Show notes –

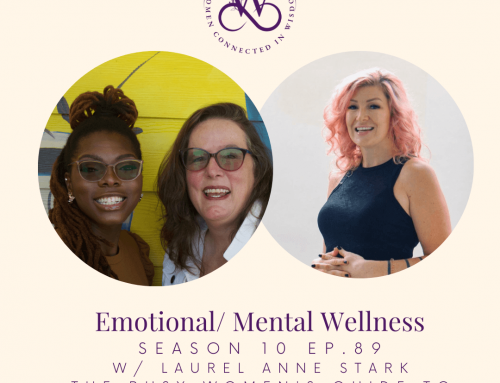

Join Shannon & Christine for a chat about Financial Wellness. A topic that’s often harder to talk about than sex.

———————————————–

I am Shannon Mitchell, a black millennial business owner, the founder of ShealoGlo, an all-natural handmade shea butter company. I am a champion for your self-care, business care & intentional wellness

and

I am Christine Gautreaux, a white social justice advocate, an international speaker, coach & published author who helps you upgrade your self & community care.

Together we are Women Connected in Wisdom a Podcast grounded in the 8 dimensions of wellness

Join us and special guests for weekly intentional conversations about how to be wise in business, relationships & wellness.

Connect with us on FB, Instagram & YouTube for our live shows on Wednesdays at 5 pm ET & head over to Mighty Networks and join our community at https://women-connected-in-wisdom.mn.co/

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Christine Gautreaux 0:08

Let’s do this.

Shannon M. 0:08

Okay ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of shallow glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness.

Christine Gautreaux 0:25

And I am Christine Gautreaux, a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself in community care.

Shannon M. 0:35

Yes. And together we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness. Welcome, welcome to our show.

Christine Gautreaux 0:44

I don’t know about you, Shannon. But I need to take a deep breath and get grounded.

Shannon M. 0:48

Yeah, let’s do that.

Christine Gautreaux 0:53

Let’s take a deep breath. Let it out with an intentional breath like a sigh or another sound. Take another deep breath and let it out with a sigh and a shake.

roll our shoulders. Wherever you are listening to this. Just take a moment to check in with your body and get present and get grounded with us here. Yes, so right before we went on air era was giving you trouble. This what happened? I had our music playing Yeah. Listen this loud. It sounded like a fog horn like okay, like it felt like a screen of death. Like I was the noise that was happening for about 30 seconds to a minute no music it’s

Shannon M. 2:00

all the systems are overheating, okay.

Christine Gautreaux 2:04

I’ve never had that happen before. So while

Shannon M. 2:07

it’s so good that didn’t have in our life.

Christine Gautreaux 2:11

Right? Well, if it dies, y’all

Shannon M. 2:14

a we gotta roll with the punches, just like Corona. Okay.

Christine Gautreaux 2:17

Right between Mercury Retrograde, Corona solar flares. Who knows what his handle

Shannon M. 2:24

is crazy, is crazy.

Christine Gautreaux 2:27

How are you doing my friend?

Shannon M. 2:29

I am great. I’m so looking forward to our conversation today, you know, on financial wellness. And earlier I saw your posts outside on your two mile walk, you know, and enjoying the weather out there. And it definitely reminded me that we were talking today, and that I was thankful of the time that I have, you know, I set my schedule. That’s one of the ways I practice my self care and my wellness. And it didn’t go as planned, which is usually the case. But because I knew my schedule, I knew where everything is. I was able to flow with the day, you know, and that’s definitely what I think about when I think about my finances too. So I’m excited about what we’re about to do.

Christine Gautreaux 3:12

Yeah, I had to make that post because the sun was shining here in Georgia. It was beautiful. i Everything was just better when the sun shines. I was on another I was on a masterclass in the afternoon, early afternoon. And they did a metaphorical check in. So we should do this because it was super fun. Okay, so if you were the weather, what would your check in the fact

Shannon M. 3:44

that, you know, I’ve been trying to figure out which direction to go in, in which direction is the most effective for my energy, especially being in Georgia? We know it just fluctuates, right? So I feel like I’m in a good flow today. That’s how I feel it’s sunny, it’s bright things are flowing. And it’s good. Even though it’s cold, we can still manage it. Right.

Christine Gautreaux 4:07

So yeah, I checked in with a sunny with a few clouds, right? Yes. Personally, I’m feeling really sunny, and in a good space. But I know so many people around me are hurting and, and struggling. So I think that’s a piece of it.

Shannon M. 4:26

But yeah, and I mean, you mentioned Texas on your post earlier, you know, and I know you’re from Texas, and I was talking to my boyfriend earlier he was telling me about the weather and how people have been affected. And it’s really interesting because I don’t watch the news. I’m not gonna lie. You know, when I was younger, I used to feel like a bad adult for not watching the news. But I was I just can’t handle it emotionally. You have to be a good steward of the way that you tell stories and we know that the news is depressing. Okay, so I’m thankful to get my my information from reliable resources now and I was thinking about you When your family Christine and how they’re doing out there with this whether

Christine Gautreaux 5:03

they’re little cold, so a lot of my people are still on well water. And because they’re on small farms are. So anybody that I know that on well water currently doesn’t have running water pipes you’re frozen. So they’re hauling water or Holland snow. Right. And my parents I grew up 20 miles south of Dallas. So when I grew up in Dallas, Texas, it was very rule. So we grew up on a small farm. It was four and a half acres when I was growing up on it, and drafty old farmhouse that my Papa had actually so my dad’s dad had actually moved a house from Vladimir drive, which is in downtown Dallas, when they were putting in a freeway. He took this old duplex, and he moved it and rebuilt it as the font family house. So it is a big two story farmhouse home, not built for temperatures under 32. So I think my mom said it was like seven degrees in Dallas. And she said even with on they the house is 42 degrees. Wow. They are bundled up there. Well, thank you for asking, of course. They Luckily, they are on the same grid as the fire station. So they not lost power. And then family and friends have lost power and it’s cycling. And yeah, it’s a mess there. It’s a myth. And so I am, I am curious about how this is all because you know, here’s the thing about right now while they’re in a deep freeze, everything is not broken, but when to thaw, then what’s going to be broken and what because, you know, people who live up north, they don’t they don’t understand why we freak out with these temperatures. But we just have the infrastructure like built for that temperature. Oh, so I think it’s Yeah. And there’s financial resources, just like we’re talking about today. Yeah. Well, things that go into this.

Shannon M. 7:19

And I mean, it’s so interesting, because it kind of feels like middle school and high school all over again, when I’m in math class. And I realized that the equation we just talked about, is something I can use in science class. And in chemistry we’re working on this took geometry. And that was my favorite one, right? And we’re balancing all the equations and stuff. I’m a nerd, I love it. Right? And that’s how that’s how wellness is. And it’s exactly what what she said, you know, different people in different places. might think that is second nature, of course, you know, like you just do this, and it will there has to be an infrastructure that you need, you know, and that reminds me of our definition that we have today for financial wellness. And if I could read it to you. Yes, so this is from the life of wellness Institute. And it says that financial wellness involves the process of learning how to successfully manage financial expenses. Money plays a critical role in our lives and not having enough of it impacts health. Financial stress has repeatedly found to be a common source of stress, anxiety and fear. Keeping track of expenses, making a budget, and sticking to it are important skills to have in order to be financially responsible, and independent. Learning how to maximize your financial wellness now will help you feel prepared to handle potentially stressful financial situations in the future. And this storm is a perfect example. You know, if you don’t have a savings, and because of the weather, which is completely out of your control, your house is frozen. And it thaws out how nature does things. And what happens when the soul isn’t working? What happens when part of the pipe freezes and falls off? You know what I mean? What are we going to do? And so it’s important to know what you need beforehand. And I just look forward to delving into this conversation because I could talk about it all day, which is why we started a podcast.

Christine Gautreaux 9:15

Well, anthemic and other things that are happening um, I love that definition you read thank you because researching for today we also ran across the definition of financial wellness at Northwestern which kind of laugh because it was much more succinct it said and and not as well defined. It was financial wellness is defined as satisfaction with current and future financial situations.

So I like the definition you gave us and about. I mean, we know like even what you said about Money plays a critical role in our lives and not having enough of it impacts health. With the disparity of health between white women and African American women absolutely see that in whole populations in the United States see that about access to health care? Right. But what people have been fighting about in our government for, you know, the Affordable Care Act and having access to health care, is how, you know, jobs are tied to, to our health insurance right now. So it all just comes together, doesn’t it?

Shannon M. 10:39

Yeah. And I mean, exactly what you said. So let’s get into the personal stories, you know, because that’s one of the first things I think about, you know, doing this podcast women connected in wisdom. One of our main goals, of course, is to provide resources and actionable steps, right. So I’m very smart. I’m sure a lot of people would guess that by listening to me speak, right. But my good Oh, Rich Dad, Robert Kiyosaki. Okay. So me that a students work for C students. And if you’re a C student, I’m not bashing you, I love everybody equally. Okay. But I was like, What are you talking about? I’ve got to read this book. Why? You know, and it’s because we’re taught to learn by one set of rules and stick to that, and there’s only one right answer. And that’s like a straight line. Straight lines don’t happen in nature, you know, you have to go with the flow, figure out what the weather is, and do what you need to do based on the situation that you’re in. And see, students are great at that. They’re like, whatever, or they’re finding their own way. And the teacher is upset about that. And so they got to see, but really, in real life, they would have been the only person to pass, you know. And so that made me start thinking about finances differently. And, you know, we talk about finances and women and glass ceilings and different barriers, even as of course, educated young black woman, I was, you know, able to take the opportunity of having my high school teacher pay for my college application. That wouldn’t have happened had, of course, a list of other things happened, but I needed it to happen. And I was thankful for that teacher who was able to invest in me, then I was able to go to college, because they said that your grades will get you scholarships. I listened to that freshman year, because I absolutely had to. And my tuition was completely covered for four years. And I graduated with honors right, went on to work in at Papa Joe and be in salary got promoted and all these things. And I found out that I was really smart, really able to follow directions and be part of the team, but to make a budget for myself and stick to it, setting goals. And knowing what I personally as Shannon Mitchell wanted to do, that wasn’t ever part of the conversation. So to find out that I was really smart, and these other areas, and almost illiterate. And finances was almost devastating.

Christine Gautreaux 13:01

I love that you bring that up shaming because I would put me there too. Yeah, different reasons. Um, you know, I think, and I know we’re of two different generations, but I grew up in a family that we didn’t talk about money, like we were actively taught not to talk about money. My grandfather, who I adore, rest his soul. He came from sharecroppers and came through the Great Depression, and, you know, did not have money growing up at all like had to, he had was he I think he was a third grade education or fourth grade creation. Because of the Great Depression, he had to come home on the farm and work, right. And so because of white privilege we’ve had, he was in World War Two, and he was a wounded veteran, that wounded in the war. And because of his access to the GI Bill, his kids could get an education. He could also buy property. That’s how he bought that four and a half acres was from his time in the service as a white male. And that’s where he started accumulating some money and had access to resources. Right. But before then did not and so he never talked about money. Did not he was the ultimate penny pincher, like, I remember once a year, he would take the family out to dinner. So it was a big deal once a year. Yeah, take everybody out. And then and he was very generous me and generous of spirit and stuff like that. But we grew up with that whole concept that we didn’t have money. That was passed down from his generation. So we had a roof over our head. We had more food, because we grew our own food. And, and did we did farm to table before it was cool, right?

Shannon M. 15:11

I love farm to table.

Christine Gautreaux 15:13

He grew up with that. We don’t have any money. We don’t have any money. We don’t right. And, you know, we had money. Right? Our needs were met. It’s all it’s so. So should we grew up not to talk about it. I remember my mom would sit down and balance the checkbook once a month, or maybe once a week. I remember her doing it once a month. But I don’t remember any education. Right. And I don’t and we didn’t talk about it at home, we didn’t talk about you know, all we talked about was we don’t have any money. Or you can have that on your birthday. Like, right? When is something you would get it, you would get new clothes on right before school started. And then you would get something special on your birthday and Christmas, like, and so I mean, didn’t lack for anything. It was wonderful childhood and growing up in nature and stuff like that. But the whole financial piece and taught let me let me back up on this actively thought that people who had money were questionable. You know, that maybe their morals were questionable, or they weren’t trustworthy, or, and I don’t know that they did it on purpose. You know. But, so coming from that background, like I really haven’t like still I’m in my 50s y’all. And I’m figuring this out. Because when you’re not taught it, and you’re actually taught to shy away from it. It’s a big, you know,

Shannon M. 16:45

yeah. And you know, like, it’s crazy, because not only that, but my Okay, so for the past two decades, my dad is making cutting yards, right? He has a lawn care service. So I grew up mowing and weed whacker, and we’ve talked about this and I would love to go get the money from the customers right? He will let me go get the money. So I come back, and I’m flipping my money making sure everything’s face the right way. That’s cute and all but you have no idea. No scope of how much things cost. Do you know a Tesla costs $67,000 I looked that up to put it in my abundance budget. We’ll get to that later. Right. But you got to know the price of it. But just you know, holding on to the money in your hand like penny pinching like you mentioned or facing it one way isn’t going to tell you to follow your expenses like this definition just said make sure that you know what’s going out and what’s coming in and what you need based on different situations.

Christine Gautreaux 17:40

I came there were four questions that I ran across as I was researching for this episode, and one of them was there for some will go through for him so we can talk about them right about how to have financial wellness. Okay, number one, do I have a budget? And am I able to save money? I’ll just be really transparent y’all. This isn’t me to have a long term savings. I’m really not great at short term savings. I’m getting better. But I yeah, I think that whole piece about knowing our numbers and I could do some definite improvement on so number two, does my behavior reflect my beliefs and values about money? I like that Yeah. When I first sat with this question, I was like well yeah, it does because you know I buy from ethical companies I’m intentional about where I put my money right I’m generous with my money when I have it but then here’s what hit me she didn’t wait teach about self and Community Care Community Care part I sometimes I’m not

Shannon M. 19:04

good at paying myself first that’s literally what I just wrote down hashtag pay yourself first. Right Yes, it is

Christine Gautreaux 19:14

not often self care being massages and things like that which can be tied to the financial writing, but it is also literally paying your bills

Shannon M. 19:24

and and if I could to, I would say so. What you just said massages, I’ll add in nails, eyebrows, mustache, beard, all those things being taken care of. Right? And for me, it was the second one right? Does your behavior match up with your beliefs versus values is very important to take care of yourself. But when I was salaried making 10s of 1000s of dollars and I didn’t have a savings account is because I didn’t set the budget first. And so I’m going to get $100 pedicure manicure because I like the hot stones. Do I want parafin Why are you asking me quick? is the sky blue? Like, let’s go. Of course I wanted hot towels. I needed 30 minute massage, you know what I mean? Like for? I mean, all of it $100. And if you have it if it’s budgeted, absolutely. And you know where your money is, of course, but when you don’t when you don’t know the numbers now we’re starting to get into unhealthy habits. Right.

Christine Gautreaux 20:21

Well, that flows into question number 3am. I using my money wisely.

Shannon M. 20:26

Right. Right. Yeah. That’s that

Christine Gautreaux 20:29

piece of intentionality. And then their money how they want to spend their money, right? judgment on that piece. Right, of course, got, if you and if you have dependents are, you know, have food and shelter and electric, especially when it’s cold, you know? Yeah. That no judgment on where you put your money. But are we using it wisely?

Shannon M. 20:54

Right, right. Right. And I love what you said from the class, the the master mind that you went to earlier about. Give your dollars a job. You know, when I was a kitchen manager, you are running multiple systems at the same time in a restaurant. I’m where I’m thinking about the host, I’m thinking about the bartenders, their servers in their great time is the ice filled up is the trash can clothes in the back. Where am I dishwashers that Where are my cooks? You see what I mean? And everybody needs they know that when Cheney comes in, she’s going to ask to make sure that you’re doing your job and that’s exactly how your dollars should be for you to

Christine Gautreaux 21:31

write that was a that came from the the eight verse best eight best personal finance app. So we’re going to talk about in a little bit that the apps that every dollar should have a job. Okay, I like that from Latoya his article. Yeah, that was an article by Latoya Irby. And that’s personal finance apps. Which, let’s let me give you the last fourth question before I get into that. But number four is Do I have financial goals in plan? Future?

Shannon M. 22:04

Boom. And goals are written down ladies there they are written down. If they are not written down, you do not have them and I’m not pointing fingers at you. We’re just talking on the podcast.

Christine Gautreaux 22:16

Say on that one I was talking about in this masterclass earlier today. Yeah. You got to put your numbers beside it. Oh, yes. Like any goal, right? Like we’re nesting Mondays, and somebody says, I’m gonna do something and either you or I pop up and say when when? What time

are you? But the same thing for our financial goals, right? Yeah. Is um, I want to reference the class you were talking about. I was in an earlier printers masterclass, done by Paul Zelizer. Earlier today, and he has the AWARE printers podcast, y’all should go check it out.

Shannon M. 22:56

It’s amazing. Yeah, it’s amazing. But

Christine Gautreaux 22:59

he was talking about for entrepreneurs that you should have. I mean, he was talking about boundaries. And one of the boundaries was financial boundaries. And so I wrote it all down. So we could talk about it today, because it was such good stuff. But he was really talking about as an entrepreneur, but I would say is anybody, right? Yeah, absolutely. Want to have a budget, but you don’t want to just have one budget. Like you want to have your minimally viable budget. What’s your basic, you know, you’re paying for your shelter, your food, your transportation, your clothes, like you are? Right, and that’s your Minimal Viable budget. What’s that number? And really, down to the penny? In honest about it? Yeah. Looking at. I know, I’ve done a couple of courses before where you, you look back to get your numbers, you look back and be really honest about what you spend. Don’t just, oh, I spend $200 a month on food. Right? That may have been before the pandemic before. You may be spending four or $500 Like

Shannon M. 24:10

literally, yes.

Christine Gautreaux 24:12

What are you spending? And then the second budget is what is a sustainable comfort budget? We’re not talking Lamborghinis or anything like that. We’re talking. We got some good stuff. We can have nice meals or nice vacations, but it’s sustainable.

Shannon M. 24:33

Yeah, like I can tell you for me the first one what I think about is again, the basic bills this is your phone, car insurance, car note rent, Georgia Power, whatever those bills actually gas. Yeah, the internet, your gas for your car, all those things basic budget. The second one is okay, now I’m getting my nails done every two weeks. I’m getting my hair we twisted every six weeks. Eyebrows beard mustache. I mean, is being taken care of on a consistent basis? Now that’s that’s the next step up. Right?

Christine Gautreaux 25:06

Yeah. Third budget is the one’s budget.

Shannon M. 25:09

Right? And that’s the Tesla, the vacation home.

Christine Gautreaux 25:13

What’s that for your vision? Because everybody’s gonna have a mission? Yes, that’s true. Want to vote? I’m like, I don’t want to vote. So I want to play, right? Everybody’s version of abundance is different, right? That look like so. And getting really specific. Cuz you know, use the word abundance. Well, what is that? Right? A ton of abundance in my life when you look at the clutter. Financial maybe different. Right, right. Check it in with what is it? And what’s your number?

Shannon M. 25:46

Yeah. And I love that, you know, and what, what our listeners don’t know that we know is we were very intentional about the name of this podcast, right? Because we don’t want to put an extra burden on top of you wellness, and manifest manifesting all this stuff is it feels like work. And we’re already doing a lot of work. And yes, it’s true. You need to write down your goals. He can’t get around writing it down, putting a number beside it, and a date, you know, but this is the fun part, you know, what is your perfect day look like waking up in silk sheets on the way to your private jet for vacation? Like, what is that, you know, I have a little fun. And remember that you as a woman who is taking care of yourself and your community have the right to dream as big as possible. And that’s why I’m so excited, Christy, because in the history of women’s history, we are in the best position in the United States right now for four years. Like right now we have so much opportunity to really see what our goal should be. And to start making steps to be more well.

Christine Gautreaux 26:50

Yeah. Right. And it’s and this whole thing about we’ve talked about before, how all the wellness interconnects and fundraisers piece, because if we can’t be well, financially, we’re dependent on other people. Whether that’s a spouse, a partner, our parents support group, right. Right, who? And so the government? How do we do that? Right? Yeah, and I loved in this class I was in earlier, it really made me think as a female entrepreneur, right? He said, When you know your numbers, when you know what your goal is, then when people ask things of you, like ask you to do something for free, or ask you to volunteer, which they do, they asked all the time, very much more so than right. They want us to give our give our expertise or our labor away for free a lot of time. But when you have those numbers, and you have in your head and you have those goals set, then you can make an educated choice, yes. And then run it through that filter of how does this choice affect what my life experience will be? Yes. And I may choose, you know, there’s people all throughout history that have chosen a vow of poverty and don’t have possessions and choose that they still have a minimal viable budget to survive, or it’s providing for them. Right, right. But that’s their choice, and no judgment on that. But running that through the filter. And if we don’t know what our numbers are, then we can get away with it for a little bit. Right? What’s our future? That last question about our goals and our plans for the future? So important?

Shannon M. 28:44

So I want to break it down for a couple of different things that I think about. Because there’s so many, again, there’s so many different conversations we could have, right? But first, again, knowing what your numbers are going, of course, like you said, going back through, and literally writing that down. So when Corona shut down the restaurant, right? I told you guys, I was a kitchen manager, I stepped down to be a server. And you know what happened to the serving industry when Corona started. And I decided not to go back and instead use my money, my unemployment money to start a business. And I did that specifically, because I knew history, and it’s black history month. So let’s really have this conversation, right, because we don’t always have it, which is also historical. But I started a business with my unemployment money, because I knew that historically, when the black community is more government assistance, they end up in a worse position. So now I’ve been told that the projection for 2025 is that we are being a word the as a community in a worse position than we were before Corona. That’s us repeating history because we don’t know it but when I saw it myself, and unemployment, which I had never been in before, right? I said, Shannon by herself, let’s money falls through her fingers, and we got to be more financially literate. How do I get an asset? Which is what we were talking about last night on clubhouse? How do I get something that will help my money work for me? How do I be wiser with my money? If I say I want to make $100,000 This year, which is a goal I have written down, then what is realistic, right? What is my monthly expenses? I know what it is compared to what it was before Corona, because I’ve been paying attention. And then what do I need to do to get there? You know, if you guys if you ladies, follow me on Instagram, you know that I’ve been talking about all the different streams of income that I’ve been working on. And I’ll be honest with you, Christine, when I wrote down my financial goals this week, and I was adding it up, and then I multiplied it, by the rest of the weeks that we have in the year, it wasn’t even $30,000. So now I know, I don’t need to change my goals, I need to change what I’m doing so that I can reach my goal. But if I didn’t do that, I would have been door dashing around the town and trying to, you know, trying to make it to $100,000, when really I might need to go be a wholesaler. Or I might need to be an author or do something else make a digital product so that I can supplement it and then get there and then whatever it looks like, again, based on the weather of the situation that you’re in, but had I not known my goal, and then set goals for myself weekly, knowing what my expenses were, I would have just had a nice goal for 2021 because it’s a new year and corona can’t hold me back and been, sadly sadly disappointed at the end of the year. But that would have been because I didn’t set myself up.

Christine Gautreaux 31:47

Right. Such important info. I want to give a shout out to our friend Tamara, who’s listening while we’re live today. Hello,

Shannon M. 31:53

beautiful.

Christine Gautreaux 31:57

always lovely to have our friend come on in. Yes,

Shannon M. 32:00

yeah. And something else I wanted to hit on to Christine is, of course, again, we’re women connected in wisdom. So we have to point it back to the women. Right? House labor and caretaking is the most underpaid industry after slavery. Right. So when you’re taking care of all the when I’m timing myself, and I realized that I’m prepping and cooking for three hours a day, because we’re mincing garlic and onions and bell peppers and kale. And that adds up to three hours that I could have been door dashing, or I could have been working on social media, you know,

Christine Gautreaux 32:37

it’s been years, but there was a study done years ago, and it was like if you added up all the things that most women do, and especially if they have children in their homes, right? The six figure job if they were six figures and are done to do outside of the home. Exactly. And it makes it more and this was before Uber and before you know what when you chef and housekeeper Yes, Uber driver and like tutor Yes. All the things their business. Right? And all that add up laundry, like you pay somebody to do your lawn, all of that, right? Yes. Yeah, it’s amazing. And you were talking about earlier, before we jumped on, you were talking about the book you’re reading. And the one about the hours of the week, 100 hours in a week.

Shannon M. 33:38

Right? So again, Rich Dad, Robert Kiyosaki, it’s all about time, freedom, and financial freedom, right. And so for me, these two things have been hand in hand. A lot of times, it points to even the class earlier, right? How entrepreneurs do XY and Z. And right now there’s this divide of this is information for entrepreneurs, and this is information for everybody else. But really, entrepreneurs are just in a situation where they know they’re responsible for managing everything, and employees are used to their boss telling them what they’re gonna make, what their schedule is, and then we we based the time with the kids or, or me getting my nails done off of whatever off day I have that week, and hopefully I have two off days. You know, hopefully I’m not working nine days in a row or whatever is mandated by this by this company, you know, so it’s really important that we just manage better as individuals, whether we work for somebody else or not, but again, that’s not how we’re taught to do things and that’s why we’re here on this podcast talking about it today.

Christine Gautreaux 34:40

I so we talked about resources for finances. We’ve talked about this, like, how do we do this with all these busy things we’re doing and how do we because it can be overwhelming, right? If you work out it, it there’s a lot of shame and guilt around finances. When I was a baby social worker, I was doing home studies, getting folks ready to be foster adoptive parents. And I would do home studies. And we would this was basically a six to 10 page document of everything in their life, right? And we ask really intimate questions. And I will tell you truth, people found it easier to talk about their sex lives than they did about their finances. Like, there’s a lot of charge around finances. And so I’m always looking for resources. And I also think, in most of the studies I’ve read, and most of the books, you know, they say finances are one of the most stressful things for couples. That’s one of the most things they argue about, right? I’m always looking for resources, about finances, and I know you are the queen of resources in our book you were referencing,

Shannon M. 35:59

yes, the 168 hours. And thank you for coming back to that, because that was definitely still on it, too. It’s about managing your time. And we all have 168 hours in a week. And when I heard that, it was more than I didn’t know, off the top of my head, how many hours are in a week, you know, but I knew that I had been working on my schedule. And as a manager, that’s one that was one of the most difficult things for me to do. And it was like that across the board for managers, you know, so if you don’t have managerial experience, and you’ve been struggling with your time, one, I would say be graceful with yourself and understand that it’s a difficult task anyways. And then when you want to start working on it, start with 168 hours a week, and then reverse engineer, which is start at the end and go backwards, right? So how many hours do you want to sleep at night, some people sleep eight, some people sleep six, because of their work schedule, you know, and figure out whatever you want to do, based on your roles, responsibilities that you have, and then map out your time, you know, make sure you give time to rest. Because if you don’t rest, you’re just burning yourself in the ground and not being as effective as you could be. And, you know, then after that you can set out your goals. And you know what, what you should be working on based on the time that you’ve allotted to it. And you can go from there. But 168 hours has been a great audio book, to be able to give me more context to how to frame my schedule as an entrepreneur.

Christine Gautreaux 37:24

I love that which ties in with the financial question. Oh, of course. Let’s talk a little bit Shannon, about the eight best personal finance apps of 2021, which was a research we found getting prepped for this show. And this was an article done by Latoya Irby in the balance. And um, you and I both have this app on our phone. Yeah, I’m really honest, and say I’ve not done a good job of using it. But the number one best overall financial app is mint.

Shannon M. 37:57

Yes. And one of my Mint is actually one of my favorite apps right now. And not because I use it as often as I should, if I’m honest, as well, but because it sends you notifications, right, and it’s like Shannon, did you really spend $0. Last week, and let me tell you, ladies, as somebody who went into Target to get a pair of shoes, I came out ahead spent $600 did not get any shoes. Okay, so went from that to Shanan. Did you really spend $0? Yes, man, I really did not spend any money. Yes, and it helps,

Christine Gautreaux 38:39

oh, by November or

Shannon M. 38:44

it was crazy. I said, this is a problem. I’ve got to get disciplined. I’ve got to know where my money goes. Because I work too hard to not to not know, you know?

Christine Gautreaux 38:53

Yeah. So we tell you, and it will connect, I know it’s an app that intersects with your bank account. Pay Pal, it can. So I know a little bit about it. I’m going to commit to using it more. And I’m because I had another friend tell me it takes a little bit to set up especially the budget piece. Once you get it set up, it works brilliantly. And it’s free. All it does doesn’t cost anything. So um, so that is meant we’ll put that in the show notes. And let us know like by tagging us on wisdom and action if you download it and you hashtag wisdom and action and download it if you download it and start using it, you know, let us know that was that awesome. Yeah. So the second one they said was one that I had never heard of. And it was it’s why in a be you need a budget.

Shannon M. 39:50

I love that and I tried to get around it. I thought that I didn’t Oh, I know about how much I know you. You need a budget.

Christine Gautreaux 39:57

Well, and the reason is it’s best for debt payoff, right? It’s best for so I want to read this because this was what their description was. And I think it fits right in with what we’re talking about. Okay, built around the four rules, right? Give every dollar a job. Embrace your true expenses, which we’ve already talked about that a little bit like being really honest about it, because we can you start really looking, you’re like, I did what, like you said, if they right?

Shannon M. 40:29

Yes, oh, by the register.

Christine Gautreaux 40:33

And then oh, with the punches and age, your money. So I think you reference the roll with the punches when like the web, or the, or the, there are going to be times that unexpected things happen. Right? So if we can prep a little bit for them. And then the age your money is definitely about, you know, investing in learning that which I know we have feelers out for some really good guests in the future coming on. Yeah. stock market investing and how to do that for retirement. Yes.

Shannon M. 41:08

And, and it’s interesting, because a lot of people talk about retirement, but whether it’s for retirement and you want to invest for the long term, or if it’s for income, and you’re trading your day trading or your night trading and doing different things, you know, so the last biggest point that I want to make for this episode, Christine, we talked about the women’s side of it, right? But of course, we got to talk about the black side of it too, because it sounds really simple. The definition, right? Financial wellness, oh, just write it down, set some goals, and you’ll be good. But we have to think about where we’ve been and how we’re psychologically conditioned, right. And when you talk about a goal, let’s say my goal, right. And if I would have been 100 years in the past, or 150 years, in the past, me having this much potential in setting goals would have gotten killed. You see what I mean? So when you talk about long term planning, I just now have started to be able to think about and really give some context to where I can realistically see myself in five years. 1020 years is still too far. I’m not there yet, you know. But when you talk about working hard, and then the sheriff in the police department, kicking in your doors and taking your assets, if you need assets versus liabilities, when you’re in a system that setting you up to only have liabilities, and then you are intentionally underdeveloped, so that we don’t know what these different things are, or how to navigate the rules, because all it is is a system thankfully, Money plays by the rules. So if I know how to study and work in the school system, I can learn this and figure it out. But all of that conditioning and being a woman on top of that, so be underpaid. And when you talk about working in the house, people in women being used to being paid nothing. If you see a woman working you expect to pay her nothing, it’s even a further distance to have to travel, you know, to get to being able to wrap your mind around budgets, long term goals, being self disciplined and knowing how to get from A to S. You know?

Christine Gautreaux 43:24

Yeah, I think it’s so true. Like, I mean, it goes back to the inequality from 400 years that our country was built on slavery, right, and free and enforced labor. I was in a class this last week with some incredible black scholars, and they were talking about reparations. And that and this was, I had no idea. For the last four decades, there has been House Bill 40. That is been put that has never made it as far as a vote. This is just This is what blew me away, Shannon. Just do a commission on the study of reparations. Not talking about how are we like, just to get a study. reparations. Never made it out of committee. It has a chance right now. Yeah. Oh, 40. Does we all need to reach out to our legislators. Because y’all this is just information write you a commission. And a study on it. Like, really shows the inequality and the racism in our country that we can’t even get the study. Like, it’s it, you know, it’s mind blowing. And I don’t have to tell you because you’re living it right. But yeah, in access resources, and yeah, it’s amazing. It is yeah.

Shannon M. 45:00

And it’s really interesting. I’ve been thinking about because I told you I’ve been reading the the lynching in America, right. And I mean, I’ve read it, the history of everything, and how things were ran, basically. And when I was listening to the Senate case this week with Trump, it was really interesting. And his lawyer is amazing, as I’m sure he should be for however much he’s paying him. Right. But this is the point that I want to I would I would like to put on the table that I think they missed. And I also felt felt like I understand why they couldn’t bring it up, because we’re in the Senate, right? Is that Trump’s said, Be peaceful and patriotic. And so his, his lawyer was, like, he said, peaceful and patriotic, how well, is that a direct command to go do and you know what they did on January sixth? And I said, Well, wait a minute. Because Patriot patriotism used to mean something else. How are you telling me that these 4084 lynchings that a lot of them were rip? These people were taken from the jails? Who were the were the guards. Oh, wait, they’re with other people. Right? That makes it you know, so if you say it’s peaceful and patriotic to me, Shannon Mitchell in 2020, just reading this book for Black History Month, I’m reminded that those two things have been contradictory. And so we definitely have to be intentional about our wellness.

Christine Gautreaux 46:30

And we have to have these discussions. Right. We have to have those discussions. I mean, we know as women, there’s still a disparity in pay. Right? The and I yeah, I’m horrible at quotes. I should I statistics, I should have looked this up before I came on you a 40 cents difference in in every dollar women made 40 cents less. But that was men, women, that was white women made less right? And black women and other women of color. And that exactly right. Even that equal rights, equal pay for equal work, you know, as part of this discussion and finances, right? Because and then you add in the fact that most of the time it’s women who are the caregivers and have children and boys, just the cycle that we got to break ourselves we got to break ourselves out of because the reality is nobody else go help. Yeah. Because there’s a reason that they’re keeping women in these positions. Right. Right. Texas, so they always said barefoot and pregnant. Right. But there was, there was a thing about that. Right?

Shannon M. 47:43

Heard that brace it? No, I haven’t.

Christine Gautreaux 47:46

barefoot and pregnant is because you don’t have shoes, so you can’t leave? And if you’re tied to the house, right? Well, it’s that concept of keeping women tied to where you want them. Right? Oh,

Shannon M. 48:01

and I know, we’re wrapping this up. But that that is I will say the last point that I want to make. Because I’ve been again in clubhouse and listening to different people’s viewpoints in these rooms on what, what men won and why they haven’t been, you know, why women haven’t been engaged to all these things. Again, it’s really interesting now being in a new space where women are less financially dependent. And if we’re financially well, we definitely have an opportunity to do that, you know, but because of the financial disparity, and that how that ties to you surviving and your children surviving, and the way that everything all the other dimensions of wellness play out. It makes sense why the conversation has been lamed a certain way, you know, so we talked about the wisdom and action, right, and you guys, you ladies downloading men, we’re going to put in the show notes, the article that Latoya wrote about the eight best apps for your finances, so that we can start paying attention to it. You know, I know that it’s a lot, especially with Corona, it makes it even more difficult. But honestly, it makes it even more important. You know, and I want to give a shout out to shallow glow. That is really what the company is about. Taking a second in the middle of the chaos and all eight different dimensions of wellness, that you’re trying to balance every day and flow with the situation that you’re in, right Christina serves. Take a second to take care of yourself. Because a lot of times they will not be it could be your husband, it could be your dad, it could be your daughter and you thought she was gonna do something or whatever it is. You are responsible for your wellness and you also have what you need, you know, we have resources available for you. We’re all connected in wisdom. That’s why we’re here. And we can definitely start setting goals and if you if you set a goal and you need to change it you realize that’s not exactly where you need To be there’s time and space to fix it, you know, so that’s what gives me hope during Corona. And even the financial upheaval that we’ve had that I’ve had personally in my life, you know, there’s things that you can do to put yourself in a better position.

Christine Gautreaux 50:15

And I want to give a shout out for community care here about mutual aid. Like I, we talked about that a lot with social justice, and I know we’re wrapping so it could be a whole nother show on mutual aid. But, um, you know, some times Well, I think it does tie in with what we talked about earlier, Shannon, like, we have to know our numbers and know what we need. Yes, what we need, whether that’s from the universe and God, whether that’s asking for a friend, whether that’s asking from an employer, because we need to know what we need to make, right? Yes, yeah. Or asking it of ourselves for how many hours do we have to give? Yes, that knowing going back to that knowing our numbers and writing them down, and when your resources get low? I don’t know if you can see this, I can see it. Oh, glow more refill your book? Do what you need to take care of yourself. Because yes, I think it’s important. So yes.

Shannon M. 51:14

And like you said, well, like the the banner said wellness is a verb, you know, lady, so tag us on what you’re working on this week. We’ll see you on social media. And don’t forget, be well be wise

Christine Gautreaux 51:28

and the whole

Unknown Speaker 51:38

thanks for listening. This has been the women connected and wisdom podcast on-air live on Wednesdays at 5 pm. Eastern via Facebook and YouTube. Be sure to like, share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment