Show notes –

Join Shannon & Christine as they chat about Financial Wellness.

Join us in community: Women Connected in Wisdom Community

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Our Sponsor – Shealo Glo – Now offering Subscriptions * Delivered on the 1st & 15th!

Stillpoint: A Self-Care Playbook for Caregivers

Book a free coaching consult with Christine here: https://www.christinegautreaux.com

Like & Subscribe to get notifications of when we are live:

Women Connected in Wisdom Instagram

Women Connected in Wisdom on Facebook

Worried you’re mismanaging your money? Give yourself a financial checkup in 7 simple steps

Become a Sponsor at the Women Connected in Wisdom Upcoming Virtual Conference – email us at womenconnectedinwisdompodcast@gmail.com & we’ll send you information

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Shannon M. 0:08

Hi ladies, I am Shannon Mitchell, a black millennial business owner, the founder of shallow glow LLC, an all natural skincare company that helps you glow from head to toe. I am a champion for your daily self care, business care and intentional wellness.

Christine Gautreaux 0:21

Hey, y’all. I’m Christine Gautreaux, a white social justice advocate, and international speaker, coach, published author and dancing social worker who helps you upgrade yourself and community care.

Shannon M. 0:35

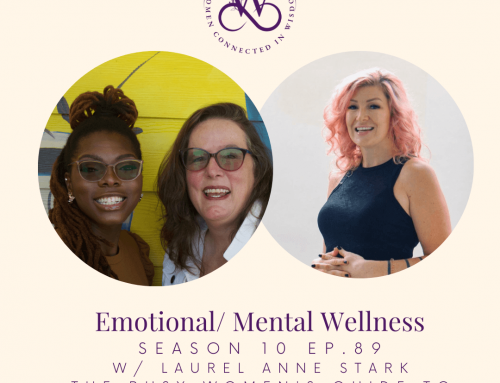

Together, we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness.

Christine Gautreaux 0:39

And we like to get together every week for intentional conversations between us and special guests about how to be wise in business relationships and wellness. Like how do we do this?

Shannon M. 0:51

All of it? Right? It’s a lot. It’s a lot. And today to give you the definition, we’re gonna go ahead and talk about it. We’re talking about financial wellness, and our women connected and wisdom definition is financial wellness is an intentional approach to your relationship with money as a tool. It includes stability with current finances, increasing positive financial behaviors like budgeting, reducing debt, saving, and investing. Financial Wellness incorporates knowledge and skills that helps to change behavior, reduce financial stress, and creation of a strategic financial plan to reach desired financial goals.

Christine Gautreaux 1:32

To mouthful. Yeah,

Shannon M. 1:34

and this is really, for me, when we talk about maintaining wellness, right? How do you do it? Financial Wellness was one of those categories that was like, screaming at me, like, Hey, you were not consistently taking care of what you need to take care of. When I started with a credit card, I said, You know what, I’m only going to buy a guess on it, I’m only going to buy what I need and make sure I have the money to immediately pay for it. And I did for a while. And then I build a x out on the credit card. And it’s still sitting there to this day, which is why I’m working all these hours. And we’re working on it. Now I use it as a tool, and it’s different. But I said I used to be wiser, how did younger me operate more wisely with money and what happened and that is the shift that showed me that I need to maintain wellness, it’s not just enough to be wise and and know all these things, you have to act, there has to be action behind it. So that’s fine.

Christine Gautreaux 2:31

And you know what I’m gonna say to you what I would say to my, what I say to my clients and my friends, is Be gentle with yourself. Because yes, your younger self may have had a handle on it. And what we’ve been living through the last couple of years is unprecedented. And so there may be a need for a checkup, there may be a need for an act kind of column A financial audit, right? Or check in with yourself because also, you know, life happens. Life happens. Sometimes relationship status change, job statuses change, the world changes inflation, you know, things. I was just I was just reading an article today that I’d love for us to talk about. Because it was this very thing. I’m just gonna give you the title and we’ll put it in the show notes. But it was worried you’re mismanaging your money. Give yourself a financial checkup in seven simple steps. You know me, I love a good resource that’s like do this do this. Yeah. And this is written it just came out today. And it was written by Sharon Epperson. And she so basically she’s saying it’s time for a checkup because of inflation. Because, you know, summers wrapping up, kids are going back to school like, oh, that impacts what we’re doing with our money, right, and especially as women. So the first thing she said is, I thought this was interesting. Number one, find your personal inflation rate, you should figure out how the impact of inflation and rising rates is doing on your budget. Right. And she also gives some really cool links in there about top tips to save on back to school shopping. And major travel costs fell in July. So we won’t talk about those their links in this article, but we’ll link to it in our show notes. But she says even though the inflation is at a 40 year high, we don’t all spend money, the same amount of money on the same things is not the truth. Like let’s pause right there. What are you allowed to spend money on Shannon?

Shannon M. 4:38

Oh, I was reading your chapter earlier. So I have your answer in the front of my mind. I’m allowed to spend money on let’s see food too. If I know I need to eat or something. I’ll treat myself no problem. What else clothes? I like clothes. And I like books to go Yeah,

Christine Gautreaux 4:56

I don’t know if I put books in the chapter. I can’t remember that but I know food and flight ours were the two things I adopted our books. Oh, yeah. Oh, absolutely. Anybody that’s ever helped me move knows that.

Shannon M. 5:10

When I was moving, I said, I have all these books. I was supposed to read the books. I had a bookshelf full of books that I had not ready yet. So I will say yes, but

Christine Gautreaux 5:21

okay, so it says, how to do this, how to check your personal inflation rate is to gather your bills and bank statements to see what you’ve spent on food, housing, gas, entertainment, apparel, education, other items for the last 12 months. So like, you may have done this before, but the last 12 months has been different because of inflation being higher. And then you calculate it, and she gives you a complete like, check, she gives you a link that you can click on in this article, but you add up your monthly spending for the last month and what you spent on those same goods and services a year ago. So boy, this is some detailed work. So for those of y’all that aren’t detailed, I’m one of those like light a candle get your favorite beverage block out some time get your, your favorite music, like when I’m doing financial kind of stuff. I like either classical or little jazz, but nothing that’s going to distract me distracting, right? Like a little Lo Fi. Your Oh, nice. Yeah, good beat going on. She said subtract your total spending from July of 2021 to from July of 2022. And you divide that difference by your monthly expenses, where we’re getting really into the weeds. Sorry, we’re gonna put this in the show notes. And the result of that equation is your personal inflation rate.

Shannon M. 6:36

So she said makes sense, though, right? She

Christine Gautreaux 6:39

said it’s the actual number is not really the point of it. The point is, you should review your expenses to see what you’re spending and what you can cut out reduce or negotiate to a lower rate.

Shannon M. 6:50

Right. Go ahead. I’m sorry, I don’t want to cut you off. No,

Christine Gautreaux 6:54

I just can guarantee food has been like because you know, I’ve had everybody home that just changed because the youngest person went back to college and the oldest is about two but you know, having four now adults in the house all summer boy that I can tell is going to be a huge difference for Yeah, yeah.

Shannon M. 7:14

But I think it’s important to right, if we talk about I know, we talk about occupational wellness right now we’re talking about millennials jumping from job to job, right. But before that, if we were staying in the same place, and we have the same income, if my expenses are changing, Well, no wonder stuff feels a little shaky. It’s not because my valuable time that I’m spending at work isn’t being appreciated it that’s not stretching as far as it did last year, because it now takes $120 a month for gas. When before it was half that when I bought my car 2015 I filled up the Honda $25 Now it’s

Christine Gautreaux 7:53

yeah, I just had that I just had that conversation with the gas thing and they’re coming down, right, the gas prices are coming down. But for the last six months or more, they’ve been high. And um, so yeah,

Shannon M. 8:06

for me, it’s just important to realize, okay, okay, so guess when a breadwinner up? How are we going to change our menu or change our traveling patterns so that we can still meet the budget, you know, it might mean, we’re not going out to hang out as much we might stay home and still spend the time. So you get what you need. But you’re not spending the extra because the budget still needs to stay the same. You know, being intentional, like that is really helped me communicate what I need to my community, whether it’s at work, and hey, this time shifted, I need to do this or it’s us in our workflow. This is now the consideration. And this is still how we can reach the goal.

Christine Gautreaux 8:43

Right? You kind of spoke to number two that she says in this article. She says avoid lifestyle creep, where I’m guilty of this one, you’re already you may have gotten a slight raise or move to a new job making a little more money. So why not treat yourself to take out most nights of the week, or you’re working so hard, you don’t have time to cook or you’re on deadline for a book. She didn’t say that but those meals and delivery cars have doubled your food cost but your take home pay hasn’t kept pace, you may be the victim of lifestyle creep, as the cost of your lifestyle increases faster than your income. So you want to see what expenses you can reduce or cut out like membership subscriptions or maybe even travel sometimes.

Shannon M. 9:30

And for that, you know I’m picky and not to pick apart this article because I think it’s great. She’s given me on on this stuff right? But I wouldn’t say victim those are the decisions that we have power that we make right and that’s what we talk about. And when we’re connected in wisdom like sorting and separating what’s yours What you can’t control what you can’t, and me eating out most days. I would love to I like it. I like to experience you know, that’s why such a big thing you’d like to be catered to. You don’t have to Don’t have to shop, we get it. But what I love about going to the farmers market, buy my own groceries, I know that this $100 is going to divide every time I eat. So here’s two meals and three meals and by 17 and 25. I’m feeling pretty good about my spending, you know, that when you eat out that multiplies it. So it’s three times, however much, plus a 20% tip for the food for the food and hospitality industry. Okay, right. And we’re more ended and that ends up adding up, of course,

Christine Gautreaux 10:35

well, and I mean, I don’t know about you lately, but things that used to be $10 and $15 Eat now and are now 20 and 25. So that’s an inflation cost. Yeah, there because the restaurants have had to stay open and stay alive. But yeah, I mean, it’s the little that you right, it feels like in some ways we’re being nickeled and dimed. It’s not like huge purchases. It’s just but I hear what you’re saying about that. We’re not victims of lifestyle creep. Their lifestyle creep is probably tension. I know what’s happening in mine.

Shannon M. 11:08

And I will also say there are things that might creep up on you if you have an adjustable interest rate. Now that that’s a creep. That’s, that’s something else. You know, that’s not to wear me. So Whammy, you know what I mean? So there’s different things like that, that absolutely they change, and we should be paying attention to, which is why I love that step, looking at your expenses once every year. And I like even that it’s July to July and not exactly when taxes are due, so that you can get those numbers before the holidays, get them before tax season. So you know what you’re looking at and can be intentional going up until that that time of the year.

Christine Gautreaux 11:46

Right. And I’m just gonna say as I read this article, y’all, I get a little overwhelmed by it just personally, because and when I’m, I’m thinking in my head, even as we’re talking about this, I’m like, Okay, how can I make this happen? And I’m realizing you gotta calendar it. Like, this is not I mean, maybe if your CPA or your numbers and you love it, you’re like, oh, yeah, let me go do this. You know, I think in my head, ooh, what can I watch Netflix? Just being really honest,

Shannon M. 12:16

honest,

Christine Gautreaux 12:18

here. Like, it’s like, okay, I need the calendar this I can saying I need to do it, I need to check in and do an audit. Because the other thing that I know, and I’m sure she gets into it, we’ll we’ll keep going on the article. But you know, the thing that trips me up sometimes is those subscriptions that I don’t know, like, I had one pop up, like I got this big old bill from, I was like, What the heck, I didn’t, you know, a lot of times I get, I’ll do electronic books. So like my subscription, and I’ll be like, Whoa, I bought more than I thought I did. But like this time, I was like, I hadn’t been buying anything. And it was a subscription that I thought was cancelled. And all of a sudden, they wanted another 40 bucks. And it was like, oh, yeah, no, no, I haven’t been using that app. Right. I haven’t been you know. So that’s where I get the lifestyle creep. I think it’s easier nowadays with our devices and our phones, right? I’m forever guilty of signing up for a free trial. And it flips over a few days. Yeah. Right. So I think that’s,

Shannon M. 13:17

that’s key. And I hear what you’re saying. And even for me, you know, this is why I always say intentional, and always say, the the maintaining of the wellness, because even now, right? I’ve been talking about keeping my receipts, and I’ve been doing a great job. And then I was seven months behind on organizing my receipts. So when the two year process, we’ve gotten better now. So okay, let’s make sure that we stay on the process, right, you have to keep drinking the water, you have to keep checking in with your body. These are things that you constantly have to do. And so for finances, I was trying to make like Friday the finance day, because they both started with F but it wasn’t working with the schedule. Okay, so I need to pick a day that works. And I was thinking about it this week, it might be Wednesday, I’m working on changing my schedule again. And that’s what we do as entrepreneurs, right, as we build the systems and the workflow, what makes sense to block together so that it’s actually done, instead of you overwhelming yourself by making unrealistic to do this, this, it’s not going to work at that time. Sometimes it just needs to be moved. Yeah,

Christine Gautreaux 14:23

total left turn and side note, and we will come back to this but I was listening to somebody’s productivity hack the other day, and they said before you go to bed at night, write your list of five things that you need to do tomorrow. And then it said when you get up in the morning, review the list and knock off the bottom two. Because it was unrealistic to have five things. I just thought about that with us.

Shannon M. 14:49

You know, you know I like to be excellent and I do a lot. Okay. I just feel like I can’t do five things. I feel like we get so much stuff done. Is this stainable to always do that. Maybe not, you know, but I say just like with health things and other things, see what feels good in your body right now. I’m okay with working the schedule. I’m working because I don’t have children yet, because I do have the freedom to kind of choose and go hard in the paint right now and then slow it down and maybe make it three. What I, I do usually have more than three on the list.

Christine Gautreaux 15:24

Me too. I just had to pull it up, because I was like, Well, that would be hard for sure. Right? Well, I think about like, okay, and then how do you how do you tweak that system? Like, okay, is it three main ones, and you have the subsets under it?

Shannon M. 15:44

But I think I think I like that, they’ll probably say this breaking the rule, they probably say if it’s three items is more than three. But I do like I do like subsets, right. This is something I’ve been trying to work out, like the time part of it. And that’s something that I think about with financial wellness is not just the money. It’s also the time that you spend, right in thinking about how I spend my time thinking about how to prioritize spending my time. And with working so many days right now work five days a week, I have two businesses, that means technically, I have a busy day for each business. And we know that all 24 hours aren’t going to the business. Right? So it’s how many things are realistic to get done in a day? And what do I want it? What do I want my workflow to be like? What should it look like if it’s healthy? What do brakes look like? You know, what are realistic timelines look like is really something that I’ve been working through.

Christine Gautreaux 16:37

I love that. Well, what a time to work on it. Because we’re on a book deadline, a conference that? Yeah, it’s I said in Tuesday’s class, because you know, Sheila and I lead a class on Tuesdays for radical self and community care. And we always the in the class, we write down one thing that we commit to ourselves for self care. And one thing we commit to for community care. So this week, I wrote I will sleep even though I’m on deadline, because what I realized is like in the past, I’ve cut my sleep short to like, get those extra and that doesn’t serve like anybody. No, no, cuz you especially in the practice of writing a book doing a conference like you, it’s a long term thing. It’s not like a short term thing, because we were going to be going hard until the end of October. So can’t do that without sleep. Right?

Shannon M. 17:33

And I think about it being a marathon, right? Like Nipsey Hussle said, and it’s so true, because it has to be sustainable. I’m like, Okay, if I put something down, what do I put down? Do I put shade look low down? It’s amazing. Am I supposed to be out here dry can’t do it. Okay, then I think about the book. And when we connected and wisdom, and we have to talk about the dimensions of wellness. It’s not just about physical, it’s also about finance. It’s also about occupations, and all these things that affect us. And I love the resources and stories and everything that we share with the ladies, those are necessary. So I don’t want to put that down. You know, I love that I will sleep even though I’m on deadline, right? He has. Yeah, yeah. So so. No, yes, go ahead. We do not have an an extra Expert. Today. Christine is actually going to be our financial expert, since hers is one of our chapters in our book coming up. So if you’re waiting for us to be excited about somebody else, today, we are excited about each other.

Christine Gautreaux 18:38

Still cracks me up that that ends up being the chapter I wrote. But you know, I was holding back since we do this show, and we have been doing the show. We’re on episode 80. Today, y’all. And we’ve been studying this and doing this work for years now. I was holding back to write the chapter that needed to be written depending on what other experts were lifted up and it still cracks me up that that was that one. But so today we’re talking about a brand new article that was written by Sharon Epperson called worried your mismanaging your money. Give yourself a financial checkup in seven simple steps. Because you know, one of the things I truly believe after years of being a coach and being a social worker and helping folks out is go back to basics. Like if things are out of whack if you are feeling uncomfortable, or out of balance or stressed out, go back to basics. So when I’m talking with clients, I mean I even go back I look at how are you eating? How are you sleeping? And are you moving your body? Right. And I think that applies to financial wellness just as well as anything else. Because when you know our bodies have two states, they have too nervous our nervous systems, right? We have our parasympathetic and sympathetic and if we are in fight or flight, which a lot of times when finances come up when If if we are stressed, and we are in that fight, you know, I gotta fight to get the money or, or I’m running from bill collectors or I’m running, you know, we’re in a state of heightened anxiety, then then that affects all the rest of our wellness, all of it. And so how can we be in our bodies be calm, even if we’re not in a great financial position, right? Like, how can we take a deep breath and get support, because, you know, we talked about all time on the show, but you know, hashtag partnership power. And the third step of self care is reaching out for support if you need it. And so that’s why this article just caught my attention today, because it was, it was back to the basics. And it’s also the call that doesn’t matter how much money you have. We’re in a recession, we are experiencing an inflation in the United States. And so let’s do a checkup. Right. So number three of the seven in this article was use only one credit card, get organized, so that you have a better handle on what you’re spending. If you have all of your transactions in one place, it will be easier to keep better track of your spending, have one credit card in your wallet to swipe at the store or use for online purchases. And if you use a digital wallet, like Apple Pay, or Google Wallet, use that same card for everything you buy. That just makes sense to me. Yeah, I’ve

Shannon M. 21:23

really liked that. I don’t have a credit card right now. And I do plan on getting one I’m sure I’ll get one in the future to build business credit and different things like that, we’ll see what happens. But I don’t I don’t even have a credit card. But doing it through one account absolutely helps me I do it through a living expenses account for my personal expenses. Because again, if you if you guys have been listening, you know, I like to separate my accounts, so the living expenses for my stuff, and then I move even if I buy something for myself, today, I I got myself some yellow roses, I’m gonna move that I want to see that little sunlight, you know, I’m gonna move that from my money, but it’s still gonna go through the living expenses and then go out for the business, I do it through the operations. So the money comes in the income and then it goes out of the operations account.

Christine Gautreaux 22:12

Right? Well, and I just want to say like for years, Joe, and I didn’t do credit cards, because we just weren’t really that great at them. But I will tell you, especially if you live in the United States, and you ever want to buy a home, you have to have a credit card, when we went to get approved for our home loan, even though we had, we were top notch leasing, we were always on time like and our mortgage was going to be less than we were paying in lease because we didn’t have a credit card in order to get approved for our home loan. It was funny, I joke about this all the time, the difference was a $250 Old Navy card, and a $500 visa card was like same income, same credit history. Same but because we weren’t playing the game of the credit cards, that that’s what we had to do to get it approved. And then we shut them down. Because we didn’t we’re not big fans of credit cards, because we like to we like to live on what we have. But we have one now for emergencies to keep the credit score higher, because it is part of the game of the credit score, and, and also for emergencies. So yeah, but we like to use our same debit credit card one for the I like that. I like her advice on that. Yeah, because it really does make my budgeting easier, because then there’s programs that I can just load it into. Absolutely. Alright, so talking about credit cards on number four, she says set limits and alerts on the cards. The limit for purchases on a debit card can vary from a couple of 100 to a couple of $1,000 a day, the bank generally sets that limit, but you can ask for a lower limit if you think that will help you rein in your spending. Some credit cards will also let you set your own spending limits. You can also sign up for alerts like email, or check my text messages or push notifications to let you know when you’ve made a purchase over a certain amount. I love that

Shannon M. 24:09

article. I had never thought about lowering the limit. Always think about raising the limit. You know, hey, that’s a good idea, though. If we want to control the flow of it.

Christine Gautreaux 24:20

And here’s the reality y’all. Everybody has different levels of self control. I mean, if you need that extra support, put it in

Shannon M. 24:29

there. And the day I spent $600 at Target and didn’t buy any shoes when that’s what I maybe I needed a limit. Maybe I needed that $300 cash withdrawal to stop me

Christine Gautreaux 24:40

is a place like let’s just I’m gonna ask you and then we’re gonna ask our listeners if you’re listening and you want to put a comment in or on social media later you can do it but what is the store that tempts you, or that you go over your limit without even like that you walk into you think I’m only spending this amount of money and you walk out and go How did that happen. I know my number one, what’s your number one right now? Costco it is, it is almost impossible to get out of that store for what I plan on. Yeah. Especially if I’m in there in person. If I Instacart it, I will tell you all one of my tricks is on Instacart things. Because yes, I pay the driver and all that. But I spend less on that than on my impulse shopping, especially if it’s at a store, like Target or Costco.

Shannon M. 25:28

I don’t. I don’t know if I have a store right now, to be honest with you, I’ve gotten really good at the rule. For the game of let me see if I can wait one more day

Christine Gautreaux 25:38

to buy. tell our listeners about that. Okay, so

Shannon M. 25:42

for example, I had this cord in the car, right, that was charging my phone. And I would have replaced it by like two years ago. And I just threw it away the other day, because it was still charging. So it didn’t look brand new. I wasn’t gonna get electrocuted or anything like that. But it looked a little bit a little looked a little damaged. But it wouldn’t kill me to keep it. And I waited a whole two years. And then I just had another one. So I had another cord didn’t even need to buy one. That one stopped working. Now I need to buy one. But as far as the priority of when to spend the money. Two years ago, COVID had just happened, I had just moved out of my apartment, all this stuff was going on, you know, the phone charger in the car is not priority. Exactly. So now I have more than enough space to be able to buy a charger. And so I play that game. That

Christine Gautreaux 26:31

game, if you could wait one more day, that just I also that just called my nanny, my my paternal grandmother raised she was a depression by me. And she loves stretching things right? I was thinking about her this week, because I have a I usually use like a moisturizer, tinted moisturizer. And with sunscreen on it is my base of my makeup. And you know how when you and this one has like a pump on top and, and it’ll quit pumping. And I was was like if I’m going to tell the story or not because it’s a little embarrassing how frugal I am sometimes. But I was like I’m out? Well, part of it was can you wait one more day because I was in a hurry. And I was like, Oh my gosh, like I don’t have time to go to the store. But I just flipped it upside down, cut it off. And there’s been like three or four more days of stuff in there. That, you know, I would have just turned away. And I was thinking about this morning when I’ve used it. And it really is the last day I’ve got to go. But I was thinking about my nanny, and how she taught us about using everything to the last job and like conservation in some ways. Like she did it out of a place of lack and coming from that generation that knew a lot of hardships during the Great Depression. But I think there’s some lessons when you’re in balance about that, that are good lessons, like even today. Like how far can you stretch something? You know?

Shannon M. 28:01

Yeah, absolutely. And I don’t, I don’t think there’s any shame because again, we’re letting go of shame and guilt, right. So I don’t think there’s any shame in you, us having your dollars work for you circulating dollars in the economy and having somebody go get your food for you because you save more money. Right? And there’s nothing wrong with you cutting the bottom of the bottom of the bottle up because guess what you pay for all of that product. So why are we

Christine Gautreaux 28:29

waiting he was and it was also thinking about Shaler glow and being in those gorgeous glass bottles. And that you can see, like, I mean, I use every drop of my hair, look my to what you can see. Right? Like you’re like, Okay, I know how much I have left, which I really appreciate. All right, back to the article. We’re on number five, y’all. Okay, five, have a mix of stocks, bonds and cash, you should have a mix of stocks, bonds, and cash and adequate emergency fund and cash reserves to cover living expenses is critical. Which I let’s just pause there that’s coming from a place of privilege. Let’s just name it that’s coming from a place of economic privilege.

Shannon M. 29:09

Which part is the stocks bonds or the Heaven? Yes.

Christine Gautreaux 29:12

I think stocks, bonds and cash. I mean, it’s a yes, I think it’s an ideal we want to stretch for. But I don’t know the latest statistics, we should look them up. But it was like 70% of Americans are living paycheck to paycheck.

Shannon M. 29:25

I think both and again, updated. Most recent research is always what we want to base it off of but I had 78% That was before the pandemic and we needed to look it up. So right now I’ll be interested. But I will also say it’s not necessarily always because it’s not possible. Some situations we know, hey, this way, if you’re getting for the hours that you’re working is not stretching as far as everything that you need for the medicine for your kids or things like that are understandable. But if we’re spending money every day before we get home, and then saying that it’s not realistic because of how much We make It’s not how much you make, it’s how you spend what we get. That makes

Christine Gautreaux 30:04

me think as a budgeting stuff because she was talking about buying two houses or two properties on like, and she was making like $45,000 a year at that time or like impressive stuff. But yeah, so what what they really want almost all financial experts want you to do. Hey, y’all, this is a great place to take a break. Take a deep breath, and hear from our awesome sponsors that make women connected and wisdom podcast possible. Shannon, we are so grateful that Shayla glow is the sponsor of the women connected in wisdom podcast. And I wanted to take this moment to ask you when you think about the people who use Shayla glow, where are we talking about?

Shannon M. 30:49

That’s a good question. I think about three groups really, one, the group that’s removing hair, right, so whether you’re using laser hair removal, waxing, shaving, you got to make sure that you’re putting back what you’re taking out the second group, I think about those with dry skin, and the problems that that might cause right, the scars, itching, burning, whatever the situation is, you definitely need all three steps, right? The exfoliation making sure you’re taking the dead skin cells off the oil, putting in the moisture, and then the shea butter with the aloe sealing it helping you heal those things help both groups, right. And third, for the third group is those with chronic illness. You know, the story is personally from cancer and different diseases that our population is dealing with on a daily basis throughout families as individuals. So I’m thinking about my mom and my grandmother and those around me with the same generation of ties, right, and what positive healthy habits, we can start to make sure that we’re maintaining our wellness, especially because the skin is like the cape, the exterior the the shield for your immune system. So with COVID We have to be intentional about covering ourselves. And those are the groups I think about. I love

Christine Gautreaux 32:01

it. And you know what else I love about your product? It’s all natural, handmade, and it smelled great, y’all, so yay.

Shannon M. 32:11

Yes, Esthetician tested and approved. Yes. Yes. What about you? When you think about your company? What groups of people do you think about?

Christine Gautreaux 32:21

Well, you know, I work with individual coaching clients, I work in community classes and with corporate teams, and with all of them, I use a strength based embodied approach to help folks connect with themselves and access joy, reduce burnout, and build resilience. You know, especially during these times, I think we need it, I think we need all the hashtag partnership power we can get. Yes. When almost all financial experts want you to do is to cover living expenses for three months if you could. So yeah, your short term savings. It also says you need to have a mix of stocks and bonds to make sure your long term savings keeps up with inflation. So and, you know, y’all we are not financial experts on this show. So we always recommend talking to your financial expert or your consultant and checking in with them is because there are women that we’re connected to and we can give some links on those that are the financial experts that are like, yep, they can help you manage your money. Right. So and you know, she goes on to talk in the article about a mix of your amount of risk or what you are allowed to take like what you’re willing to take and then I’ll also depends on what age are you What stage are you? Are you paying for kids college? Are you getting ready for retirement? Where are you in your work life? Yeah, yeah.

Shannon M. 33:46

Did you just have a baby? That’s completely different, right? Yeah. Who

Christine Gautreaux 33:50

Yeah, cuz, you know, we had our babies when we graduated from college, and you know, we were buying diapers. Like we weren’t. We weren’t out drinking every night. We were by divers. Yeah, okay. Number six, check out online investment tools. You can consult online investment tools offered by major brokerage firms, as well as nonprofit organizations, which I talked about in my chapter in the book and give a link to some basic one on one classes. And we can put those links in our show notes. And if you have a representative from your employer’s retirement plan, if one is offered, you can also talk to them. There’s a lot. I mean, the cool news is, is the times we live in, there’s a lot of resources that are free that you can look up and check out. And I’m a huge fan, you will have YouTube in it. If you have a question google or youtube it and see what’s out there, right about how to do things, even simple things like how to make a budget, how to you know, there’s going to be people that that can help have you with us and there’s people you can hire. But there’s a lot of people that do content for free around this area. Yeah. All right, number seven, you ready? Work with a financial advisor, a financial planner can help you set up a strategy that will be able to weather market volatility, and still reach her goals of having money divided between different types of assets. And she gives a list of certified financial planners. But yeah, I think it’s important. It’s good stuff, right? Yeah.

Shannon M. 35:33

And Michael, as I was watching this video yesterday on on scram, and it was putting Grant Cardone and Dave Ramsey against each other. Right. Dave Ramsey believes that all debt is bad. Grant Cardone understands that you need to use good, good debt in order to build wealth, right. And so that’s the conversation that people have. And so I think it’s interesting the way that, again, I’ve gotten information from different places, and I kind of do a mix of the different the different steps. So I am going through the Dave Ramsey Financial Peace steps right now, even though I do plan on possibly using good debt as a strategy to build wealth, right. So right now on the Dave Ramsey Financial Peace steps, he says to have three to six months saved. So I like three months as a minimum for what you’re going to have put to the side for your expenses. Six months, of course, is a buffer, because with inflation, just like Grant Cardone says it’s going to take more time and more money than you think. So before, if I would have based my gas budget off of what it was, when I bought the car, I will be out of money and out of luck, you know, so for me, it points to the yearly review points to reconsidering how much money I’m making. You know, it doesn’t have to be a pressure. But now it’s okay. I can no longer make $1,500 a month, I need to make $4,000 a month, what does that look like? What am I going to do? And or how can I make my money work for me. And when she talks about the stocks and bonds, that’s what I think about it’s having my money in different places, right? If something happens, you need to get a new set of tires or something happens with your transmission, we’ve got to have something liquid, you have to have cash that you can access without having to call other people, ideally,

Christine Gautreaux 37:15

right. But then our backup credit card like we talked about, right? But

Shannon M. 37:19

But even that, for me the backup credit card, the way I want to use it as a tool is to not have the interest, make it so that I pay more money, right, I spent $2,000, I don’t want to spend $2,500, I want to spend $2,000. And a lot of times when you use it in that emergency situation, is when it’s almost guaranteed to sit over there longer than you thought it would. And now you’re spending more money, I would rather just wait and pay a $40 late fee, or whatever it was, whatever makes the most sense to pay the least amount of money. Let’s say that, right? So again, in order to stay ahead of it, expecting it to take more money, which is why as a woman, I always champion the ladies to charge what you think you’re worth, or excuse me charge what you’re worth, right? Charge the money that you need to make a sustainable, instead of trying to be nice. And now we’re not realistic with the money that we need to take care of the inflated prices of everything. And now we’re stressed and not showing up in our community and can’t show up for ourselves. Because we didn’t really have anything to base our expectations off of, we got to have realistic expectations. And so that’s what I think about when I hear this stuff. And then for the stocks and the bonds, I think about just making sure that if something happens to one, you still have another backup plan, and also making sure that your money is working for you. Right, because that’s that’s another way that you make money, we want to make sure that it’s not just decreasing in value, or only getting 3% back these credit cards that give money back 3% Thank you for something back. I appreciate it. But that interest on that credit card is 28.99%. So it’s a big difference.

Christine Gautreaux 38:57

Right? I’m reading the fine print. Right, reading the fine print. And if you don’t know or have questions, get nobody to help you

Shannon M. 39:06

with it. Right. Yeah, I think that’s what I needed. Yeah. Yeah, that’s what I’ve needed to see. And even for me as a social support on Should I stay at this job? Right? It was a lot to ask. We’re on the podcast, we had this podcast for a reason. Right? So I had just just got out of the top cough training, salary manager training, should I really move? The you know, it’s I’m looking at the finances looking at the goals thinking about the occupational wellness and all this stuff. It’s like, yeah, it makes sense. Let’s go ahead and jump Do you know, but I did that looking at the goals, seeing my plans for the timeline when I wanted to have six months of expenses saved and go on a pappadeaux helps me do that faster. So that you are

Christine Gautreaux 39:49

so good at that. I just want to honor you and lift you up about that. Like you know, you know your numbers. You have a plan and you stick to it. Right I know you have to wiggle sometimes because life, but the fact that you were looking at that and knowing that when I was your age, no clue. No clue. I mean, still I struggle with having and and it’s Yeah, I think we’ve had this discussion before I’m here how financial training and personal finances and things like this is something we need to be teaching our kids and our young people from the very beginning. Like, I can’t remember what book I was reading that talks about people that are upper class, they have these discussions from the time they’re little bitty, with their kids, and middle class and lower class folks don’t they don’t talk about money. They don’t. And then it it perpetuates the cycle of not knowing or understanding. Because it really is like, it’s a system and it’s a game. And once you can figure it out, once you know it or learn it, you know, you have a better chance at it. But if you It’s like going into a board game and not knowing the rules.

Shannon M. 41:08

Yes, I heard some late some women speaking at Top Golf, and she was talking about having kids she was I didn’t know that you could get all this money. She had like three kids, and she was just found out having a baby, you know, so things like that is making sure that you know, we’re connected so you can maximize the health that you can get. Yeah, yeah,

Christine Gautreaux 41:31

absolutely. Absolutely. It’s always so fascinating to me. And I think that thing that is fascinating for me is how quick it changes. But how many resources are available to check it out, too. Right? Like things are I mean, life has changed, right? That’s the only constant is things are gonna change. And but just that we have access to these resources at our fingertips. So I think that helps us to be well around

Shannon M. 42:00

it. Yeah. And for me, I think about, again, it’s money as a tool. Right? So money is not always in the front of the picture. It’s there, because that’s what we’re talking about. But why right? When you say oh, you’re amazing at being intentional about it. That’s not just because of money. And that’s important, of course, to be wealthy, all this stuff is great. But it was my mom passing away. And I had to go back two days later, back to work. I want more time. You know, Linda’s anniversary is coming up of her one year. And when I think about Linda’s story, it’s, you know, corporate chick, God’s girl worked at Aetna for 30 years, and had less time than I would have wanted her to for herself. And in less than about five years. She was gone. You know. So it’s the time for myself. It’s not just oh, yeah, all this stuff. It’s no, I need to make sure that if somebody passes away, I can take however long I feel like I need you know, when I have kids, I want to take however long. I feel like I need to not ask somebody for Thursday night. I don’t want to do that.

Christine Gautreaux 43:04

Right? Well, and I knew I said that I saw a meme or something this week that said, it’s really not the the money that you want. It’s the freedom that you want. It’s the freedom. Yeah. So whether that seeking the freedom through having the extra money, you know, or if it’s a change in your lifestyle, like, I mean, if it’s the freedom that you’re seeking, how can we get that freedom?

Shannon M. 43:31

Yeah. And that’s my biggest thing with the conversation of the millennials, right? And how we jump there saying we jumped jobs. I hope that we’re doing it to be healthier each time. Right? Some of it might not be that. And so for that part of the possibility that’s my biggest thing is let’s be intentional about why we’re moving. You know, removing because it betters the company betters what we’re doing it better. He’s our goals are just because we’re not voicing what we need in that in that space. And so we’re not getting it. Those are two different things, you know. So yeah, being intentional about it, so you can build the life in the freedom that you want. What does that look like? There’s so many different ways to get it. And that’s, that’s what I love about when we’re connected in wisdom right now, before and we talked about this in the book, right? How are your parents gonna teach you things that they don’t know, before the libraries were separate? You and I would not be sitting here at this table at the same library reading about financial wellness, right? And so now that we have access to resources and YouTube university that helped me get my new labels that are coming out and all that stuff this week, you know, now what do you do with it? And really, with finances, it’s what’s the right first step, right? Trump that his parents gave him this money for a seat. His first step was different than my first step. But I had to stop working during COVID and I had to move out of my apartment. You know, his first step was right for him and where he was trying to go My first step was right for me where I was trying to go And it’s important to be mindful of the strategy, depending on where you are if you are a mom if you aren’t a mom, because I think that part in the unrealistic expectations that we have some sometimes around that is what either sets us up for success and sustainability. Or it sets us up to be possibly in the victim mentality, like we talked about earlier, right. Or it’s not realistic because we weren’t coming from the right place. We weren’t using the right strategy and something that was tailored to our specific situation.

Christine Gautreaux 45:33

I completely agree with you. Yeah, what’s the next incremental step? They just can’t do it all right, and say you’re digging out of a hole or you’re digging out of a problem situation, you may want to get some free counseling and support around it to just really identify. And you know, in interplay, we have a thing where we talk about incremental steps where we lay out the steps. So say, there were five steps that needed to happen. And then we choose okay, what’s the number one thing? And then we go down? In that number one thing? What are the three steps under that? And then just start with the first step, right? Because sometimes it can be overwhelming, not just financial wellness, but any of the other, you know, if you’re coming from behind, or you know, you don’t want to use that language, but if you’re feeling overwhelmed about it, let’s say it that way, then let’s break it down into incremental steps. And go from there. Yeah, I’m loving this discussion, my friend. Thank you.

Shannon M. 46:37

Of course, I think it’s so important, you know, we can beat ourselves up so much, oh, I’m an adult. I’m a certain age, I should know this. But when we look at history, women, were not happy. We talk about credit cards, women weren’t having credit cards 50 years ago, it’s not that long ago, we talked about the history of the world, you know, so of course, there’s some, there’s some learning in some things that are going to feel uncomfortable. And that’s why it’s so important to have this space where we can say, hey, I struggle with that, too. What store do you go to and spend all your money? And it’s like, okay, this is a thing. It’s not just me. So,

Christine Gautreaux 47:15

I love that. Well, when you think about today, when you think about financial wellness, what do you think about your wisdom and action?

Shannon M. 47:28

Let’s see. I liked what you said about routed I put it in maybe it’s just an affirmation that I make. I like when you said I will sleep even though I’m on deadline. So for finances, I think I’m I’m feeling like a breathe in flow, hashtag breathe, and flow. And you know, I like to explain it because flow for cash flow, right? Because cash flow is one of the parts of the BI triangle for business. And that, again, is from Robert Kiyosaki. Right, the different parts are their legal, the product, communication, and then the cash flow. So as we set up the second business, making sure that my cash is flowing the right way that I’m mindful of it. intentional about it, and that I know where everything is, and that it’s organized. And then breathe. I always think about what I went skydiving for my birthday. And they said in the training, when you feel like you can’t breathe, remember that you can. And so just breathing and flowing with the cash flow and sticking to the plan is what I’m working on this week.

Christine Gautreaux 48:34

Hmm. I love that. And did I know you had gone skydiving for your birthday? At what age were you when you did that?

Shannon M. 48:44

Cool. All the 20s are all jumbled up now. Maybe 24 I think there was a year I went to the Beyonce concert. I went to the Beyonce concert and then went skydiving. year a year in Costa Rica.

Christine Gautreaux 49:03

Super fun, my friends and myself. So you may not know this about me. But when I was 18 I went skydiving. No, I know in your shadow out to Aunt Joan. She was a master jump master and at that time taught people how to jump out of airplanes. So literally, I talked about it into the show where I would tell that whole story but yeah, I went skydiving twice. And I love Oh my gosh, one of the best things I ever did. Eleanor is listening and says can you talk about your Summit? Oh, Eleanor, thanks for that question. And actually, we decided very clearly today that it is going to be it’s a virtual conference. Yes. Because we were talking about the difference. I don’t know why I’m going towards a bad British accent and what I stopped doing Summit. I don’t know what’s happening. Take a deep breath and get back here in Georgia. Um, that we’re doing a virtual conference. And that virtual conference is coming up at the end of October to give a more specific,

Shannon M. 50:08

yeah, yes, the 25th to the 28th, starting at 9am.

Christine Gautreaux 50:13

And we’re going to be launching that website. Hopefully, by the end of this week, y’all. And we will put that in our show notes. And we will get y’all all the information, it’s going to be a free virtual conference. And we are going to have at least 20 incredible speakers and women that are connected in wisdom, talking about the different eight dimensions of wellness. And we are also Yeah, and there’s there is going to be an octave so the conference is free. And then there’s going to be an opportunity that if you want to purchase the downloads of all the all the talks and freebies and workbooks and things like that, that you’re going to have that opportunity. That’s what we’re working on launching, and Oh, y’all, it’s good. We’re excited. And it’s a lot.

Shannon M. 51:04

And if you would like to be part of it, if you’ve been listening for all 80 episodes, you and your business would love to be a sponsor, we do have the opportunity to be connected, and those spots are filling up. Again, you have a list of authors, we have 18 authors, so we want to make sure that the panelists and the sponsors get the opportunity to speak but if you would like to be one of them, reach out, we would love to have you.

Christine Gautreaux 51:26

I’ll put that in the show notes. We’ve got a way that you can be a sponsor on that show. Yeah. Global hybrid publishing is one of our sponsors.

Shannon M. 51:33

Guess the mermaid guardian?

Christine Gautreaux 51:36

Yeah, one of our sponsors, environmental wellness. So

Shannon M. 51:39

we’re chugging along getting ready for you guys. And yeah, four days two dimensions on each. So once we release it, get your dimension that you’re interested in working on, you know, tell your friends about it, so they can get plugged into our resources and our experts

Christine Gautreaux 51:55

and we’re also working on a gift bag too because we you know, we love all that stuff.

Shannon M. 52:02

Love some some inner ally cards or something. Shealo Glo

Christine Gautreaux 52:05

like we got all kinds of goodies coming your way this fall. It’s gonna be super fun. Thanks for that question, Eleanor.

Shannon M. 52:13

Absolutely. Okay, guys. Well, thank you so much again for joining us for 80 episodes of women connected and

Christine Gautreaux 52:21

great for ad my friend.

Shannon M. 52:23

Thank you. It’s the moisturizer. Oh, we will see you guys back here live at five next week. In the meantime, don’t forget be well be wise and the whole

Unknown Speaker 52:46

thanks for listening. This has been the women connected and wisdom podcast on air live on Wednesdays at 5 pm. Eastern via Facebook and YouTube. Be sure to like share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment