Show notes –

Join Shannon and Christine as they talk about Financial Wellness. What is it? How do we get it? What else do you want to know?

Shealo Glo – www.shealoglo.com Now offering Subscriptions * Delivered on the 1st & 15th!

Discount Code – WISE5

Nominate your Shearo by emailing subject “My Shearo” to shealoglo@gmail.com

Stillpoint – https://www.amazon.com/Stillpoint-Self-Care-Playbook-Caregivers-Breathe/dp/1732370400

Join us in community: https://women-connected-in-wisdom.mn.co/feed

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Like & Subscribe to get notifications when we are live

Instagram @womenconnectedinwisdompodcast – https://www.instagram.com/womenconnectedinwisdompodcast/

Facebook page Women Connected in Wisdom Podcast – https://www.facebook.com/womenconnectedinwisdompodcast

This week’s resources and references:

https://www.consumerfinance.gov/about-us/blog/what-new-cdc-eviction-moratorium-means-for-you/

Student Loan Article – https://news.yahoo.com/student-loan-forgiveness-stalled-biden-202441082.html?fr=yhssrp_catchall

GA – Hope Scholarship – https://www.gafutures.org/hope-state-aid-programs/hope-zell-miller-scholarships/hope-scholarship/initial-academic-eligibility/

Secrets of 6 Figure Women by Barbara Stanny – https://www.amazon.com/Secrets-Six-Figure-Women-Surprising-Strategies/dp/0060933461

Karen Drucker – Money is Coming to Me – https://www.youtube.com/watch?v=KM-hfV6Papg

Robert Kiyosaki – https://www.amazon.com/Rich-Dad-Poor-Teach-Middle/dp/1612680194

Before you Quit your Job https://www.amazon.com/Rich-Dads-Before-Quit-Your/dp/161268050X/ref=sr_1_2?dchild=1&keywords=before+you+quit+your+job+robert+kiyosaki&qid=1628718363&s=books&sr=1-2

Noir https://noirdor.com/

Profit First – https://www.amazon.com/Profit-First-Transform-Cash-Eating-Money-Making-ebook/dp/B01HCGYTH4

Laurie Johnson – https://revisionfinancialsolutions.com/

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Christine Gautreaux 0:08

Let’s do this.

Shannon M. 0:08

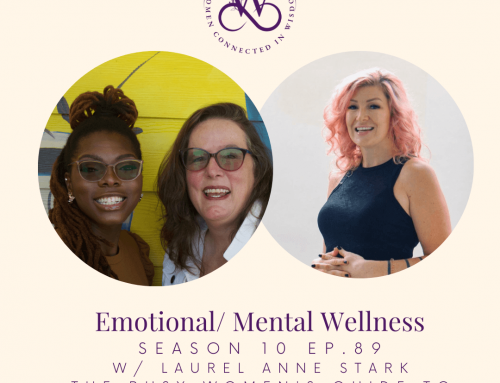

Okay ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of shallow glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness.

Christine Gautreaux 0:25

And I am Christine Gautreaux, a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself in community care.

Shannon M. 0:35

Yes. And together we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness. Welcome, welcome to our show. And every

Christine Gautreaux 0:44

week we get together for intentional conversations about how to be wise and business relationships and wellness looking for some wisdom.

Shannon M. 0:57

Let’s I’m going to go ahead and give us a definition because there’s so much to talk about today with financial wisdom. Okay, financial wellness. So capturing the complete definition is tricky, right, because it means different things to different people. At its most basic level, financial wellness is a holistic approach to counter financial illness. This holistic approach includes a combination of factors such as satisfaction with current finances, increasing positive financial behaviors like saving, reducing debt, and budgeting, financial knowledge that helps to change behavior and reduce financial stress. The last point that I’ll make is creation of a financial plan to reach desired financial goals.

Christine Gautreaux 1:47

Right? That’s a big one. It’s one of our longest definitions. And then No, we’ve been messing around with it and tweaking it. I would love if our listeners, if they see this live, or they’re listening audio afterwards, I would love for them to reach out to us and tell us what is financial wisdom mean to you? Or what are they want to know more about? You know, because it’s such a broad category, like, so many things, like, I think about the very basic beginning step shaving of being able to talk about finances. Like, to me that’s that’s an incremental step of financial wellness, is being able to have a discussion about finances without that wash of shame, or guilt coming over.

Shannon M. 2:33

Yeah, and I know you talk about the way you put it, when you’re you were a baby social worker and talking to the different couples and how they’re more comfortable talking about their sex lives, and they are their finances. All right. And for me, that points to the difficulty that everybody is having with it. And the lack of understanding, and that’s where the guilt and the shame and everything comes from.

Christine Gautreaux 2:56

Right. Well, I think some of it becomes from religious teachings. I think some of it comes from society. I think some of it comes from our family of origin. And was money talks about or not, but you know, money is a tool. It’s a tool, and it’s the system we live in. And, you know, I have some friends that choose not to partake, you know, I have, you know, I got friends of all walks of lives. And, you know, some of them were talking about a barter only system. Okay, well, that takes us back to when. Because right now, the system that we live in is a capitalist system. And yes, does that need to be changed? It depends on who you talk to. Because there’s a lot wrong with it. You know, there’s a lot wrong, but it’s the system we currently function. So money is a tool in that system.

