me why you’re nominating her. Give me her information so that if she is honoured with the self care with the free gift of self care from Shayla glow, she will know why. And the nominations in tonight for this month. So let us know. You know again, we talked about how often women take care of everybody else, which is usually what happens. And so this is about honoring ourselves, honoring our ladies and taking better care of ourselves and being intentional about what we put on our skin. Because it’s important to right. Oh,

Christine Gautreaux 52:54

I love it. Yes, yes. And my favorite like I like the unscented, but I love the mango. And yes, it is.

Shannon M. 53:05

I’m about to come up with a new set.

Christine Gautreaux 53:07

Everybody.

Shannon M. 53:09

So good. Yeah, I would research right now.

Christine Gautreaux 53:12

So enjoyed our conversation today. And I as always look forward to next week’s conversation. where can folks find us in the meantime? And and what do you want them to do on social media?

Shannon M. 53:28

Yes, so again, we talked about financial wellness, ladies. So on Facebook, on Instagram, use our hashtag, hashtag wisdom and action. What are you going to do? I’m gonna hold you accountable. Like you know me and the people that know me know that I run up on you. Okay, what are you actually going to do about the things that we talked about today, you’re going to set a budget, are you I’m having I’ll tell you what my wisdom and action is sweet. We are having a family meeting. And we’re talking about wills, life insurance, and the second quarter. So as a business owner, I think about quarters, but as a family, I want us to know what we’re doing. We’re talking about reparations and stuff. So what is the plan outside of that? You know, that’s not wisdom and action, but what is your wisdom and action? Let us know on Instagram, Facebook, and if this helped you share, share the live share our our show, so that everybody else can get plugged into a free assessment with Terry if that’s what they need, so that we can start really being well, yeah,

Christine Gautreaux 54:29

you know, you brought up reparations, my wisdom and action for community because, you know, I always talk about health and community care for communities to reach out to my representatives about HR 40. It’s, it has been a bill that has been introduced for years. And it is a commission to study and develop reparation proposals for African Americans Act. It’s just to study it. It’s not even like so the I I’m just amazed In our country, that hesitation to it, right? I want to reach my community wisdom in action is to reach out in support of HR 42 to develop a commission to study it. And my wisdom and action personally, is I’m working on this market. Organizing I am, I’m being more intentional about putting systems in place, so it becomes easier every year. And really kind of doing a spring cleaning of my finances this week. Oh, all right, my friend is Oh, enjoyed this. I look forward to our conversations every week. And and I am grateful

Shannon M. 55:40

for Yes, thank you. Thank you so much. You know, I enjoy it too. And ladies, thank you so much for joining women connected in wisdom. We will see you here next week, Wednesday at five and don’t forget, be well be wise and the whole channel out to Amanda for all the comments. Okay.

Unknown Speaker 56:03

Thanks for listening. This has been the women connected and wisdom podcast on-air live on Wednesdays at 5 pm eastern via Facebook and YouTube. Be sure to like, share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment