Show notes –

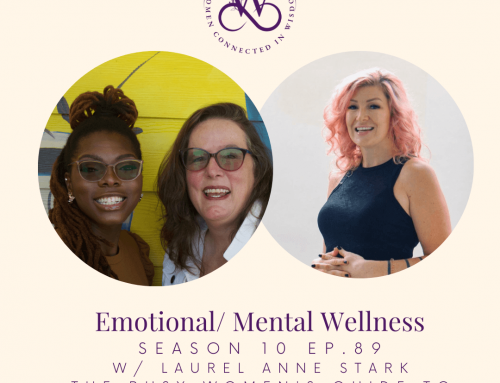

Join Christine and Shannon as they chat about financial wellness & wisdom with special guest Jennifer Oladipo.

Shealo Glo – www.shealoglo.com Now offering Subscriptions * Delivered on the 1st & 15th!

Stillpoint – https://www.amazon.com/Stillpoint-Self-Care-Playbook-Caregivers-Breathe/dp/1732370400

Join us in community: https://women-connected-in-wisdom.mn.co/feed

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Join Christine at an event: https://linktr.ee/christinegautreauxmsw

Book a free coaching consult with Christine here: https://www.christinegautreaux.com

Like & Subscribe to get notifications when we are live

Instagram @womenconnectedinwisdompodcast – https://www.instagram.com/womenconnectedinwisdompodcast/

Take Home Paycheck Calculator – https://www.calculator.net/take-home-pay-calculator.html

Jennifer Oladipo’s writing and communications work lies at the intersection of arts, business, and culture.

Find out more about Jennifer & connect:

https://www.linkedin.com/in/jenniferoladipo/

https://twitter.com/JenOladipo

Clubhouse @jenoladipo

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Shannon M. 0:12

Hey hey

Christine Gautreaux 0:24

got a little extra pep in our step today Don’t worry my friend.

Shannon M. 0:30

Fingers, you know, when the screen Listen, the excitement from everything in general that’s going on is just like I would, I would just be excited all the time, which is a great thing. We’re doing great,

Christine Gautreaux 0:48

right? I can’t wait to share with our listeners what has been happening and what is going on. I can tell you, as a body wise practitioner who teaches this stuff, I’m going to somebody said on a call today that confession is good for the soul. So I’m going to confess something to you, my friend, completely out of my body this morning. Like, I dumped half a cup of coffee on myself. And then a little bit later, I spilled my whole cup of tea.

Shannon M. 1:17

Is that what that means? I was like, Wait, like,

Christine Gautreaux 1:20

I need to get present and get in my body and take a deep breath and get here. And this week just feels like a week where I’m dancing way fast and exciting. And it’s good news. So yeah, yeah.

Shannon M. 1:42

And I was going to ask you what you mean. And I think we could go more into it what you mean when you say out of my body, right? Cuz I drop stuff. I feel like sometimes I need to make more space for myself in doorways, turning sharp corners, like, Why do I not know how much space I need? Like my car when you’re taking those turns? You got to know, you know, but maybe that’s what it is. Maybe in those moments, I need to get grounded and centered back into my body.

Christine Gautreaux 2:07

Right and being present in the moment. I know. For me, what it often is, is I’m running too fast, like my brain is five steps ahead of where my body is because there’s so much on my to do list or there’s so much happening or there’s so much exciting news. Right? So all of that, right? Should we do our intro and then tell folks what we’re vague looking about?

Shannon M. 2:32

Cuz I’m ready. I’m ready to talk about it. Let’s do. Hi, ladies. My name is Shannon Mitchell. I am the founder and owner of Shayla glow LLC, a handmade shea butter company. I’m your champion for natural skincare and practical business systems.

Christine Gautreaux 2:50

Hey, y’all, my name is Christine Gautreaux. I’m a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself and community care.

Shannon M. 3:01

Yes, together we are women connected in wisdom, a podcast grounded in VA dimensions of wellness.

Christine Gautreaux 3:06

And we like to get together every week and have intentional conversations about how to be wise in business, and relationships and wellness. And talk to some pretty phenomenal guests.

Shannon M. 3:20

I love I’m like I can’t wait to have this conversation. And that’s why we have the podcasts and bring them on so we can share it because I need it. And I love all of the different things and the details of you know how we get to go deep with these ladies and how they do it. I listened to you talk about yourself with the upgrade community and self care. And I heard it differently. The week after you sent me Panera when I got my teeth taken out. And I loved everything you said I don’t even know if we talked about it. But when I was in bed with that gauze in my mouth, I was like thank you Christie because what we do without each other, you know,

Christine Gautreaux 3:59

right? It’s and in order to take care of our communities, we have to be paying attention to our self care also, right? Because when we give from abundance from an abundance of health, from an abundance of being in our bodies and being grounded and being centered, when we get from that place, it is coming completely different from when we’re giving from lack or when we’re giving from our leftovers or we’re you know it is a different space and energy. And we want to be able to sustain it. Like we want to be able to sustain ourselves care and our community care. Because y’all the world needs us. Like we got some work to do. Yeah, it’s important. So absolutely,

Shannon M. 4:45

absolutely. So let’s talk about what we were. So what we are so excited about.

Christine Gautreaux 4:54

So y’all, day, Monday, we were on our Monday manner Testing mastermind, which is a group is where Shannon and I met three years ago, close to three years ago, or,

Shannon M. 5:06

I don’t know. It’s March

Christine Gautreaux 5:09

this space time continuum. Now that the pandemic is thrown in, I don’t know anymore. Like, I don’t know what year it is, or what’s happening. But um, so this is a group we belong to for years. And it is a group of entrepreneurs, mostly solopreneurs, who get together every week, and we support each other, and we give each other support around our goals and connections and resources that we need. And we always celebrate our successes. It’s one of the things that we do that’s a little different than some masterminds like we start with, hey, what’s working? Like, let’s focus on the good, which is a principle of interplay. And let’s celebrate what’s working. So Shannon was given her shout outs and she said something I can’t even remember what you said my friend that sparked me to go check on Listen notes, which listen notes is like the Google of podcast if y’all if y’all are interested in new podcast, or you want to check out like it is you can find any podcast in the world on Listen notes. And so I popped over there to check something and found out that after what are we We’re on episode 661. Today, one, yeah. So after 60 episodes, we had the distinction of being in the top 10% of podcasts in Yes. Yes. So big thank you to our listeners, and for everybody listening or watching or both such gratitude, because that’s part of it is y’all liking and subscribing and listening? And that’s part of what makes up that ranking. And we are so grateful. And yeah, it has made our week like we every day we’ve checked it with each other and we’re like

Shannon M. 6:54

yes, yes. And speaking of manifestation Mondays, too. We are doing a live tonight. What did we decide? Christine?

Christine Gautreaux 7:01

Seven 737 30. Yeah, on Instagram, we are going to bring together some of our ladies that a lot of them will not be new to you, because a lot of them have been guest on our podcast. Now. They were some of our first guest because you know, they’re our friends. And we’re like come doctors on this brand new button. But phenomenal women that we are connected to. And we’re going to go live on Instagram tonight at 730 Just in celebration and appreciation of International Women’s month as we as this month shockingly draws to a close. I say shockingly, because how the heck is it going to be April 1 like at the end of this week?

Shannon M. 7:36

It’s crazy. I feel like last last year’s New Year’s is like a few weeks ago. You know, like it was just the beginning of 2021. So it’s incredible.

Christine Gautreaux 7:47

It’s incredible. Well, I am so excited for our topic today speaking about it being April as we roll into tax month as we roll into those of us that are solopreneurs and entrepreneurs and like oh, yeah, okay, that’s what’s on all of our to do list right now. Yeah, either already gathered that information to send to our accountants or be gathering it or be doing our taxes depending on where you are on that spectrum. But it is been in most of the conversations I’ve had in the last week or two in some way or another. So today, what are we talking about my friend,

Shannon M. 8:20

we are talking about financial wellness, and capturing a complete definition of financial wellness is tricky because it means different things to different people. At its most basic level financial wellness is a holistic approach to counter financial illness. This holistic approach includes a combination of factors such as satisfaction with current finances, increasing positive financial behaviors like saving, reducing debt, and budgeting, financial knowledge that helps to change behavior, reduce financial stress, and creation of a financial plan to reach financial desire or reach desired financial goals. Hmm. Yah, yah,

Christine Gautreaux 9:02

hoo. Let’s take a deep breath on that one. I don’t know about y’all, but every time I talk about financial wellness, like I feel like it’s a lot of adulting. And it’s a good thing, right? It’s a good thing, but it’s a lot of adulting. So I’m excited to talk with our guest today. Because I feel like she brings such knowledge and expertise to this and with her business and just who she is. So you want me to bring her up on stage and yeah, Alright y’all. So our guest today is Jennifer Ola depot and Jennifer Ola depot’s writing and communication work the I’m totally blowing it today. Here we go. Let me try that again. Her writing and communication work lies at the intersection of arts, business and culture. And we met through an organization called alternate routes. So welcome to the stage How are

Jennifer Oladipo 10:03

you? Great, congratulations. Thank you. Hey. Matt again,

Shannon M. 10:13

yes, thank you so much.

Christine Gautreaux 10:16

It is just made our week. And so it you know, it’s one of those things when you have a goal, because it was a goal of ours. Like we literally put it on our goal list that we wanted to have this distinction. And then when you hit that goal, I think about it when we talk about financial wellness, right? We can celebrate around those goals to

Shannon M. 10:39

absolutely, I can’t wait, one of my financial goals is to, to we talked about it being adulting, right? I can’t wait to have fun with money. I just want to fly around the world and do what I want spontaneously, like, you know what, I really want this sandwich from Zimbabwe. Let’s go get that, you know, one day.

Jennifer Oladipo 11:00

Yeah, small thing with money. That’s what that’s one of the things that I’ve been trying to do is like, you know, just enjoy. Enjoy

Christine Gautreaux 11:08

your MO say more about that.

Jennifer Oladipo 11:09

Yeah. Well, I mean, that’s just not something I really grew up with. The opportunity or, you know, wasn’t like something of me. So I’m learning to like, when you when you are hitting those financial goals, like just to switch gears and be like, Okay, I can have a different relationship now. Yeah, you know, two things. And money is like a, you know, it’s a vehicle, it’s a tool, it’s a it’s a way to do other things. You know, it’s just the thing to get. And, you know, yeah, so but you can start a little, I have a friend who, who told me, Herman, shout out my friend, Mary Elizabeth Harmon. And she talked about just doing things that feel like you’re, you’re at that place where you want to be, so that she and her friend would have lunch, you know, at the Ritz Carlton, like, every so often just lunch, you know, just the sandwich, but it’s Carlson, and it just, you know, put them in that mindset of, like, one day, I will stay here when that we’ll have dinner here, you know, stuff. So I try to learn from that and do that. Absolutely love

Christine Gautreaux 12:14

that you bring that up, because we don’t know what we don’t know, in whether that’s where we’re talking about financial, or we’re talking about energetically, right? Because I remember I’ve had the privilege one time of staying at the Ritz, and it was through my husband’s job. So you know, the job was having a event there. And I had no clue. Like, you know, I’m this little country girl. And, you know, you roll up in there, and they greet you at the desk hill with would you like champagne? Or would you like I can’t even remember the other option? Because you know, I went for the champagne. Like, a water? I think it was water. Would you like champagne or water? I looked at my watch. Oh, yes, I would like no clue that that even happens. Because when you don’t have that experience, or like, how would you know? Right? How would you know that there’s some places that greet you with that option?

Shannon M. 13:17

Right. And we were talking about it, Christine? I don’t think she’s been on the show yet. But one of our future guests and the difference in the I won’t say where it is because we’re not talking about her book yet. But the difference in how different level employees were fed at work, right? The lower employees had vending machines, then it was like a buffet cafeteria style. And then it was the dining with the China, you know, and it’s completely different between putting some coins or a card into a vending machine and sitting down at a table with a napkin and being waited on. Absolutely.

Jennifer Oladipo 13:53

Your meal should not Krinkle a meal that’s not you’re just not being fed on so many levels. Yeah. That’s interesting. That’s deep.

Shannon M. 14:09

Yeah. You know, so Jennifer, I can’t wait to dive into this conversation with you about financial wellness. Yes, when you talk about the first thing I wrote down that you were talking about before the call is saying your number. I know that say the number Thank you. I know that that was something I had to learn. So can you share about your perspective on that and what you think about when you say that?

Jennifer Oladipo 14:34

Yeah, I mean, I’m just I have my my personal experience with it. But as a you know, solopreneur baby printer, I’m just having that like, colds like sweats. You know, when you’re going to ask for whatever it is, for a fee for you know, the service, mostly communications is what I’m talking about. So, you know, a lot of times I would be Trying to price you know, a long term engagement. And I think I’ve come up with a number that’s appropriate. And, you know, back in the early days, like, I mean, I just laugh like now at that at that number, because it’s, I mean, it’s it was nothing people said yes to fast but but before they said yes, too fast, and I realized that the number was too low. I mean, I would have to, you know, practice practice with my husband, he had a sales background, you know, how am I going to say this? Am I gonna say that go in there still be sweating, still be nervous, you know, only halfway present in the conversation, because I’m trying to make sure I’m like, geared up. Am I sitting? You know, do I look like I’m commanding enough, like, respect, you know, so that when I say this number, you know, and invariably, I’d say, you know, x, it’s gonna cost you X amount of dollars. And they say, okay, so and move on. And I’m like, Ah, oh, I could ask for more, you know, and that happened, like all the time. So I would work with that. But the thing that really just got me like, passionate about this, and I was so glad that you all at this opportunity is because for years, I’ve been like, wishing I had an opportunity to talk to women specifically, because what happened is, after a few years, I started getting to a point in my business where I, you know, could hire help for various things. And there was one week where I was talking to women I know, who are experienced, I’m talking like an age range of probably 2530 years. So you know, they’re different generations, and a range of things I needed. It was accounting, design. And I think that the third one might have been something like hiring another writer or something else, I thought it was actually something outside of my expertise. So I was like, okay, like, I have money, I can spend it, I want to grow my business, and I’m leaning on anyone for help. And every single one of them could tell me so much about what I needed. And I mean, just great. And then when I was like, Alright, how much would that cost? Us? Well, I mean, you know, um, if you I mean, well, we could talk about, you know, and I was just like, just just told me what it’s going to cost. And at that point, I’m just thinking, the first couple of times from expediency, like, can we just, like, finish the conversation? You know, so I can, like, move on. And then by the third person that week, I realized, like, we have a problem, because these are very capable women, and, and just couldn’t say the number. I mean, literally, I’m like, what does this cost and as like, the demeanor would change the conversation, the cadence of their speech would change. And I was like this, this is tragic. And like, what’s going on there? You know, why do we feel like we just can’t say the number and, you know, where did that confidence go? Where did that? Where did you go? Where did you disappear to where you’re not your your whole self anymore? You’re not, you know, in that in that power? I mean, this is something that you all have have seen or experience, oh,

Christine Gautreaux 18:03

this morning to? Like, I did a keynote last night for the University of Georgia for their honor society for their social work department, I was honored to be asked to go do this keynote. And so I had shared that on LinkedIn. And somebody reached out in my direct messages this morning and said, Oh, my gosh, I love the work you do in the world. What do you charge for nonprofits to come and speak for an hour? And I had that reaction? I know, and then it and then I had to unravel it in my brain. Because the other thing in my brain is I charge different rates for different organizations, depending on size, and are they a nonprofit, or they’re for profit. And in some of my training, I’ve been taught to have the conversation before you name the number. But I did notice in myself, even the about because I knew what popped up in my head immediately. And then it was like, I could even feel myself with my years of experience in the work I do in the world. Like, can I say that number? I think it’s, yeah, it’s, I do think we have a problem. And here’s the thing I will say too about it. When I do coaching, and when I talk with my women at manifesting Mondays, I always tell them to double their number. And it’s so easy for me to say that to them. Take my own advice, right. And I will tell you what, most of them when I say double their number, they get that number.

Shannon M. 19:38

Hmm, okay. Yeah. Okay.

Christine Gautreaux 19:41

That’s good because they’re undervaluing themselves.

Shannon M. 19:43

Mm hmm. And so I can tell you that I don’t know if I don’t know if I ever struggled with the number saying it. For me, Jennifer. It was not even knowing what to ask for for a salary less Say right the first time I was a salary manager, I don’t know what the market is, I don’t I don’t know. I didn’t know what I needed my income to be. That was one I didn’t know my personal expenses to say, if I want to make three times my monthly expenses, my income needs to be this, right at a minimum. Then again, every time they move me because I started at one location, got promoted five or six times through the different lower level positions, became a manager, they transfer me became a kitchen manager, they transfer me and I opened a restaurant. Every time they asked me to move, I was honored for the opportunity, right? Because that’s the type of person I am. I never asked for anything. Why not? I didn’t even realize it till I’m listening to the secrets of six figure women, this audio book over quarantine. And I’m like, wait a minute, negotiate salaries. That makes sense. Why did I not ask for more money. And so this time around, I’m doing a lot better job at it. But it was interesting, because now also as an entrepreneur for shallow now I’m working on wholesale prices, right? We have some nail salons and massage parlors that are interested in the oils and different products because they offer services and they want products to you know, increase their revenue. And I did the math. And again, because we I think we hesitate because we don’t know how to base the number part of it is fear. But then part of it is where do the numbers come from? And that’s the cost of goods. For me, it’s the cost of goods, labor, and then I keep in mind my goal, profit margin, right. So I did the cost, I did the calculations, I gave the the wholesale discount that my partner and I had talked about after we did some market research on what normal companies do for wholesale discounts. And this person said, oh, you should charge more. Now mind you, this is 100, hundreds of dollars for a half a gallon of oil. And, okay, he told me, this is a person that’s interested in buying, if he’s asking me to charge more, I’m going to charge you more. So when I send the invoice the next day, it was more money after I had worked it out. But yeah, it’s a thing.

Jennifer Oladipo 22:12

So those were the two things that you know, that you both are talking about, I think they can get you to say the number is, is conversation and education. And I think that’s one of the first things is we forget that it is a conversation, it’s you know, I think we have these notions about negotiation. And if you look at older books, it’s like, you know, you got to come in, in a certain way. And it’s a more adversarial kind of thing. And I’ve seen these, you know, memes out there, where they’ll have like two cowboys, and you know, they’re like in the Wild West, and like, they’re gonna draw their guns, and one says, like, you know, whatever company and the other says, freelancer and one says, What’s your rate, you know, and the other ones like, Well, what do you what’s your budget, you know, and there’s this, like, pitted against each other in this adversarial relationship. And it’s like, no, we’re having a conversation, not a confrontation. And I think that’s part of what might have been happening with the women that I was talking to is, we were having a conversation about my needs and their capabilities. And then because of our acculturation, it switched into a confrontation mode. And in which case, you you may have fear, you may feel uncomfortable, you may feel like you need to arm yourself, like that was how I was feeling I was going into things, you know, in the early days, like, okay, it’s them, it’s me, you know, and a lot of times too, I mean, you know, it was a male dominated space, like I wasn’t, you know, negotiating with men, or I didn’t even negotiate because my prices were too low. And they’re like, Yeah, that sounds good. And we moved on, but that was what I was preparing to do. And so that remembering that it’s a conversation, and we are just, we’re just getting coming to an understanding, you know, and if somebody won’t, if somebody says, No, that’s okay. That’s just another, you know, it’s like, okay, I was gonna go this way, I guess I have to be a little left or veer a little right, or something like that. But that is just, that’s fine. You know. And then, to your point, you know, Shannon, not knowing that’s, that’s a huge one. And I don’t notice, I don’t necessarily know if that was what was going on with people. But I know that that is a real issue. And, you know, I think there are two ways to approach that. We can do a lot of research now. You know, there’s really, there’s really no reason to not ask around to not do your research. There are so many in almost every field. Everybody’s doing these surveys of of, you know, especially for freelancers and things like that, like what are people making, and to me it’s appallingly low in almost every case where I see in my field the things people do, it’s it’s shockingly low. And, and when I see that, I know that people aren’t, they’re not having the conversation, right? They’re not pushing the number up, they’re not seeing exactly what’s there. And I almost sometimes look at those things and be disappointed, because I’m like, this is reinforcing a really low. I mean, again, like, maybe some people are sort of like earlier in their career, or still really building up a skill set. So, you know, they, they don’t have as much to offer, I can’t charge as much, and that’s fine. But a lot of times, that’s not the case, you know, people are making the same wages, even as their experience and skill set grows, and they have more and more to offer, there’s charging the same thing. I think that conversation and education and that’s where you can have the conversation more confidently if you do your research. And then I mean, the other thing is, man, I had a coach who just said that you educate yourself about like, what do you need a business coach, and it blew my mind the idea of, oh, well, let me what like what, like, How much money do I want to make, like charging based on that it just never occurred to me. And I could just charge based on what I want to make and find the clients who are a good fit and other ways and also willing to pay that. So I had to educate myself, okay, like, what does it take for me to have a beautiful life? How much money does that take? How many hours can I work? And like, what do I need to charge to make that equipment work? And that was just amazing to me.

Christine Gautreaux 26:26

How I love that

Shannon M. 26:27

work. All right.

Christine Gautreaux 26:29

I love that conversation, Jennifer about I think so many people, especially when they grew up not having a lot or not having or not even knowing how to budget, like, I know, I came from a place of what’s my bare bones budget, right from putting myself in college through college and, you know, eating way too many ramen noodles and things like that to, to be to not just going bare bones, to what does it take to make a beautiful life. And Eleanor is listening and says women’s labor is 20% to 40%? And I’m not sure give us some clarification on that comment, Eleanor. In the comments. What else you want to say about that? I think I know what you’re saying. But but give us some clarification on it.

Jennifer Oladipo 27:20

Yeah, I’m interested in that.

Shannon M. 27:22

And, and also, ladies, you know, I like to go to the root of things too, right? A few decades ago, we weren’t even able to get credit cards without our husband’s signatures, women weren’t able to own land and own assets. So when you talk about balancing liabilities and assets and all this stuff, it’s a whole it’s a whole new world, you know, so thing is, you know,

Jennifer Oladipo 27:48

fantastic point of view.

Shannon M. 27:50

Absolutely. You know, and so being able to have, let’s see what she says women’s labor is 20% to 40% cheaper than men’s labor. So there is a lot of pressure on us to not negotiate a salary. I hear you, Eleanor. And I think about Oprah story, when she says she’s found out that one of her colleagues was making about twice as much as she made, right. And when she brought it to the supervisor, he said, Well, he has a family and a home and you don’t have those things. Why do you need it? And in my mind, I’m like, because I want them How can I ever afford to have it if I’m not making the money to support it? You know, so it’s important to see the difference, because the time is the same out of our life. You know,

Jennifer Oladipo 28:35

I’ve had that happen. To your point, Eleanor, um, I found out later after I had it, you know, we had a colleague, and we remained friends, and just offhanded conversate we were like, you know, just talking about the old boss. Yeah, you know, and he, you know, throughout this number, and he was like, I mean, yeah, I’m not gonna put up with that for X number. And this number was more than what I was making. And I had coached this, like, I was above this person when they came in, and, and he and I both know that I’m twice as talented in this particular field. And twice, I was twice as talented and three times as experience. And I mean, that was like a gut punch. And this is like, you know, years after I left the job, and I just could not believe like, it happened to me, you know, I never would have I didn’t even occur to me. And I but I remembered when they hired him, there was this whole thing about and probably, probably, this is what I took when I went to work with myself like, oh, man, he can really command a room this guy could just, you know, own a room and they were talking about before hiring I think this is the guy he’s just own a room, you know, and I was like, is that what they were paying for? Like his you know, um, you know, and what did i What did I own except for like, a whole lot of responsibility and labor and and yeah, 20 to 40%. Yeah, that’s right on the money about how much less I was making. I mean, it’s crazy. That’s crazy. And that was, you know, like a second point that I wanted to come to was about was about this notion of knowing your worth. Right. And I hear that a lot when people are talking about I think, essentially the the, say the number thing, you know, know your worth, say the number. But for me, I think there is we really do ourselves a disservice if we are tying our worth, to our, you know, financial transactions, because I think, you know, if something happens, and I can’t work another day, tomorrow, my worth does not disappear. You know, when, when, when my labor is devalued? As it has been in the past, like, in that situation I talked about are the situations you talked about Shannon, where I mean, you weren’t offered opportunity, you weren’t, you know, no one said to you, we’re asking more of you. So we’re gonna give you more exactly, exactly my opinion, that was that was you were being devalued. But was your worth less with? You know, with every devaluation that came from outside? No, no, it was, you know, your financial game was less than men. So, you know, I feel like, know, what your work is worth, or your service or your offering, know what your offering is worth. But that is not necessarily your worth. And frankly, I mean, what we have to offer is not worth the same amount to everybody, you know, it’s just simply not either in terms of how they see what you’re doing, how much they need it. Another thing about saying the number and educating yourself is, depending on who it is that you’re trying to work with, I mean, like a lot of the clients that I work with, you know, that I’ve worked with, I’ve kind of I’ve had this, like tech, technology and life science niche. And there are some spaces where, if my number is too low, I am not taken seriously, because they don’t think I understand the difficulty, the complexity or the importance, because they are used to spending at a certain level. So if I’m coming into low, that’s just signaling to them, they, what that is worth to them, um, you know, it’s like, don’t price with your own pocket, you know, know what it’s worth to them, how did these people spend? First of all, say

Christine Gautreaux 32:24

that, again, say that, again,

Jennifer Oladipo 32:25

about your own pocket? Oh, many times don’t price with your own pocketbook, know what it’s worth to them, again, with it with the labor or the value of the service, or the engagement or the relationship or whatever is worth to those people. And, and those are hard numbers to say, you know, I’m talking like a prop, you know, if someone’s like, I need you to do, you know, I’m web copy. And there are folks who, you know, we’re overhauling the website. And I’ve had situations where if I did not, quote, five figures, I knew I would not be taken seriously one time somebody and and I learned this from somebody who was kind enough to nudge me and say, um, let me clarify what I let me give you more details, before we commit to this price. And I understood and it was, this was a woman, who was just the sort of like, project manager kind of person who kind of, you know, so that wasn’t going to be the person I was working with. But before they passed my quote on to where it was going to go to the who was writing the checks, they were like, let me just clarify, we mean, this, this, this, this, and this. And I just wrote back. Oh, thank you for clarifying. Because in that case, you know, and I think I added like, 30%, or something to what it was, and they were like, oh, okay, that sounds a little more like what we thought you might say, and then it moved on. And I was like, sister, thank you, like, you know, though, you know, like, oh, what that is worth for these be okay, for this kind of client, you know,

Christine Gautreaux 34:02

thank you for lifting that up, Jennifer. Because right there was showing the way that women connected and wisdom can support each other like that. We don’t know what we don’t know. So reach out, like her reach, saying that to you just made a huge difference in your business in your life. And that took her an email, right? I mean, that’s beautiful.

Jennifer Oladipo 34:26

Actually, that has happened twice. That has happened to me twice. Completely different clients different, you know, years apart where somebody again, it was, it was it was a woman who was kind of in the project manager position was like, this number. Let’s talk a little bit more about it. You know, and I have passed that on. I just very recently was talking with somebody and um, you know, they were quoting something we were both collaborating. They’re like a designer. And so we were collaborating to deliver a service and After recall, I said, you know, is there a reason why you charge $100? an hour? Not that’s too low, just is there a reason why you charge $100 an hour? Because for the client that we were working with, that was on the low end, I know, you know, I knew from my experience, and they were just like, You know what, thank you for asking me that, because I have felt like, maybe I need to do more, or try to push it or whatever. And thank you for asking. I mean, somebody, I needed somebody to ask me that. So I you know, so it’s not just this, like, internal. It’s like, yeah, when someone from outside is just and you know, and I just said, Well, why don’t you you know, I get it, like, it’s uncomfortable. So, you know, what if, what if, on the next three quotes you give, you just add 20%? Just try it, you know, and I know for a fact that this person, they’re gonna get it, they’re gonna get it, it’s not going to be an issue. Christine, you tell people to double things that feel like very uncomfortable,

Christine Gautreaux 36:04

right? It’s a it’s a gut, like, even as I say it, sometimes it’s easier for me to say it than to do it personally. But

Jennifer Oladipo 36:11

when you add a tip, add the gratuity. I like that.

Christine Gautreaux 36:16

I love that. I love that advice. And, um, it’s one of those level ups or growth edges, that once you do it, like, it’s always shocking to me, every time I’ve raised my prices, or every time I’ve done it myself, like and people like, oh, yeah, I mean, they pay it. I mean, I had it happen one time early in my coaching business, that a guy that I’m still friends with, and I coached him years ago, he came to me and he says, I know that you’re my coach, and I’m coming to you, because you’re lower than this guy. And about two sessions in he says, To me, you’re charging way too little. And you are more talented than this guy in this guy, and raise your prices. And so, you know, doing that for each other and and saying, and it’s not to, and I don’t want to say like, you know, put out whatever number when you don’t have the experience or the background or the we’re not saying that like, but so many times when women undervalue themselves, and they undervalue what they bring to the table in and I always think, Okay, well, what are the white males charging? Like, let’s look because they’re not undervaluing themselves. So let’s check that out and see, see what our rates need to be?

Shannon M. 37:36

Right? Absolutely. And I know that we value experience, of course, we, we value the tenure in different industries. But I will also say because so many industries require, even if it doesn’t require you should continue the education. If you’re right out of school, you might be the most up to date with the newest technology or the software that’s being used right now to offer what that client is looking for. So even then, I would say, ask for and if they say no, I so what I did recently, because again, tomorrow’s my last day at the the salary job I’ve been talking about, went from door dashing last year cleaning buildings with one of our guests that we had on the podcast, and I said, You know what, I was paying attention to the KPI. And I said, I’m losing money, like I’m losing money cleaning these corporate buildings. I should just go back door dashing, started working on the Financial Peace workbook, and Dave Ramsey’s, like, what side gig? Are you going to pick up? I said, you know, what, they’ve, let me go ahead and go to top golf. And I’ve been moving up. And each time I’ve moved up, I’ve asked for more. And they said, Well, this is what we have. And I said, Okay, and so when I got the call to get an opportunity, now I’m going to take the opportunity and continue to fall in line with what I need to make based on my goals of generational wealth and building these companies, you know, but that was uncomfortable to have just gotten in the salary position and say, you know, what, guys, if this is where we’re going to be respected, and I need to go, you know, and not worry about what the team thought, and what about the systems I was putting in place? And what about the time that I invested some people say, Well, I hate to waste it. And it’s definitely not a waste, you know, everything adds on to itself. And if I’m looking at what I need, and what it cost me to do X, Y, and Z, this is more in line with that and the different things I need for my environment and occupational wellness and all the things that we talk about then it’s not even a choice is something I have to do is how I look at it.

Christine Gautreaux 39:38

I love that channel. And here’s the other thing I want to say on that is you brought your best self while you were in that position, and you did the work like you got paid for the work you did. I think even as I’m hearing you speak I think we do this as women often or at least I know I’ve done it let me just speak for myself. I’ve done it in my own on jobs, I stay way longer than I need to. Because I feel a sense of loyalty that they may not feel to me, or that they are, or I’m not checking in with my physical health and well being, and I’m giving everything to the job or the corporation. And that’s not reciprocal. So it was right. It’s not reciprocal. So I just want to say yay for you. Thank you, for you, in checking in with yourself and knowing what you need and knowing your numbers. So when another opportunity came along, you could say yep, and I know, our listeners may not know, but I know because you did this with integrity, you went to them and said, Hey, I have this other offer. And I want to give you a chance to match it, or meet it. And they, they couldn’t. So you’re like, Okay, thank you very much. And you gave your notice. So I watched you handle that with such integrity? And well done. Yeah. Well done.

Shannon M. 41:05

Absolutely. Yes. And, and I’m gonna say,

Jennifer Oladipo 41:10

go ahead. So I wanted to ask, like, you know, when, when you didn’t get that, you know, either reciprocal offer, or you know, the offer like that would keep you there financially from people that you had invested in? Like, did you? Did you have any kind of like feelings about that, like, oh, you know,

Shannon M. 41:27

no, not at all. And thankfully, I’ve been blessed to be in a position where the people who I’m working with directly, I know, the value that they have in my skill set, I do have the experience that we’re talking about that is usually favored and sought after. So it’s not that they don’t know who they hired, you know, and I know that they specifically as individuals do not control the budget that’s set aside for certain things. So again, I go to the Four Agreements, take nothing personal, don’t make assumptions, do your best and be impeccable with your word. You know, again, I tried to operate a certain way. So I would offered it. And at the same time, too, I also had arranged for myself, so this is what I asked for. But I knew that I needed to calculate out taxes to see what I was actually going to take home and make sure that I was still on, on track with the financial goals that I have for myself. And I’m going to ask above that just in case they lowball you, you know, so those were the things that I was thinking about. But no, it wasn’t personal.

Jennifer Oladipo 42:29

You know, yeah. Because you you your worth, you didn’t tie yourself worth exactly, you know, or to your income. So if they’re saying that, you know, for whatever reason, we’re not going to give you that, it’s like, okay, that’s fine. That’s, that’s not about me, that’s what exactly this, you know, financial relationship. Um, one thing that you were saying about taxes, I want to encourage everybody to use a good calculator, a good take home pay calculator, I think one of the first one or two that pops up on Google is really excellent, because it asks a lot of things, it’ll ask your state taxes, your you know, and various, you know, a little bit more detail to give you a real number and this and that’s how much you can don’t take home. And I think that’s one of the things that that trips us up and gets in the way of financial wellness is yeah, not thinking about the right number, you know, and if it’s complicated, I mean, you know, for a lot of freelancers, or something, like if you just take 20% off the off, whatever, your that’s a, that’s a good round number, but I think it’s good to really know, the take home, you know, I recently just took a job, and I was on that calculator. You know, okay, if we, if I, if I, you know, ask for this much. This is what I’ll get, if I asked for this much. This is what I’ll get, you know, I was on that run in those numbers. And it was very empowering. You know,

Shannon M. 43:49

I didn’t even know there was a such thing as a take home calculator. I’m just trying to figure out how much I remember, I’m gonna use it.

Jennifer Oladipo 43:56

That’s important yet, when they ask, especially things like, what’s your state tax? What your it’ll ask you something, you know, some of the things that are on the tax form. So, like, special deductions that you might want to take dependents and stuff like that. So I mean, it’s not like, you know, it’s not like, law or anything like that. But it’s, it’s, it’s, I will, I would be surprised if most people can come up with that number on their own. Right. Because the taxes the tax situation is so complicated. And that’s just a great way and you can, it’ll, you know, it’ll break up how you want to do it bi weekly, you know, how you’re getting paid bi weekly, annually, monthly, so you can even make it in whatever terms that you need. You know, for some people, an annual number is just too big for me. bi weekly is just too small. I can’t really figure out what kind of, you know, financial power I can get with that number that’s only broken out into, you know, 2626 payments or something like that. So that’s just a really nice tool to use, and it takes the light bulb Personal away from it, you know, you don’t have to question yourself as much,

Christine Gautreaux 45:03

Jennifer, that’s a great resource. And we will put that in our show notes for folks. And I’ll confer with you after the show to make sure we get the the one you like the best. Yeah, put our show notes. So folks can just click on that and find that out. Because often we’re like, people ask, like, how do I figure this number out? And that’s a great resource and a tool to be like back into it. Right?

Jennifer Oladipo 45:26

It’s so empowering.

Shannon M. 45:29

And I want to give space to Jennifer for something else we talked about before the call about space for myself, and also someone else, right, so I talked about just getting the position, and I’m excited about the systems, I’m setting the retail inventory and training and all these things. And I’m leaving sooner than expected. But I knew I was leaving, because again, I’m building generational wealth and going to create jobs myself, but didn’t expect it to be international women’s month. 2022, right. But with me leaving, I’m able to hopefully pass it to somebody who’s been really excited about it. Another young lady, we don’t know yet, right? But I would love for her to get it just to pass it to her and set her for success as a smooth transition, and see what she does with it. So I know I’ve enjoyed doing that through my professional career, you know, putting people on a salary jobs or in college, me and my roommates, we all worked at the gym, I got there, and then two of them came on over and that helped us pay our rent and take care of stuff in college. So when when you think about that, can you tell us more about it?

Jennifer Oladipo 46:34

Yeah, that is that is such a big thing. So you know, once you are, you know, you know your number, you’re educating yourself, you’re saying your number, then there’s that shift of, you know, if this is something that’s, that’s a challenge of, oh, I’m, I’ve set the number I’m getting it, you know, and to really believe that that is, that is true. That is, you know, that is true for you today, it will continue to be true for you as often as you need it. Not to say that there aren’t like ups and downs, and back and forth, or whatever. So for me, like, personally, I had a situation this week where, like, you know, after these years, I say the number I can get the number, you know, I’m I’m so like, like happy with my financial situation right now. I you know, I’m where I would never have, I didn’t really believe that I could get to where I am right now. And, um, but some more but and one great thing about it, I think that I’m financially well, and like comfortable with the pace of the work, and I’m enjoying it. And so, you know, I think that’s all a part of financial wellness is like the way the money comes in, you know, is that healthy. And another opportunity came up, you know, and, like, I had that twinge where I was like, man, that’ll put me in a real stress mode, but you know, I can handle it. It’s just a few hours here and there. But other than that, you know what I’m telling myself, and like, even as I’m like, Uh huh, yeah, oh, that sounds great. You know, like, accepting the work. Like, I’m knowing that I shouldn’t, you know, because there was that, like, fear that thing of, you know, or even, and I was telling myself, Oh, well, if I do that, then I can get to this other goal faster, right, like this other financial goal, like, it’ll be just that much more, and I can get a little bit more yada, yada. And then, but by the end of the night, I was like, you know, what, that was a mistake. That was a mistake, I should not have taken that. And so I went and said, you know, like, realistically back to the person, this, this isn’t gonna, you know, it’s not gonna work for me, I actually, you know, do not have the bandwidth. And, but I had somebody else to recommend another another colleague, and the really wonderful thing about it was I, you know, usually people, I’ll just do the connection, and people just leave you off a little email exchange. And for some reason, they both like, kept me on, so I got to see them talking. And I was so excited to see that my friend is a better fit, like, she is actually going to do better than than I would have, you know, just by their, their exchange, I’m like, Wow, this, this, this opportunity is just as great for her, you know, and I, it didn’t occur to me that in making space for myself, you know, to, again, like what’s a beautiful life, a beautiful life is not one where I am working constantly, you know, even if the money is good. So I was making space for myself, like, I’ve got breathing room, let me breathe, let me keep that you know, and not suffocate myself again, with work. I realized, Oh, I made this space for somebody else, to have an opportunity to shine to connect with a new client to do something and I think it’s probably going to be great. And I was like, I was like, damn, like, she’s gonna do a better job. You know, I think I would have done a great job. But she’s just got a different background. She’s got a different experience. You know, she’s, she’s just oriented differently. And they were just like, hitting it off and I was just like, man, like, so so we don’t know when we are creating, creating opportunities for other people by by being financially well for ourselves, you know, and that may mean taking the work. And that may mean passing it on. Because in taking work, I’ve been able to bring other people along with me, like you were saying, Shannon, you know? And that’s like, that’s a new one for me. So I’m gonna have to sit with that one for a little bit, because I hadn’t thought about that. Really? Yeah. So I can see it, like play out in real time was really great. That is so beautiful.

Shannon M. 50:28

I love it. So oh, this is Jennifer’s website. So if you would like to get in contact with Jennifer, go to www dot. How do you say it? You know? koat.com? Gentle co

Jennifer Oladipo 50:42

Yep. I want to jump taken by some like Swedish guy. Yeah.

Christine Gautreaux 50:49

And we will put that in the show notes so folks can find you. And do you have any events coming up, Jennifer, that you need folks to know about? or anything that you have? You have? I know you’re always doing incredible stuff in your community?

Jennifer Oladipo 51:06

Yes, I mean, um, thank you for asking. I am. The only thing is my little side baby, my little arts publishing side baby that I’ve been like, working on in fits and starts for like, good 12 years. Now. I’m getting back into that again, because I’m like, I’m gonna leave myself space to do things that I love, you know. And so that’s the only thing. So that’s the cord.co T H E ch o rd.co. And maybe just to like, bookmark that and keep an eye on that poll subscription box there. It’s been kind of on hiatus for a while. And I’m gearing that back that Right, right. Yes, thank you.

Christine Gautreaux 51:49

Okay. No worries. And we’ll put that in the show notes. Yeah.

Jennifer Oladipo 51:51

So just to just to kind of keep an eye out for a relaunch revival. I know what you want to call it. But it’s coming back with some great discussions with visual and performing artists, because that’s what I love. So thank you for asking about that.

Christine Gautreaux 52:04

Absolutely. Well, you know, we like to wrap with our guest every week, talking about first of all, what a fabulous conversation. But as you think about this conversation today, and you think about a hashtag for wisdom in action, from our conversation about financial wellness, what would your hashtag be?

Jennifer Oladipo 52:29

I would set Okay, hashtag. Yeah, I would say hashtag walking wisdom. Because we talked about a lot of different kinds of wisdom. We talked about being wise about what you need, being wise about the financial reality you’re dealing with in terms of what what the other people need? What are the numbers? What is their playing field? You know, we talked about and knowing ourselves. So yeah, hashtag walking wisdom.

Christine Gautreaux 53:06

And loving what you got Shannon?

Shannon M. 53:08

I have to I have hashtag raise your price. Okay, raise it. Okay, raise the price. And the second one is hashtag enjoy the money. Enjoy your money.

Christine Gautreaux 53:23

Yes, no, I love that one. I was going back to our very opening conversation about hashtag know your numbers. Like know your numbers, like know, and know that. I loved what you said, Jennifer about. What do you what do you need to have a beautiful life? So not just the you know, not not just our basic budget, y’all, but what do you need to have a beautiful life? And it doesn’t have to be extravagant. I mean, I think about like, I mean, to me, when I think about a beautiful life, it’s like this week, I got to go to Lowe’s and buy the five Boston ferns that go across my front porch. And there’s there’s been years that I haven’t gotten to do that right. And yeah, and it’s one of those things that every year when I have the ability to do that, it just makes my heart smile. And it’s not like it’s not crazy extravagance, five hanging baskets from Lowe’s, right. It’s like it’s those things like knowing our numbers and know what brings us joy, and nowhere to add that in. Right?

Shannon M. 54:31

Yeah, I love that. That reminds me of one of our guests and her joy list right? What adds joy and that’s what I think about when I say enjoy the money what are the things that bring me joy, you know, getting my nails done or going to get some good food I need to I need to continue my list but

Christine Gautreaux 54:49

right and if you’re listening and you’re not in that place, things I did for years was make my I had a little I still have it around here somewhere. I would do things that didn’t cost any money. Like I put little strips of paper and a little, excuse me, a little bowl, and I could draw out, like, go for a walk in the park or go down to the river or, you know, things that if my budget wasn’t in a place to spend money, I could still find the joy in the day.

Jennifer Oladipo 55:21

When I eventually started, making sure to spend at least a little bit of every check that came in, as a celebration of that of that money that came in. So I mean, sometimes it was just like a little, you know, coffee and cookie date with my husband. Sometimes it was a nice day, you know, depend on how big the check is, um, so, but every single time I was like, some of this is gonna go to my enjoyment. You know, I’m going to, I’m going to and, and it was fine. It was always fine. You know,

Christine Gautreaux 55:57

I love that.

Jennifer Oladipo 55:58

No time. How am I going to celebrate this? And it’s like it is it is something to celebrate. You know, when that when money comes in? That’s a beautiful thing. You know, when it goes back out? That’s that’s a beautiful

Shannon M. 56:11

thing. Yeah.

Christine Gautreaux 56:12

I love it. Eleanor says, hashtag Know your value value. Oh, that’s a good one. Eleanor. Thanks for listening today. Yeah, yo, this has been such a good conversation. Thank you so much, Jennifer, for taking time out of your schedule and being with us and sharing your wisdom around financial wellness with us. And I’m so grateful to be in community with you and and to be connected.

Jennifer Oladipo 56:39

Thank you so much for the invitation. And I’m so looking forward to learning more about the other people in your community. I’ve been listening, you know, to the podcast, since you invited me and it’s just as great what you all are doing. So thanks for you know, allowing me to be a part of it. And I would love for anybody who’s interested to reach out just say, hey, you know, I don’t have anything to sell right this minute. So whoever’s, you know, coming, willing called around this is probably, you know, somebody to connect with. So,

Christine Gautreaux 57:08

right, absolutely. Because, you know, it’s our firm belief and our values that when women get connected, and sell lock arms and celebrate with each other and lift each other up, we could change the world, you know, like we can literally changed the world. So thank you for being here today. Jennifer, we so appreciate you and look forward to talking to

Shannon M. 57:30

you. Thank you so much. Oh, my goodness,

Christine Gautreaux 57:33

what a fabulous conversation. Well, that

Shannon M. 57:38

quick, then it and I’m so glad that I’ve been working on this, you know, with and I mentioned it at the beginning of the call having my wisdom teeth taken out. Thankfully, I have this position. It’s been amazing. Benefits are amazing. I had health insurance have health insurance, didn’t have that day, so I had to pay it out of pocket. Oh, Shannon wouldn’t have she wouldn’t have had it. She didn’t have in her account. And so I’m thankful for the growth and the opportunity to be intentionally wise every day because we have to stay there you know, we can know to do better, and then still slide into habits and have things that we struggle with like we mentioned every day you have to be intentional about it, but I’m grateful.

Christine Gautreaux 58:21

It’s incredible, y’all we will put a whole bunch of fun stuff in our show notes and I’m aware of our time so I want to close this out pretty quick here but you can reach Shannon and I through our show notes. Check out shallow glow our sponsor, and they got some fun stuff happening over there. Oh wearing your shirt.

Shannon M. 58:43

The shirts have been upgraded so I had to wear it to end off the month for our Instagram

Christine Gautreaux 58:48

fan tastic my friend speaking of if you want more of us today, we are going to be live on Instagram at about 7:30pm Eastern time with a bunch of our Connected women from our manifesting group. And in the meantime,

Shannon M. 59:04

be well be wise be whole. We’ll see you next week for episode 62.

Christine Gautreaux 59:09

Looking forward to it.

Shannon M. 59:10

Yes

Leave A Comment