Shannon M. 3:47

Absolutely. And I think about barter systems today, you know, personally had a great barter situation that helped me out with my financial wellness. But the thing is just like money is the one thing that we use consistently, it would have to be one thing. So in my mind right now, would it not still be the same people that have the most amount of whatever item we’re bartering to be able to barter with? But that’s also something I think about with women connected and wisdom. You know, it’s not always monetary, that we trade back and forth, but we still get what we need.

Christine Gautreaux 4:20

Right? Oh, and don’t get me wrong, y’all. I love a good barter, you know, but it’s also time, often it’s time or your knowledge or your and so it is one of those things could it sustain itself on its own? Exactly. It kind of depends on where you live, you know, and what you’ve already got established as far as housing and and basic needs met. I’m always fascinated by it, because I don’t know if you know this about Michigan, but you know, for years, my runaway Fantasy was off the grid you know, some little cabin think throw you know by the by the pond.

Unknown Speaker 5:00

sounds beautiful.

Christine Gautreaux 5:02

It’s a lot of hard work. Yeah. Right when you think about it, because I was raised on a small farm, like, it’s a lot of hard work, right? Especially depending on what amenities you have, do you have an air? Like I’m a little spoiled to my central heating there, I didn’t grow up with that. I love being able to go flipping out and not have to go get wood or not, you know, be in front of a big old water cooler fan? Absolutely. Yeah, it’s, um, you know, you and I, as we were prepping for this conversation today. There’s so much. I mean, here we are at the end of August 2021. We are, what are we 18 months into this pandemic? Yes. And what does personally before we get into the larger picture? What does financial wellness mean to you in this moment?

Shannon M. 6:01

To me, financial wellness is having a healthy plan and sticking to it. Financial freedom is different. But right now, financial wellness is below that, you know, it’s not freedom yet. But where are you at? What do you need to do next? And then staying on that plan?

Christine Gautreaux 6:24

Well, for me, you know, I think I’ve mentioned on the show before that I’m you’re a divergent. So you know, I was diagnosed with ADHD when I was in college. So I was probably 19, when I got that diagnosis, maybe 18. And I always struggled to pay bills on time, like really, until automated banking came out. It was a struggle for me. And it’s a really weird struggle, because sometimes I have more trouble when I have money than when I didn’t have money, because I wasn’t paying as much attention. So for me, financial wellness is paying things on time, making sure everything is set up automated. Making sure that my systems are in place to meet my obligations, held healthy, and to not have shame around it. Because there was a lot of shame attached, because I felt like I was a failure. You know, I came from a mom who I can’t tell you how many times I’ve heard she had never bounced the check in her life. Well, that was not true for me. And and it was part of understanding in the system of figuring out how things worked. And of course, nowadays, you know, my kids, I don’t know that they’ll even ever have a checkbook, you know?

Unknown Speaker 7:46

They might not. Yeah,

Christine Gautreaux 7:47

so I think for me, financial wellness is paying attention to my numbers. Yeah, knowing my numbers, knowing where I am, and, and what I’m going towards with my goals. But also being consistent, because it’s still, you know, I have to make sure my systems are running, I have the systems in place, but sometimes tech happens. So and things change. And so I think that’s for me as the wellness is, is being able to look at that and, and adult.

Shannon M. 8:22

I love it. And I your specific breakdown of it is exactly what I’m talking about. Yep, that’s exactly what I’m talking about. I realized when I was salaried that, even if I have the money in my account, I like it being in my account. I don’t want to give it to you. So I would like you said I would still be late on stuff. It’s like, what is what is going on there? You know, I like that

Christine Gautreaux 8:44

knowing though that you didn’t want to give it to somebody like that. I mean, that’s part of wellness, right? I have a thing that I do often when I’m paying bills is I will light a candle and give gratitude as I send off the money. You know, I’m so grateful that I have central air does it cost me more? Yes. So instead of like being grumpy about the electric bill, I’m like, Oh my gosh, thank you that as a pyramid of positive woman when I go need to turn that air conditioner down, it responds. Thank you. Thank you, thank you.

Shannon M. 9:18

Yeah, I’ve been working on that to you know, my relationship with money as a tool and being appreciative to have it and use it for what I needed for. And then being a being appreciative of what I’m able to do to get it the skills that I have the help that I have to be able to work forward and continue to learn new things to continue to make more of it and put it in the right places. So I love

Christine Gautreaux 9:41

that. I had a teacher one time this image was coming to me and for those that are not watching that are listening, I’m holding both hands up. And I had a teacher one time tell me that that is often the best way to handle finances. So finances come in and then they go out but you are open to receiving versus being like, Oh, I got it, and let’s hold on to it, but being open to receiving and it flows through us. Yeah. And we get to keep a little in the well, in the safety Well, or the, you know, savings Well, or whatever we want to call it, but that we are open to receiving and we’re open to giving.

Unknown Speaker 10:18

I love it. I do too.

Christine Gautreaux 10:20

Like I like to give. Yeah, I like to give, but I gotta make money to give it so

Shannon M. 10:26

hello. And I mean, and honestly, that’s one of my big motivations, and of course, generational wealth and things like that. We’re gonna get into that for the show, you know, but especially I would love to do something like paying tuition for somebody, you know, we’ll talk about student loans or, and home improvement used to be one of my favorite shows when I was growing up, and they’d be like, move that bus and they would move, is that the right show? I think it is right. And they will move the bus. They will move in. And sometimes they would also have groceries and stuff in there for a year. And you know, and I always thought about doing things like that. I

Christine Gautreaux 11:03

think that’s the show my sister was on. Really, it was the one where I think so I think that’s the one she did. Because she for years, she had a company called Newman development that she built really cool homes out of recycled shipping containers. And so I think there’s an episode I think that’s the one I’ll try to find it and put it in our show notes. But there was an episode where the firefighter in Bastrop, Texas lost her home. She was out firefighting for somebody else in lost their home. And they rebuilt her home and Katie rebuilt her artists studio. She did the artist studio piece of it. So I’ll try to find that and put that in our show notes.

Shannon M. 11:42

I love your sister has that experience. Oh, she’s

Christine Gautreaux 11:46

a genius, Shannon, like Yeah, and shout outs because her greatest achievements turn to on Monday. So my nibbling my my nephew’s ease on in Knox, give them a shout out turn to on Monday.

Shannon M. 12:03

Is it Monday or Sunday? Because it’s in my planner.

Christine Gautreaux 12:06

It was Monday, their birthday party was on Sunday. But birthday was on Monday.

Shannon M. 12:13

What does it say when you said as it always says middlings. I didn’t write a

Christine Gautreaux 12:18

gender neutral term for siblings. And so you know, she didn’t find out what she was having before they came into this world. So they have been my nibbling since I’ve known about them. So they are ridiculously cute. And up to 300 words. So and have a sense of humor. Because we will be FaceTiming every morning and we’ll go to get off. And Katie will say say I love you Tia and they look at me and go I love poppin ma

years old, giving me shea

Shannon M. 12:59

butter. I like the shipping containers, we’ve been watching this show about living mortgage free. And people have been building houses for $5,000 now to shipping containers, and you’d be surprised what you can make, you know, so that’s really cool.

Christine Gautreaux 13:13

Yeah, she’s a designer, she’s no longer running the company full time, because she had these twins and was like, you know, it was an 80 hour a week job if that and so, but she will do consulting and designs and plans. So I’ll put a link for folks. Because she’s incredible. She’s designed some beautiful buildings. So yeah, and they’re sustainable. You know, when we talk about financial wellness, it’s sustainable, and, and creative. And there’s all kinds of things you can do. Um, what do you want to talk about? Like we had we you and I were going back and forth about a whole bunch of stuff before the show today, we’re in regards to financial wellness, because there’s so much current

Shannon M. 13:56

Yes, in the world. Yes. So and so. So you guys know, if you’re listening, or if you’re watching, it’s gonna be you, I Christine today. Okay, so we have you for the whole time. And I want to sit dive into what we talked about, about student loans, about these evictions that are happening that are coming up, and how we can share some of the resources that we’ve looked up and gotten access to. So if people need help, or they need help figuring out where to start. We can we can, you know, point towards those things.

Christine Gautreaux 14:31

I love that because that’s what women connected wisdom is all about. That’s helping each other and lifting each other up resources. Yep, that’s what we

Shannon M. 14:39

do. Yeah. And I remember. So let’s let’s backtrack real quick. Right. So I’m going to share the story because this is why we’re here. All right. I went to college. I knew that I would not be able to afford to go to college if it was not for financial aid. Right. So Now growing up in a family that made a lot of money benefited me in that situation, because I was able to get Pell Grant, they told us freshman year, hey, if your grades are good, you can get financial aid. I remember that. So I got hope, you know. And because of my LSAT scores, I had another scholarship. So thankfully, I was able to go to college with my tuition covered, then I found out about a position at Kennesaw State University shout out to the owls, the resident assistant program. And I was did that for two years. So my room and board was also covered. So thankfully, as we go through this conversation, I’m one of the people who have benefited from being able to take opportunities and my student loans be very minimal. But going through that process is interesting. You know, and a lot of times, we haven’t always had the best, or people don’t always have the best access to information or help or the opportunities that I had. So well, I want to

Christine Gautreaux 16:01

jump in real quick before you talk about a little bit, because folks that aren’t from Georgia, and we’ve got folks from all over the world for that listen to us, and what the Hope Scholarship is, and you know, I’m not from Georgia originally. So when I got here, I was like, Y’all, this is the best kept secret in Georgia. So the Hope Scholarship Program requires students to meet academic eligibility requirements. In addition to basic requirements, like you have to live here, I think now the requirements six years or something like that. But what happens is, um, if you are eligible, it will, and you have a certain grade level, it will pay for your tuition and books in college in Georgia and state schools. And if you go to a private school, it will give you the amount of money you would have that would have gone to the public university. So it is a way for people to get a incredible college education without a huge amount of debt. And I have to tell you, like when we found out about it, we moved here, Sammy was going into kindergarten, Alex was going into fourth grade, we found out about the Hope Scholarship. And everybody back in Texas was like when you move in home when you’re out we’re like, well, not until our kids graduate college, this boy. Holy cow like we we came in with student loan debt and, you know, a lot for years. And so the fact that this is an option here in this state, huge incentive.

Shannon M. 17:29

Absolutely. That makes sense, because it cuts out a lot. So right now we’ve been looking at articles, and we’ll link to them in the show notes about the pushback of repaying the loans, right. So that’s a huge thing, when you talk about debt and how much money you’re trying to pay back to have 0% interest is a great opportunity. But the question is, what’s going to happen next? Should I spend this money? Should I spend the $1,500 on this one loan that I have for college? Or should I pay my rent? You know? So, Christina, as far as student loans and everything, how do you feel like it’s changed? Or the story has changed for you over time as you moved from Texas to Georgia? Oh,

Christine Gautreaux 18:13

that’s a good question. Well, you know, we were part of that generation that they like, gave us loans, gave us loans gave us loans. And so we got in over our head. And, you know, if Joe’s listening, he will, like, we’ve had a lot of discussions about this, we would not be where we are today without those student loans, we would not have the jobs we have, we would not have been able to purchase our home. Would we do it again? I don’t know. Like, I mean, we were young and dumb. And, you know, we had kids, not that I recommend this at all. But you know, we had a baby, like I walked across the stage and a week later gave birth to her first child. So like he was, he was just, you know, and I’m so grateful for them, because we didn’t come from homes that had could pay for our college straight out. And so it gave us access to an education and a lifestyle that we would not have had access to. And there’s a lot of burden of debt in shame and guilt about did we handle it? Right? Did we not handle it? Right? All that and, and there’s some predatory things out there. So you’ve got to, you know, this is so timely because kids are going back to school, they’re going to college, you know, my youngest goes off to college next week. And she just signed some of those papers. You know, she didn’t have to take a bunch. But, you know, it was like we had a big long discussion about it, and how do you pay it down earlier? And what do you do and looking at you’re having the foresight to look ahead about what is the career you’re going towards, and is this worth it, you know?

Shannon M. 19:57

And that’s a huge that’s a huge Question, you know, because let’s say, for me and my psychology degree, you will look at certain things. So okay, Industrial Organizational is at the top, then I might do this, then I might do that. But it’s not just about what’s available, you know, me and my work experience. I’ve had we talked about occupational wellness last week, I’ve definitely had some difficult situations and different jobs and conversations and actually was demoted from a position that I was in. And not officially, but by what I was scheduled, you know, so different things like that. Can you can you can think, Oh, well, I’m going into this field, I should be making this much money. But there’s way more than that, that goes into it. And that’s what we’ve seen with the increase of student debt, the increase of student loans being taken out? And then the question of what is the rate that you’re going to get paid? And of, of those salaries going up over time in the community? What does that look like realistically? And how does it affect people individually, we talk about self care, and then the community as a whole, the family and everybody else that it touches?

Christine Gautreaux 21:11

Right? And read the fine print yell? Yes. Like, it’s worth it to read it, if you don’t understand it, talk with somebody that does, and because not knowing that can get you out of it. So, you know, I know, there’s a lot of discussion on the National Front right now, especially for people of my generation. And right behind me, where there was a lot of predatory lending, and people are struggling under a lot of debt. And, you know, they’re talking about do we cancel that debt? Do we? What do we do? You know, and I know, it adversely affects people of color, that because they, you know, national average, they still make significantly less than their counterparts that are white, and especially black women. You know, I think I don’t want to misquote this, but I want to say it’s like 38%, less than something like that. I mean, it’s significant. Hopefully, that number has gone up recently. But yeah, it is a big chunk. And it is like, how, you know, that makes a difference. It makes a difference. Now, you were talking about a recent article, you read about them postponing payments right now, right? That’s coming from a federal level. Yes.

Shannon M. 22:35

So they were talking about post the deadline for the student loan repayment being pushed back from coming here, coming up soon to January 2022. So I don’t know how official that is. I’ve definitely seen different information, different places. So if you have students, go ahead,

Christine Gautreaux 22:56

it’s worth to reach out to your lender. Exactly. I mean, on any of the programs that I’ve been seeing lately, that have been helping for pandemic relief. A lot of times it’s not automatic, there’s a step that you have to do. But it’s worth that step. That’s a, you know, a step toward your wellness, it’s a step towards understanding what’s going on. And so I think that that’s an you know, it’s important, and you may need a buddy to do it. I know some of these things can get really overwhelming and really big. Like, a lot of times I work with clients that they just need some partnership power, they need somebody to be on the phone with them or be in the room with them when they’re making that call, especially if it’s a call that they’re not quite sure about, or they’re scared about or it’s emotional. You know, they’re like, oh, and so having partnership power, I think is a really good, a really good thing.

Shannon M. 23:45

Yeah, I definitely needed it even to file my taxes this this past year, you know, when being with my friend in the room helping me walk through it. I said, okay, that felt better. This year, we’re going to do it better so that we don’t have to do this again, you know, and when you were talking about reading the fine print, I know, it made me think about when I was looking up these articles, and we were looking at the student loan debt and the dates and where it is historic or where it’s been historically and where it is now. It made me think about debt consolidation. And that’s a big thing right now, right? Companies are like, Oh, just rolling in one. But when we talk about the fine print, please make sure that we understand the the interest rates because the 0% interest rate on the student loans is saying that you are paying back whatever you owe already. Now for me personally, because it’s been years since I graduated college, some of that total has interest in it, but they’re saying they’re not adding any more on but if you consolidate everything, you have five 613 different loans, different places, if your interest rate is 36%. That’s crazy. That is right. So yes, please make sure that we’re reading the fine print, and that you know when possible, we’re talking to Do an expert, somebody who’s going to be able to walk you through the latest laws and legislation so that we have the correct information. Right. One of the resources,

Christine Gautreaux 25:08

I’m going to put in our show notes, Shannon is the Consumer Credit Counseling Service. It’s a free service that will help folks with their credit score, it helps them with consolidation, it helps them with budgeting, debt management plans, like it is. And they also will help you with a credit coach or a debt coach. So it’s a I’m going to put that link it’s credit.org. Backslash CCC s, and I’m gonna put that in the show notes. For folks, that is a good place to start for free resource that if you need support and help, because you and I were talking about before the show, you know, you don’t know what you don’t know, right? Like, if you didn’t grow up learning this stuff. And and to be fair, we’re all going through a situation which we’ve never been through before, you know, people that never thought they would have an eviction notice or never thought that they Yeah, it’s happening. And so to do away with blame, shame or guilt, and and like, what do you need to get through this? You know, I wanted to pull up talking about evictions, because they just passed, let me see that this just came out this week about the CDC just released a new eviction moratorium. And so what that means is that’s from a federal level, that there is a moratorium, which means it cannot happen. Like there’s a state, it’s like a big stop sign about eviction. But there are things you have to do. Like it’s not just so we’re going to put a link to the Consumer Financial Protection Bureau in our show notes today. Because there is a CDC declaration that you must give your landlord, and you’ve got to fill that out. And so it’s especially around areas that the pandemic is spreading, which it’s everywhere right now. So you should be able to qualify. And it also, there’s also a link to get help paying your rent and utility bills. So we’ll put that in the show notes. Because

Shannon M. 27:18

yeah, because it’s so important. And one thing that I would like to say too, is that if you’re struggling financially, right, you feel like you’re failing, all this stuff is happening. One, I would I would say that’s not true, because it’s a global pandemic. And I’m too I would say that that’s also natural to feel that way. I’m so glad that I listened to the audio book Secrets of six figure women by Barbara standing. And she reminded me that people connect how much they make to their self worth. And so when you start making less, you feel you don’t feel as good about yourself, you know, when I stepped down, and my mom was sick with cancer, and I went from almost $60,000 to 40. You know, for all it kind of shifted a little bit, especially when rent was $1,100. And then when Corona shut the restaurant down, I remember the day and one of my managers that I used to manage with was like, Yeah, you know, we’re going to have less tables in here. So what I heard is less servers, you guys are running the restaurant with less people and you’re not giving us two weeks, like you would want us to give you two weeks even though it’s not just here. It’s global. I understand. I’m thinking about my rent. You know, I’m thinking about my stuff. So I went from 60 to 40 to 15 is what the paper said, but I need the need the Department of Labor. If you’re listening this, you have a voicemail from Shannon Mitchell missing some money. Okay. Good. So I have to remember that my financials position is not the same as my work, right? So if you’re struggling financially, again, blame the shame that guilt is natural, but no, we just need to come up with a plan and get some partnership power and we’re going to get through it.

Christine Gautreaux 29:05

Right. Well and also, you know, when you have those feelings because you know, Shannon, I come from the somatic background and Interplay it’s okay to acknowledge them and take a deep breath and shake them out, you know, just let them out or, or, you know, one of my favorite I don’t know if I’ve ever told you this before. So one of my favorite secrets is I will put on the song by Karen Drucker it’s money is coming to me easily and effortlessly, and I will dance around. And so it does a couple of things somatic wise, like it reminds me to have fun with it and play because it’s a playful song. And you can tell they’re having fun while they sing it. And it gets me out of my chair and out of my head. And so it gets me moving. And so if there’s feelings that need to be moved out, it does it through that song. And then at the very end, they laugh like you can tell that they were having such a good time. Make the time And then there’s a little cash register sound effect. And then they laugh, they bust out laughing. Just brings me joy every time because as a recovering serious person, like, it’s like, oh, we can have fun with this. We can have fun with making money, we can have fun with imagining we can have fun with dreaming. And steps need to be taken along the same way. Like I mean, every time when we talk about manifesting, we talked about that. Yes, dream big and get the what you need to take the steps to make it happen.

Shannon M. 30:33

Absolutely. Absolutely. So I need to listen to that song I like right now, cuz I’ve been thinking about it. Right? I’ve been trying to figure out what song I’m going to play when I completely get out of debt, because I’m on this on this journey with you guys, too. And right now, I like money by Cardi B. And I like classical intro by Gucci because he says he’s got a money making marathon. And that’s definitely what I’m on right now. But yeah, so with the student loans, right now, of course, they’re on pause for everybody, a 0% interest. So if you’re in a position to be able to pay it off is definitely a good opportunity to take that right. But also with with a lot of people’s income being lower. Again, this is something that you would have to check into with your lender, but they’re, you know, should be options, or maybe options where now that you make less, you can pay less. And that was something where I didn’t know before. So when I stepped down, I’m still making payments to my student loans, like I was making salary when I could have, you know, been putting that money towards groceries or other things that had changed priority based on where I was. But thankfully, again, this is last year for me a lot of people are moving now. I moved last year, I moved by May 1, I said I’ve got to be gone. took the picture off the wall. I said they don’t want me here. I know it’s probably illegal, right? It’s not personal. But once it lives, where’s this $18,000 gonna come from? I’m not gonna have it, then I might as well move now. And so I’ve been gone. I’ve moved already, you know, but is definitely a readjustment. And that’s why for me, I said the financial wellness is what is the plan? You know, it’s not my worth is less now that I’m not making $60,000 a year. And that I’m not well, I can be just as well with the same ratios and the same percentages with less. But what does that look like? And that’s what I’ve been working on the Financial Peace planner in my budget. And that’s really given me the freedom to say yes to certain things, and no to other things to make sure that I’m taking the steps that I need to take to be able to one day help somebody else help another young woman pay for her tuition or, you know, another family pay for groceries. Because I know what those things feel like but first, this is where we are. And that’s okay. And that’s how I’m being wise, taking my incremental steps every day.

Christine Gautreaux 33:05

I love that. I love that. Yeah, I was, um, when you were talking about financial freedom earlier, I had googled and found an article about 12 steps to achieve financial freedom. Okay, you want to hear him? Yeah, what does it say? Okay, this is from USA news. And I wanted to also say the definition because I know sometimes you have a definite different definition. So we’ll put their definition and then see yours. It says for some financial freedom means being able to pay the bills with the money left over each month, or having a fully funded emergency account. Others may want to retire early and travel extensively. So basically, what it’s saying is financial freedom is different for every person, right? But it’s about a comprehensive approach to money management. So the first thing I know you have talked about several times, and almost every expert says is commit to living within your means. So I know that when sometimes easier said than done, right? Especially with the current price, the current price of rent, you know, my oldest who’s 23 We were having a pretty heartfelt discussion recently. And she’s like, Mom, I feel bad because, you know, I can’t afford my own apartment. And I’m like, well, nobody in America minimum wage, I mean, the studies show it If you are making minimum wage, you cannot afford a one bedroom apartment in America right now. So it’s not it’s a it’s a systemic problem. It’s not just you know, but it especially affects our young people before they have a trade or degree or a way to make their living beyond a minimum wage job. So so that can be tricky when rents are so high. Absolutely. Okay, this is one we love. So the second one is know your current financial situation. So we talked about know your numbers, where are, you know, where are you calculating your debt, calculating your expected income, and identifying holes in your financial picture. And your I’m gonna say, Yo, I’m get help with this. If you’re not good at it, or you don’t know how to do it reach out, there’s experts that will help you with this for free. So get help with that, or you got a friend that’s really smart and sharp about this. And if you’ve got a numbers, friend, often they like to share that info. So find somebody to support you on this journey don’t suffer in silence. Open the right accounts. Now, this is like one of these things about what you you know, you don’t know what you don’t know. But they say there’s no one single account that is right for all your money. So cash for retirement should be placed in a tax favored 401k or IRA account, while college savings are usually best kept in a 529 plan. Not interesting. And those with high deductible health insurance plans can open health savings accounts to pay for medical expenses. That is something Joe and I have done the last several years with his company, it’s a benefit that his company offers. And it is a great thing. Because we deduct our medical expenses for the year. We pay different we don’t pay as much taxes on those because they’re all for medical and they come out of this account. Right? And, yeah, so and then it also says meanwhile, you want an emergency fund that separate from your other savings to avoid dipping into it unnecessarily. Alright, set up a deposit schedule. Once you have your account set up, create a system for ensuring that they are fully funded. And I know you are a genius at this my friend, like you have been working on this and you are working towards it. But you want to divert a portion of your income to checking regular savings and your emergency fund. You want to monitor your credit. This is one of these these are hard if you’re an avoider. Hello, I’m Christine and I used to be an avoider

Shannon M. 37:18

again was 34 times. And honestly Christie right now, I’m not even worried about my credit. I know that Honda is calling me and that is hitting my credit. I know this already. So when you when we talk about the pandemic and being so far behind. Maybe if you do need another apartment, of course they’re going to check your credit. Maybe if you do need to downsize your car and you’re going to the dealership, they’re going to check your credit. I’m not saying don’t be mindful, but me where I am. I know that my credit is not as good as I want it to be. But that’s not my first step. My first step is baby step number one with Dave Ramsey saving the $1,000. Yeah.

Christine Gautreaux 38:01

Well, and that’s the thing about prioritizing, right? Yeah. And and there are people also to help you with your credit score. I get mad about this one. Shannon, I have to tell you, I don’t know if it’s the anti systems person in me. Or if it’s the like, oh, this whole capitalistic credit. Ah, so what I tried to do is do a mind shift. I’m just gonna be real honest with people how I tried to do it is I tried a mind shift that it’s a game. Because I like to play games. Like I like to play board games I like to show I’m like, Oh, it’s just kind of a game. I try to trick myself. So it’s fun. But occasionally I get really resistant because it makes me mad. Because especially it is already adversely affects people that are in the margins. And people it’s poor people in America are punished. I mean, there’s just no other way to say it. Like, the less money you have, the more you pay in this country.

Shannon M. 38:59

And and you know this, this is why I love Robert Kiyosaki, Christine, because I had never heard of Cashflow Quadrant before. And it’s it speaks to without going all the way into it. How your cash flows to you. And that is why I kind of cringe sometimes when I hear these financial wellness definitions, and of course, again, like we said, it’s hard to pinpoint it. But for me, time and financial freedom. What else do you have? You know, because if not, then I’m going to be 62 asking somebody for permission to go to my granddaughter’s play or something. You know, I don’t want to have to ask anybody anything. I want time and financial freedom to do everything. If somebody’s sick, I don’t want to have to be the person that puts everything down. I want to be able to afford a caring, competent, you know, passionate person who loves taking care of people, and I can be there and enjoy my time with my loved one and not overextend myself and put my own immune system at risk. But we have to be set up to be able to do that. And I would love to see that for everybody.

Christine Gautreaux 40:08

Absolutely. So I know you’ve read several of Robert Kiyosaki books, which one would you recommend that people start with?

Shannon M. 40:16

I don’t even know. I feel like I read them out of order. The first one is Rich Dad, Poor Dad. So I will recommend starting with the one that he started with. But really, it depends on where you are, you know, if you’re about to invest, what the rich teach their children about investing might be where you start. If you have enough money, and your bills are paid, and you’re not getting evicted, and everything like everybody, right now you’re about to start a business. Maybe what to do before you quit your job is something that you need to listen to. So you remember to think about all the systems you need legal systems, you need. The production team, it’s not just you and your specific skills that’s needed to make it successful. You know, maybe it’s a book that helps you talk to your children about money, it depends on where they are.

Christine Gautreaux 41:06

Yeah, which you know that what to do before you quit your job is. It’s an important one, because so many people, you know, and you and I are both part of this GIG system, and this, you know, but it’s, it is so attractive to people right now. But part of the reason it’s attractive, is because of the way our systems are set up. And the way that we’re out of balance with work and, and money in this country. So I was reading an article the other day, I should have pulled it up before this episode about that it’s not normal, how many people are going into the gig economy right now? That it because what it does is it undercuts security, like, like with insurance and with like, because we don’t have universal health care in this country yet. I mean, you and I know this because we do this work, right? If we go down our business and happened, right. And so the wellness is even a bigger part of it, because we have to stay in balance. Because it’s vital.

Shannon M. 42:13

I was I would say depends, because for me, if somebody is starting a side gig that says that they’re not making the money that they need to make in their main side gig, so if they’re making more money might put them in a position to be able to afford insurance more readily than before, what I would say for side gigs is Be mindful of which one it is, right? A lot of times again, I was in a network marketing company, network marketing company, and people would think it was a pyramid scheme. The difference is a pyramid scheme is where people make money off of you joining. And there is not a product being so the majority of the income from this company is coming from people joining not from the products being so, so newer was amazing. I absolutely love the products. I believe there’s a list of reasons why I could have done better personally skills that I needed. But I can tell you ladies that it was also because of the type of product, you know, this was an anti aging skincare line. I’m a beautiful young, black female, you know, these older what white women who the products were marketed to, they might not think that I’m the best person to sell them, they’re not going to be convinced by me, you know, of course, it’s also my salesmanship, which is something I’ve been working on, but be mindful of how you align with the brand that you’re gonna make a side gig and you know, that makes it easier to be successful. How much time is it gonna take? Do you have that time in your schedule? Is it gonna take you paying a certain amount monthly? Can you afford to do that so you can really invest the time that it’s going to take before you start getting your groove, you know, things like that are important to think about, so that you can choose the right side gig for you. But yeah, I think side gigs are great. And when we talk about minimum wage, and the living wage is really set up so that this is really how I feel, Christine, I feel like it’s a sentence. It’s a financial sentence. They tell you that go to college, and then there’s the student loan debt, and then they tell you to get married and buy a house. And then it’s a 35 year mortgage. No, this is a sense. And so is that on top of that to have a certain type of lifestyle, but then we’re stressed out Heart attacks are increasing on Monday mornings and Tuesday mornings. And that’s why I love our women connected in wisdom, because we’re really talking about how to be well in all the different dimensions. It’s not just about having a really nice Jeep with great tires, and there’s nothing wrong with that and riding down the street in style. But if we’re living if 78% of Americans living paycheck to paycheck, maybe we get that car that It’s five years old instead of one year old and have a lower car note or no car note at all, so that we can put that money into investment. And then it’s growing faster than the rate of inflation. Because that is very important. We don’t even have time to go into

Christine Gautreaux 45:16

I know cuz I was, I was like, Oh my gosh, like we have been chatting. Katie, just put a note that says, I love this support for the idea that your income and financial situation is not a measure of your self worth. No, with all the mental health stress around the pandemic, it’s easy to forget that this problem is global. Yeah, absolutely. You’re worth it, Katie? Yeah, absolutely. Because it is it is a piece of it right? And it doesn’t matter what stage of life you’re in like, it is, it is a reality because we’re putting food on our table.

Shannon M. 45:51

And it’s been so much right. So like, for me that this has been one of the I feel like the biggest acrobatic things I’ve ever done, because I think about Maslow’s hierarchy of needs, and then cashflow quadrants together, you know, and at the bottom of Maslow’s hierarchy of needs is survival. That’s where a lot of people were before this. That’s what we talk about when we talk about the black community and policy violence and all this stuff that we could go into. It keeps people in our survival mentality. So you really, according to Maslow’s hypothesis, okay? You are unable to reach self actualization at the top of the pyramid, which is knowing your hobbies, having love and belonging, knowing who you are, if you’re worried about eviction, you’re not going to that birthday party, you have to pack okay, like that’s where you’re at. And so, rebalancing, knowing that I’m in a survival state and needing to work on financial literacy and financial wellness, knowing that it doesn’t mean that it doesn’t change my worth and then trying to think about who I am. That’s been a real balance and yeah, women connect it in wisdom and intentionally having the support group and intentionally not isolating myself when my mom passed away in the restaurant shut down and then I had to move and then I started a business so tell us

Christine Gautreaux 47:17

about that business because we have been chatting like you know, we always laugh and blame it on the guest but I don’t think it’s I guess so tell us about that business you started and tell us what’s up with it.

Shannon M. 47:32

Yes, Lady. So this is really what Shea look glow is about. You know, we do all we take care of all this stuff. We have to take care of ourselves. We’ve been used to be in sick and being tired but no more we are prioritizing ourselves. So we have actually have some goodies here. I’m trying out some new scents. This is Lavender Vanilla. So yeah, it’s gonna look like these are some gifts but we have new scents coming mango lemongrass, lavender, vanilla. And for you ladies, I have the code wise five for 5% off so that you can treat yourself and enjoy some shallow glow products. If you know somebody who’s been doing an outstanding job, you know, I think about the nurses I think about the teachers who have been risking their lives to continue to make sure that we’re okay and that the next generation is taken care of. But we know that you know she may need some help taking care of herself. If you know somebody who you’re interested in giving the free gift of self care to please nominate her at Shiloh glow@gmail.com with the subject title shave Oh nomination and tell me what she’s done. Why do you think she’s so special? And I would love to honor her with a gift of self care so that she can take better care of herself.

Christine Gautreaux 48:50

I love that. Thank you Shayla glow for sponsoring wisdom committee women connected in wisdom and for honoring like the Shea rose out there because there’s a lot of them, you know, there’s a lot of them. Well, my friend before we close for today, what’s your wisdom and action around financial wellness this week? What do you do?

Shannon M. 49:10

So every and I got this from Profit First we talk about that every 10th and 25th Those are my money days when I transfer my money from my income accounts to the different accounts is the 11th I forgot to transfer I did other stuff. I forgot to do that. So that’s my wisdom and action to finish my profit first that making sure that everything is allocated correctly in the different accounts

Christine Gautreaux 49:34

nice. Um, my wisdom and action this week is I’m doing the tax homework that my money coach gave me. You know, when I talked about not doing it by myself, y’all practice what I preach. So I reached out to the amazing money coach Laurie, which we’ve had as a guest on our show before and she is walking me through some tax stuff as we level up our business. So that is my words. Have an action. I’m gonna do the homework. I’m gonna listen to the experts and do what I need to do. So we encourage all our listeners, if you’re listening to us to hashtag wisdom in action and tag us on social media, we’re on Facebook, live and connected in wisdom podcast, we’re on Instagram, we’re on YouTube. Tell us what you’re up to. We’d love to be in conversation with you and, and support each other because we you know, that’s what it’s about.

Shannon M. 50:25

Yeah, we nobody does it by themselves, you know,

Christine Gautreaux 50:29

not the truth. Yes.

Shannon M. 50:30

Okay. Ladies, thank you so much for listening in. We will see you next week Wednesday at five and don’t forget, be well be wise.

Unknown Speaker 50:50

Thanks for listening. This has been the women connected and wisdom podcast on-air live on Wednesdays at 5 pm. Eastern via Facebook and YouTube. Be sure to like, share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment