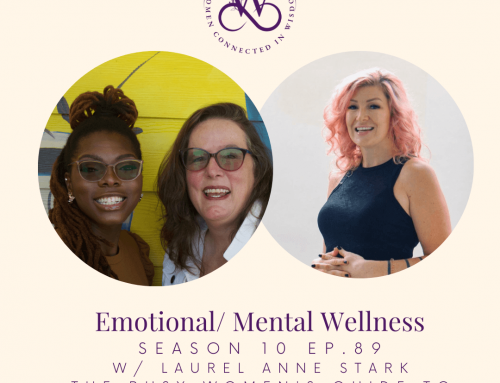

Show notes –

Join Shannon and Christine as they kick off year two talking about Financial Wellness.

Shealo Glo – www.shealoglo.com Now offering Subscriptions * Delivered on the 1st & 15th!

Nominate your Shearo by emailing subject “My Shearo” to shealoglo@gmail.com

Stillpoint – https://www.amazon.com/Stillpoint-Self-Care-Playbook-Caregivers-Breathe/dp/1732370400

Join us in community: https://women-connected-in-wisdom.mn.co/feed

Listen to past episodes: https://womenconnectedinwisdompodcast.com/

Book a free coaching consult with Christine here: https://www.christinegautreaux.com

Like & Subscribe to get notifications when we are live

Instagram @womenconnectedinwisdompodcast – https://www.instagram.com/womenconnectedinwisdompodcast/

Facebook page Women Connected in Wisdom Podcast – https://www.facebook.com/womenconnectedinwisdompodcast

https://www.cnbc.com/2021/11/17/use-this-checklist-to-get-your-finances-in-order-before-2022.html

https://www.thestreet.com/investing/tips-to-improve-your-financial-wellness

https://www.cnbc.com/2020/12/09/annual-ritual-to-gain-clarity-and-plan-for-the-new-year.html

Financial Peace University:

Show Transcript –

NOTE: While it’s not perfect, we offer this transcription by Otter.ai for those who are hearing impaired or who don’t find listening to a podcast enjoyable or possible.

Shannon M. 00:08

Let’s do this. Okay ladies, welcome to our podcast. I am Shannon Mitchell, a black female, millennial entrepreneur, the founder of shallow glow, a handmade shea butter company. I am a champion for your self care, business care and intentional wellness.

Christine Gautreaux 00:25

And I am Christine Gautreaux, a white social justice advocate, an international speaker, coach and published author who helps you upgrade yourself in community care.

Shannon M. 00:35

Yes. And together we are women connected in wisdom, a podcast grounded in the eight dimensions of wellness. Welcome, welcome to our show.

Christine Gautreaux 00:43

We love to get together every week to have intentional conversations about how to be wise in business relationships and wellness. Happy New Year, my friend. Happy New Year. All right. I know we’ve said it like a couple of times. I am still savoring our show last week, and celebrating our one year anniversary and our 50th episode. I just smiled like I even just still thinking about it. I was like, Okay, this is why we do what we do. Yeah, that we meet these incredible women. We get to hear their stories, we get to hear the incredible work that they’re doing in the world. And together, we lift each other up

Shannon M. 01:27

and be part of all of it. We get to be part of their stories. We get to be part of soteria and her tables that she’s doing in Virginia and the roots and wings and Joe with the drumming and I love it right. Yeah. Yeah, even our guests that we were talking to before I said, we have a whole nother year of new guests. The new connections on the way I’m excited.

Christine Gautreaux 01:50

Right. And some good ones, y’all some good ones. We had a little mix up today. Mercury is in retrograde for those of y’all that follow that. And our guest today is actually coming next week, which we’re excited to have her on then. But in the meantime, we’re gonna do a little talking about financial wellness. Yeah, because it’s a new year. Mercury is in retrograde, which often often means finances get a little. So you want to give us the definition. And then we’ll jump into it, Shannon?

Shannon M. 02:21

Absolutely. So for financial wellness, capturing a complete definition is tricky, because it means different things to different people. At its most basic level, financial wellness is a holistic approach to counter financial illness. The holistic approach includes a combination of factors such as satisfaction with current finances, increasing positive financial behaviors, like saving, reducing debt and budgeting, financial knowledge that helps to change behavior, reduce financial stress, a creation of a financial plan to reach desired financial goals.

Christine Gautreaux 03:03

You know, I listened to you when you read that every eight weeks or nine weeks. Yeah, and different things stick out to me at different times. You know, what stuck out this time was that it counters financial illness. Because I know like I I immediately thought of the patterns that run in my family. I thought, Oh, that’s a financial illness. Or of our ancestors, not what’s actually true today. Like because in my family, we weren’t supposed to talk about money and we didn’t have money. And that like in I catch myself sometimes being like, oh, and I’m like, You talking about woman? Like you got a color? You got a house? You are bills are paid. You got money, right? Yeah. But go ahead.

Shannon M. 03:58

No, go ahead. I’m sorry. You were

Christine Gautreaux 04:00

just saying it. But you know, a lot of my ancestors did not, surely did not, but kept passing that down to generations. We don’t talk about money. We don’t have money. We don’t you know. And if you talk about it, people will take it from you. So that’s a financial illness. Just diagnosed in my family right here on air.

Shannon M. 04:23

But it’s important. You know, I’ve been working through the Financial Peace University and the baby steps and that was what one of the lessons was about this week is realizing where the fears come from realizing where the mindsets come from, and it really even shed some light on the way that I was thinking about things with COVID. I’ve shared with you ladies how I had to move immediately when the restaurant shut down I sell well. It doesn’t matter what happens with the moratorium or if they forgive part of the rent. I’m not even going to have it for next month so I don’t need it to stack up. Not even for one month I’ve gotten Go. And I was talking about specifically putting my stuff in trash bags. I said, I don’t want to move and have my stuff in trash bags. That’s how it was when we had to move so many times when I was growing up. And it wasn’t just the letting go of the space that I had for myself or the having to move spur the moment, it was the financial instability Have you didn’t set yourself up enough to be able to stay? So the financial plan is actually what stuck out to me this week, like you said, we read the definition in different parts sticks out. Because before I would have thought that the budget is the plan. And even though that’s still true, there’s different parts of it, right, you can have a plan to invest in, and that’s going to help you reach certain financial goals. And you have part of your budget for investing. But that’s not the budget itself. I wouldn’t have been able to articulate that two years ago, right.

Christine Gautreaux 05:51

I was reading an article in prep for the show today. And I’m doing a little shitting all over myself, to be honest. So I want to admit that to our listeners. And and as we have this conversation, because you know, financial conversations can be hard, like it brings up stuff, right? Shame or blame or guilt. And this article was use this checklist to get your finances in order before 2022. Or it’s like, I’m late. It’s January. And I do have like, So Shannon and I were having this conversation before the show like no, we’re not late, take a deep breath. It’s right on time. But what you’re saying what I want to what I want to point to this is, in their article they talked about make time for a life audit. And it said, try something a little fun, which you know, I’m all in. And if we can make finances fun, I’m definitely in. It says if you haven’t done so already make time for a life audit. During this process, you basically list out all your goals, short term and long term, but you do it on post it notes, right? That way you can reprioritize them. And they give a breakdown of how to do it. And I’ll put a link to that all in our show notes. But really playing with it, like letting go of some of our judgment of ourselves and others and playing with it. Like what do we want to create this year?

Shannon M. 07:22

And I think and there’s so much you know, and I think that’s part of where things it comes from when I think about calls or what I want to do. And it’s everything on the list, let’s say the to do list, right? But really, you have to prioritize it with makes sense. So I moved out of my apartment, right? Got rid of stuff I didn’t need wasn’t using, I’ve lost all this way it kept it off, which means that leggings were too big stuff was too big. So now I’ve had to rebuild my wardrobe. Right. But if we’re not really going out as much, and now I’m going back to work well, I need what before I was going back to work, I need to work out stuff, right? I was running four times a week. So that was the priority, then I went back to work. So now we need work clothes. Of course I want fashion over outfits and billowing yellow. So dresses. But I don’t need that right now. We’re not going to a ball right now. So that helped me prioritize my financial steps and say, Okay, first we put the money here. And then we put the money there. And it gets rid of the anxiety. And it helps you have fun with it and cross stuff off your to do this.

Christine Gautreaux 08:27

Well, and you can reward yourself with that yellow silk gown. A certain, you know,

Shannon M. 08:36

level, yeah, you have to get through the certain steps. And that’s where we are. And that’s what our time is being used for. It’ll be time for that. And it’ll be easy to take care of.

Christine Gautreaux 08:46

I love that. I love that. Well, another article I came across, as we were prepping for today was called five tips to improve your financial wellness in 2022. And this was from a Money Magazine called the street and we’ll put a link to it in our show notes. But I just wanted to go they have five quick tips. Yeah, you’re gonna love number three, and it actually breaks down even more. So it may take the rest of their show for us to get through this. But I wanted us to talk about it because there’s some things and y’all we looked at several resources for y’all this week and one on we were like, oh, no, there’s some about that. Like, you got to know yourself and where are you on the path? And where where do you want to be? And it’s okay to take incremental steps. It’s okay to start right where you are, and and go from there. So, number one, you and I both had some opinions about but I’ll just read it and then we’ll go from there. Automating to save time and headaches, automating your finances to take the headache out of financial tests. Let’s look at reoccurring contributions to an investment account is an example that both you and I were like We’re gonna start with automating our bills. But you can with reoccurring contributions, you can set it up and grow your portfolio. And you can learn more about this in this article. But y’all if you’re not already automating, like your bank account, and things like mint, we’ve talked about mint on the show several times, it’s an app that can help you budget, use those tools, like use what you’re comfortable with, but also you may want to learn them. I will tell you, as somebody who was diagnosed with ADHD in college, and finances have not been my strong suit, like it is not something that but I will tell you automatic banking, changed my life and my credit score for the good. So I highly recommend it. And if you need help, your banks will help you, like you can go in and there are people that are paid to help you with that. So don’t be afraid to call and make an appointment. Yeah,

Shannon M. 11:01

and and that’s a minimize what the article says either, right? I look forward to after I pay off my car moving that money over and now just like I was automatically spending it, I can automatically put it into an investment account, do you know where the money will grow, actually just shared a post last night on my Instagram about that how this person found out that their $339 car know if they would put it in account, after 30 years, it’d be like $500,000, instead of putting it into a brand new car, which automatically loses its value. And so your money is going to be worth less instead of worth exponentially more. But again, in the meantime, you know, if we’re automating then there’s different levels that it can help us on? Absolutely.

Christine Gautreaux 11:45

Well, I love that idea. Because I don’t think about it, right? Like, I know that my husband’s 401k We’re lucky enough that he has it through his corporation, right? Because he’s not an entrepreneur. You know, and so that’s automated, so we don’t have to think about it. So I need to think about that for myself. Like, I mean, even if it’s 50 bucks, or you know, that’s, that could be that could be very doable. So I’m gonna do a little research on this, that may be my wisdom and action this week is his research on this. So number two talks a little bit more about investing, talks about diversifying to minimize your risk. So as you’ve heard people say, Don’t put all your eggs in one basket, whether they know it or not. They’re promoting diversification. It is one of the cornerstones of financial wellness. It says this method used by investors for generation reduces risk by spreading investments across various categories. So a real world example that they give, is if you’re only invested in two companies in one crashes, you lose half your investment. If you’re invested in 20 companies and one crashes, you lose 5% of your investment. I mean, it makes sense comments. Yeah. I also think about it as do you invest in real estate? Do you invest in the stock market? Like what do you do, you know, do Roth ri IRAs, but you know, all of that? Absolutely. All right, I want to get to number three, because you are going to love this my friend. Number three, learn something new about finances. Whether you’re a savvy market veteran or opening your first bank account, learning more about finances can help. Here are a few ways for you to continue your financial education. Now there’s five of them, but we’re gonna go we may go on a little bit of a tangent here. Okay. If you’re a reader, pick up one of the following. This is what you’re gonna love 12 Smart personal finance books to add to your reading list?

Shannon M. 13:51

Are you ready? Yeah,

Christine Gautreaux 13:53

I know. We’re gonna see because you read a lot of financial books. That’s why I was like, you are going to be thrilled about this. Number one is the intelligent investor, the definitive book on value investing by Benjamin Graham. So billionaires Warren Buffett and Charles brands credit Benjamin Graham’s investing philosophies with making their fortunes possible. Mm hmm. All right. So worth it. They in this book, he teaches the art of finding undervalued stocks and buying them at low prices. And Buffett has compared Graham strategy to snapping up hamburger meat on snail

Shannon M. 14:33

what does that mean? I’m snapping it

Unknown Speaker 14:35

up on sale. Sorry. J le.

Shannon M. 14:40

Snail, some type of financial lingo? I don’t know.

Christine Gautreaux 14:43

Sorry. I mispronounced the word right. I’m numb to book some exciting for our listeners. Women with money, the judgment free guide to creating the joyful, less stress, purposeful and empowering CS and yes rich life you deserve by Jean and I hope I pronounce her last name right? Chatzky. So she is the CEO and co founder of her money. And she has a reputation for telegraphing no nonsense clarity and wisdom through many channels, including the her money podcast, and the Today Show, we got to see if we can get her to come on and talk to us. Yeah, that would be super fun. This is the quote, out of this book. Anyone who tells you women don’t need financial advice specifically for them is wrong. Women, whether they’re the caretakers, the breadwinners, or both face a unique set of financial challenges. To Jean,

Shannon M. 15:49

I don’t so so let’s take a second right now. This is my thing about money is if we’re supposed to go to school, to make money, and that’s everybody, right? They don’t just tell me to go to school and stay in school, they tell everybody to go to school and get a good job. Why would we not need to know about money, even if we’re a caretaker, right? If I can be more strategic about the way that I order a prescription for my daughter, and it saves $72 a month, that’s going to add up over the year that could have been investment or a date night out, or part of a trip or something else. And so if we have that information, we can be more strategic and intentional with the rest of our lives. It makes sense.

Christine Gautreaux 16:34

I am really attracted to number two for a couple of reasons. Where it says the judgment free because we all judge ourselves. Like right, we do and creating joyful, less stressed and purposeful. Yeah, I think I’m gonna get this book on Audible. Yeah,

Shannon M. 16:51

it’s important and it is stressful, you know, because this is what we spend our time on. This is what we talk about the rat race this what I think about with financial wellness is the the cash flow board game that I’ve been playing and it teaches you how to get out of the waiting for the pay day and then onto the fast track and how to invest and do all this different stuff. But that this is what keeps us from children from spouses from the things and passions that we would do if money wasn’t a question. So of course, it’s stressful sometimes.

Christine Gautreaux 17:26

All right, I’m excited about these resources, y’all we’re gonna have to report back and if you are one of our listeners and you are watching or listening, let us know if you’ve read some of these books or if you recommend them and or if there’s any others that you recommend. Alright, number three, you are a badass at making money by Jen Sincero I might have been sincerely pronouncing that wrong but it says part of the multi book badass series The making money volume concentrates on the attitudinal side of earning and personal finance once readers take an inventory of their roadblocks mental blocks system who doesn’t want to come out of my mouth sincero invites him to develop abundance from the inside out. I’ve heard about her before

Shannon M. 18:20

Yeah, I think I’ve heard of the series I don’t know if with the money but but I’m for it.

Christine Gautreaux 18:25

Alright, I like it. Says part of this lies in changing the self talk script. Much of it stems from learning to laugh at yourself sincero who still lived in a converted garage at age 40 puts it like this my broke asking get rich you can too

Shannon M. 18:42

converted garage.

Christine Gautreaux 18:47

I like her already. Yeah, we should ask her to cool all right. I don’t know that I’m gonna run through all of them. I’ll run through the topics and and and you tell me if you’ve read them or like so number four is zero debt The Ultimate Guide to financial freedom by Lynette Kalpana Cox. I can I just stop and say, out of the first four, the top three were women, writers. That’s a That’s a change. That’s true. Some of the things we were looking at last year or the year were I’m really excited to see

Shannon M. 19:23

this. And I honestly and I know Presidents Day is coming up. I was thinking about our vice president, but I think that we can expect to see that in this presidency honestly, is more women and women of color in general. Right? The landscape Yeah.

Christine Gautreaux 19:41

I love this because when we looked for resources a year ago, these were not good points available. Alright, number five is the richest man in Babylon by George S. Clawson.

Shannon M. 19:52

I didn’t know if the book was going to be on there that I read it. I’m actually reading it right now.

Unknown Speaker 19:56

Okay, okay. How is it is really

Shannon M. 19:59

good. And, you know, I’ve read The Seven Habits of Highly Effective People in a couple of different books and I see how they overlap. But it’s good. Okay.

Christine Gautreaux 20:12

Number six rich habits, the daily success habits of wealthy individuals by Thomas Corley CPA. He did a five year study on wealthy people. And it he said it all distilled into 10 principles that a majority of them follow. Says but before you dive in, you might want to ask yourself what’s on your to do list? He said, Corley found that four and five rich people keep such list in rich detail with two thirds of them completing 70% or more of their daily task. Also, this is interesting to note, only 23% of wealthy watch more than an hour of TV a day, which leaves them to pursue more other activities that broaden their financial horizons. Such as, yes, reading

Shannon M. 21:05

is really important. You know, and I think that with TV and entertainment it gives us is, it’s another form of being told what to do instead of thinking about what to do for yourself. That’s how I feel about it. I think it’s necessary for entertainment, like we talked about taking a break and not always being on but 40 hours a week of TV is a whole workweek. We could be doing more with the time.

Christine Gautreaux 21:32

What was that? I’m having a moment. I know, we talked about it probably close to a year ago, that documentary about social media, and how it purposely keeps us picking up our phones. And

Shannon M. 21:47

I think I know what you’re talking about. I think I watched it. I don’t remember the name of it either.

Christine Gautreaux 21:52

Right? Yeah. But how it really talks about it promotes addictive behavior. So like if you’re, if you’re giving yourself a hard time, don’t give yourself a hard time just notice the pattern, right and see where you can start making some small shifts right. Number eight on this list, the Automatic Millionaire a powerful one step plan to live and Finish Rich by Dave buck. It says if you can get past the cheesy jacket photo, then you’re about to learn some bedrock million wisdom. All right. I don’t know that one. I don’t know if it’s just I don’t know. I have a little judgment about that title. Number nine, I Will Teach You To Be Rich by Ramit Sethi. He’s a personal finance adviser and entrepreneur and founder of growth lab, helping people turn their niche skills in the viable businesses. All right, that’s interesting. And then number 10, tiny habits the small changes that change everything by BJ Fogg PhD. You know, more like that one because I like tiny changes and incremental steps. Yeah. And it is an inspiration for two m one blogs in September. It tiny habits describes how incremental small actions over time, easily sidestepped anxiety, and all or nothing thinking that too often freezes in our track.

Shannon M. 23:20

Yes.

Christine Gautreaux 23:21

I love that. Yeah. That’s cool. Number 11. How many of these are there? 12. Okay, I was like cheese. Number 11. The Psychology of money Timeless Lessons on wealth, greed and happiness by Morgan Housel. Okay, that’s cool. And then it’s 19 short stories in that book, exploring the strange ways that people think about money, and focuses them into actionable advice. And then number 12, atomic habits, an easy and proven way to build good habits and break bad ones by James clear. This is talking about the psychology to help people build smart, sustainable habits that don’t rely on motivation. I like that.

Shannon M. 24:09

And I haven’t read this book, but I’ve heard it. And from what I understand of it, this is exactly what I tried to do. You know, when you started this podcast, we were like, We don’t want to overwhelm people. We don’t want it to feel like work. It’s gonna feel like so much. But that’s why we repeatedly go through all eight, every few weeks, right? And when you make it second nature, it doesn’t happen to the well of your willpower anymore, because it’s just what you do. And it sounds like at some point, that’s what all 12 of these books are gonna be talking about.

Christine Gautreaux 24:42

Right? Well, it’s also about the embodiment of it, right? Like the being able to have the conversation to be you know, you and I’ve had this conversation when we talk about anti racist work, like being able to say the words and have the conversation and have the discussion, financial wellness, being able to talk about yourself finances and have a conversation. And I was on an interplay class this last week, and you know how we do, I could talk abouts back and forth where you say something and one of the players I was playing with said, I could talk about the financial meeting that I’m supposed to have with my husband after this call, because our finances are a mess and how let’s just keep in her play. When she said it, and I’m sure I’m butchering exactly the way she said it, but when she said it, my whole body relaxed, because you know, how often we think, Oh, I’m the only one that puts off that meeting with my partner or my spouse, or, Oh, I’m the only one that would say, my finances are a mess, or oh, you know, and, and also that some self talk and old language, because they probably aren’t, they’re probably not perfect. I don’t know when they ever will be. But from where I started where I am now. You know, it’s so interesting. Yeah. And talk to ourselves about it.

Shannon M. 26:05

And that’s one of my favorite things about being connected and sharing testimony, sharing your story, women connected in wisdom, because when you start talking about it, I think with most things, you’ll realize, of course, you’re not the only one. Everybody has stuff in these categories to a certain extent and talk to themselves a certain way. Because it let’s say, in America, we’re all in the same environment to a certain extent. So we’re conditioned the same. So what you were taught, I was taught, we just didn’t talk about the fact that we both knew and operated the same way. Right? Yeah.

Christine Gautreaux 26:40

All right. So we got through the list. Yes. I’m taking us back to learning something new about finances.

Shannon M. 26:48

Yeah. And that’s the article right?

Christine Gautreaux 26:51

Number four, the article. And we’re number two, oh, number three of the article three of five. And we’re number two on that learning. It’s stacked two really good stacked article, you know, how I like stacked things. So it’s probably what drew my attention. Number two is if you’re looking to sit back and be entertained, while learning, checkout finance movies, like the big short or too big to fail. That’s like, we can have fun with this, right? I forget that sometimes, like, especially when it comes to finances, which is funny, because I have fun in almost all areas of my life. I just need to apply those Interplay principles to I wonder number three, are you a podcast? fanatic? If so, try out the Dave Ramsey show or women in money.

Shannon M. 27:41

Yes. And I really liked the Dave Ramsey show for the the personal stories, you know, you get so many people on there listening to their life, how they thought about money before, both individually, let’s say as a couple and then how they came together. And also how it transformed and how they now think about money. And then it’s countless stories like that.

Christine Gautreaux 28:03

Okay. Yeah. Thank you for that testimonial. I’m curious about the women in money show. I don’t know anything about it,

Shannon M. 28:10

either. But I would, I would think it’s the same thing you know, and yeah, personal stories with people that are similar to you in different ways. I think it helps you refigure the way that you think about things.

Christine Gautreaux 28:22

I love that. I love that. Okay, number four, looking for a bite sized newsletter that brings learning to your inbox subscribe to some like the morning brew or easy money. I love all these resources. Yeah, like I Yeah. Alright, number five, looking for something a little more advanced? Maybe not. But maybe. So check out Khan Academy, or add xs finance for everyone. I love this bite size financial, like just a little bit. Just learn something new. You’re always going for it. You always impress me, my friend on how much you were studying this. And so I’m going to take a page from your book this year and do a little more studying around this.

Shannon M. 29:07

Yeah, yeah. And what I like about this article is how it changes it based on the type of person that needs to help you know, do you like podcasts you like to read the unique community and education and different ways to address the same the same topic because that’s really important.

Christine Gautreaux 29:26

Well, you know, how we talked about in Stillpoint? We talked about self care, and we talk about community care, and we talk about partnership power. And so I have always been attracted to but have not done it yet. Like a female investing group, like a group of women that are striving towards this together. So I think I got to look into that again this year. Like having an accountability group of women around this topic, I think would be really yummy.

Shannon M. 29:56

Let’s do it and let’s do it in women connected in with done in our community. Because I love it.

Unknown Speaker 30:04

I love that idea.

Shannon M. 30:05

I can’t wait. I can’t wait for a couple of things in my life. But I’m definitely excited about it.

Christine Gautreaux 30:10

Because even if we started with $5, or $10, you can do that. Now, you used to not be able to do that, you know, when our parents were coming up, you had to have a certain chunk of money. And I think that’s why so many people didn’t invest because they were waiting Intel, you know, but nowadays, I mean, we’ll have to look at the minimum investment. But yeah, let’s do that. And the women connected in wisdom community, let’s start an investing group. And you

Shannon M. 30:36

know, that’s, it’s so interesting that you say that, because I almost feel that way about, well, I was gonna say everything. That’s not that I wouldn’t necessarily say everything. But it’s the same with the business, you know, before you had to have money for brick and mortar and an inventory to fill the store and everything that it takes to do that. Now you can set up an LLC, and even have a digital product that might cost you $0 to make and then sell it and operate from your phone phone in the computer, instead of spending $12 million to build a restaurant or whatever it would have took before. So the landscape is different. So the considerations and what’s needed is different. Right? Yeah.

Christine Gautreaux 31:16

Yeah. And just because our parents didn’t do it doesn’t mean we can’t change, right, and learn and grow and have different opportunities. Absolutely. All right. There’s two more overall on this big list. I’m taking advantage of retirement accounts. So it says there’s a reason why you hear everyone from financial advisors to parents talking about contributing to retirement plans, and it says they are a great savings vehicle. So it talks about IRAs, it talks about compounded interest. You were just talking about this about your Instagram account. Yes. Yep. Okay. So it says it’s a great way to give your future self a gift.

Shannon M. 31:57

And, for me, it was my past self. My 401k helped me last year, okay, when unemployment stop coming in. So you usually don’t want to touch it. But when situations happen, I was thankful to have automated, like we talked about on the first step, automated that percentage to come out of my account, the first time I was salary, my company was meeting it. So I made sure I maxed out what they were meeting, and I definitely needed it and I was glad to be able to benefit from it being there. What I will also say is right now, I think that a lot of times we think about retirement at 65, based on my new financial literacy, I plan on and we can play this episode back. Okay, I plan on retiring by 45. So right now, it doesn’t have to be super far away. How are we being strategic about our finances and our time so that they can work to our good?

Christine Gautreaux 32:53

Right. I know, we’ve mentioned it on the show before but The Four Hour Workweek by Tim Ferriss, he also talks about not retiring. He’s a little bit of a rebel and sometimes some of his languaging I get like it about, but he’s got some good strategies in there. But he also talks about not waiting to retire to create the life that you want. And you and I’ve talked about this on the show a lot like you’re currently in a hotel room in South Carolina zooming in you know, I we’ve done the podcast from different countries even since we’ve started so in all different places, like creating that life you want while you’re working towards this and while you’re working towards financial wellness, absolutely. Okay. I love it. Alright, last one, and I’ve mentioned it before on my wisdom and action, but it’s always a good reminder. And I think it’s one of those things we’ve got to schedule. Number five, scheduling regular checkups for your accounts. Schedule a regular financial check in for yourself so you can avoid help avoid mistakes and ensure everything is in line with your current goals. Whether it’s a monthly, quarterly or annual check in, you can use this time to review your accounts, ensure your budget is accurate and make any necessary changes, consolidate investment accounts or bank accounts, and make sure you’re on track to hit your goals.

Shannon M. 34:19

So I’m going to challenge the ladies to be even more specific, right, based on the statistics before COVID 78% of America was living paycheck to paycheck. Absolutely not waiting until the quarter I would say every day, especially if you’re uncomfortable with it. Right? So you know what you’re working with just like you can’t eat. If you don’t have food in the refrigerator. You don’t have money to spend. There’s no money to spend and you need to know that before we’re spending money. And so it was really interesting. I realized one day somebody said that checking your bank account is like Somebody with bad grades checking their report card. And I said, oh my goodness, that makes so much sense. Because I remember the anxiety, people would have tried to literally change their grades people get in trouble with their parents, because they’re lying about what actually happened. But that’s what we’ve tried to do with our finances. Let me move this over here. So I have this money that’s not here. And then we end up paying more money trying to it’s a crazy cycle. And so at you know, I love to give the lady specific details. And again, practical business systems. So I’m going to break down what I’ve been doing that’s really helped me feel confident and knowing where I am. So on the, let’s say, on the less regular scale, I paid the bills, right, so on the 10th, and 25th, that’s when I transfer money. So it’s not related to when I get paid is always on the 10th and 25th. That way, the bills when it hits the account, if it takes a few business days, it’ll still be within that month. So for the month of January, I’ve transferred my money, and I know where it is by the end of the month. And then just like a new day, I’m starting new, I start new every month. So if I need to pay a bill, if I need to move my money from my business, from my income account to my owners compensation or my operations account, I’m doing all of those things on the 10th and 25th. Outside of that I actually felt like and that’s based on the Profit First system that we’ve talked about on the show, I felt like that wasn’t frequent enough for me, I felt like I would start spending money because I spend money, right? So we’ll start spending money. And I wouldn’t know where my account was, I would try to wait till the 10th. I’ll do it the 10th and 25th. But I wasn’t knowing my numbers. And so now, I’ve actually challenged myself to have a finance Friday. So I’ll go in. And then if I need to move anything, right, I like alliteration and knowing which days things fall on, I never know what day it is, right? So finance Fridays, we’re going to look at the account, and also challenged myself to to move the different percentages for my business on those days, right. So if somebody paid or bought a shitload Glo product from the website, I move the money from PayPal, if they’ve bought something in person, I move the money for cash app and make sure the business money is not sitting on these other platforms. And software’s right, I’m getting it into my account. And then I’m redistributing into the accounts that it should be based on what I need it to be. So I actually know how much I have for operations in this week, how much we have for the taxes this week, how much we have for the owners compensation, so we can base our sales go off of that. So we can have the revenue that we want, right? So the 10th and 25th, for moving money for those deadlines, finance Fridays, but then outside of that, it’s also on my daily checklist with my email to just check the check the the account, you know, so I just bought some labels from Avery robot to do production when I get back in town. And I had to cancel it because I actually something else happened. We don’t have the three ounce containers for my vendor. So I’m like, let me cancel these labels. And let me check my account to make sure they didn’t pull the money out. So I know where I am, you know. So that’s specifically why I say every day if it gives you anxiety, because that’s going to give you the most repetition to get comfortable with it. And then once you know your numbers, you set your budget and you know that you’re not spending outside of that, you know, you spent the $53 when you went out to eat and the $100 on fashion over so you don’t have to worry about

Christine Gautreaux 38:32

Yeah. And that’s, I think, no, it will Yes. And you know, that big sigh was about how much prices are going up right now. And like you talking about spending $50 When you go out like it feels like everything, like the inflation right now and everything’s going up. If we have our mindset, I’m guilty of this, like if I think well, you know, I volunteer for reforming Arts, which is a program that uses the arts in higher education for people reentering society after being incarcerated. And I was watching a video this week. And one of the things that we’re talking about is one of the things that’s so hard about reentering society is you have in your head like a burger costs $1.50. Right? And then burgers now. 10 bucks. Right. So if you’re making plans, but I think yes, it’s dramatic when somebody has been taken off of society and are coming back in. But I think for even every day, like, I’ll have it in my head. Oh, you know, this cost this amount? No, right now it costs four times that amount. And if I’m not paying attention to my numbers, if I’m not being real about it, I can overspend in a heartbeat because it didn’t cost $30 For my family to go out to eat anymore. It cost 100 bucks without even blinking and that’s not for fancy. That’s just

Shannon M. 39:59

yet Everybody there that’s with one in school and the table right there at that meal for $100. Right?

Christine Gautreaux 40:09

I used to when you thought about $100 meal, you thought, Oh, that was a drink. That was appetizers. That was dessert. That was an entree. Y’all never not anymore. That’s about an entree in entree and right? Yeah, right. And

Shannon M. 40:24

that’s why this is so important. You know, and I’m grateful for the stimulus checks. I’m grateful for the unemployment that I got when I was unemployed for COVID. That’s how she looked love started, you know, and I’m thankful for the wisdom and the financial literacy, to know that I needed to start a business. But putting out the money causes it, it increases inflation. And I saw this post the other day on social media, it was talking about how I think it was like 20 years ago, they said 20 years ago, or let’s say 1010 years ago, minimum wage was $7.25. Now it’s $7.25. Somebody made a good point, though, but rent was 800 something dollars, and that was $1,400. So before, if you were financially wise, you were saving, right, if you have $10,000, in saving is going to be gone in less than two months, for just the rent by itself in this example, when before it would have lasted you a lot longer. So it’s absolutely imperative that we get wise that we get educated and that we know what’s going on because saving is not going to be enough. You know, we have to know how much we need to make how we’re going to do that. And then when we get the money, what it’s doing and knowing what job we’re giving our, our dollars, and that’s what’s been my goal, how am I good boss to my dollars? And where do I send them off to do their task?

Christine Gautreaux 41:48

Well, I love that you play with it. And you tell me the game, you said you were playing again, cash flow, cash flow. Yes, say more about that.

Shannon M. 41:58

So I really love this game, I’m gonna just start up front, because we like to know the prices, it was about $60. And that’s what the discount that they ran. But again, this is an asset, because it’s going to put money back in my pocket, because it’s changing the strategy that I think about money, right. And so the there’s two different tracks that you’re on on one track is basically the rat race, right, and you’re going around, there’s a Pay Day, and depending on which job you pool at the beginning, you pull a card, I’ve been a police officer, that was interesting, right? I’ve been an engineer, and you have a certain amount that you made. At one game, I had three, three children, right, that changes your expenses. And in it, depending on what else might happen, it might lower your payday. So now you have more expenses, less money coming in. And the point is that anybody starting from anywhere, can get out of the rat race, just like we were talking about out of the garage, right, this person was in a garage, and now they’re rich. So you, the point of the game is to get your passive income, which is income that you are not physically working for, to pass your expenses. So if my expenses are $1,200 a month, I need to get $1,201 a month. And now I’m out of the rat weight race, I no longer have to work for my income, something is paying for it without me physically being there. And now I can go on to other things. This is the fast track, right. So on the fast track, you have things like parks being named after you and Safari trips and going to Africa is one of my things. Right? And it’s interesting, it reminds me of this this question I got Linda, my mentor who actually passed away last year, we’ve talked about Linda, again, cancer with these chronic illnesses and us taking care of ourselves, right. And she took great care of herself. But she invited me to this entrepreneur event. And the host was like if you guys had $10,000 Right now, what would you do? And looking back, I realized with my financial literacy, I answered this question wrong, right. I had a sweet answer. But that’s not what she was asking. She was asking about for your business. What would you do it for? I get on the mic. And I’m like, if I had $10,000, I will take my mom to Africa because she says she wants to go and she sick. And so I would love to take her to Africa. Since again, that’s not what she was asking. Right? It was the sweet answer. But that’s on the board on the fast track. Take a trip to Africa. So please believe that the first time we played this after Christmas, that was my goal. And I won the game. The first game I played, I did not make it out the rat race. My strategy was off. I was investing when I shouldn’t have invested then I got downsized. That’s part of the rat race too, right, which we know is real life. And when you get downsize, you have to pay like all of your expenses. So I had just invested didn’t have the cash flow. had to pay like $3,900 Something like that. I’m just sucking at the game. And now I was winning. And I was able to go to Africa when I when I bought the game so it’s great.

Christine Gautreaux 45:04

I love this I love using Play to teach ourselves exactly I know we had talked about it I didn’t realize you got it I’m so excited for you I need to come over and we need to play this game. Yeah, probably gonna kick my ass but

Shannon M. 45:17

No, and that’s what I love though because it’s not about oh, I beat you. I’m the winner we can go together let’s I love that Oh, go you know write about it. We could talk about the strategy and there’s a person that audits you so they can help you you know, so you know, it’s grateful.

Christine Gautreaux 45:35

Yeah, well I’ll put a link to it in in our show notes for our listeners because you know, we want to share with them I am looking at the time shaving because we have just like we have a few more things to do before we close tonight but we want to close on time today because you know, I think we’ve whispered about it a little bit but we are in the process of putting together 20 Plus fabulous authors for our listeners. Women connected in wisdom and doing a women connection and wisdom book. So we have an author call tonight in a few minutes so we’re gonna want to jump off here but before we do what’s happening over Shayla glow,

Shannon M. 46:18

yes so as always, and I usually don’t have all three products but I’m traveling so actually let me do it in order so you guys know I usually don’t show the eight ounce containers. This is what let me get it straight into the camera. This is our scrubbing glow. And this is our dark brown sugar scrub. I’m always talking about it for exfoliation, right? What people love about it is the fact that it keeps them moisturize as they exfoliate. Usually sugar scrubs dry you out. This one is not going to because it has that grapeseed oil and honey in it.

Christine Gautreaux 46:52

I love mine. I love it. I love mine I use the other day. It’s fabulous.

Shannon M. 46:58

I can’t hold on to it. It’s crazy. Then the oil the multi use oil is great for your scout hair, skin and nails. I love it because it’s light coverage and it’s not going to leave you oily. It has the MCT coconut oil in it, which is great for a lot of things, but especially pulling the moisture into your skin. And then we’re going to seal it off with the shallow glow. And this is the glow butter. We just renamed all of the products. We’ve done the bigger sizes so you guys can have the home glow set. If you know you need more in the travel glow set. If you are traveling, some of those products are sold out right now again, I talked about that in part of my yes a great thing right in part of my examples. But make sure you go online if you’re looking for and I’m excited, Kristine, we’re about to start we have excuse me started working with the sketch students. And so we talked about gratefulness and the quiet time we take for ourselves. I love helping in seasons and transition, you know, and for me that has been going back to the schools. I used to go target Hiram High School and and hang out with the seniors and haven’t been doing that since COVID. So to have the opportunity to help you ladies in your family take better care of you and talk to the scared students. I’m just super excited.

Christine Gautreaux 48:17

I love it. Yeah, I love it. Well, I have a few things coming up. So I’ll just drop my linked link tree into our show notes if folks want to join me at a few events, but I am doing the sovereign women living the New Earth vision TELUS summit that’s coming up January 29 and 30th. And you will see if you join us you will see some friends from the show on there because Carolyn Rene is one of the presenters with me and Cecile Armstrong. And so there’s some folks shall will recognize that that summit, and I will I will put the link to join us on that. And then you know, I’m doing an interplay 2022 Play a thon for 12 weeks and our guests next week, Marla’s going to tell us a little more about that. So I am I am excited, my friend. We have a lot of really delightful stuff coming up. Yes. Oh, before we go, what’s your wisdom and action this week?

Shannon M. 49:14

Oh, let’s see last time I wisdom in action was knowing my numbers for my debt. And I will say that my wisdom and action is closing the credit card. We’re shutting it off.

Christine Gautreaux 49:29

I am going to download one of those books we talked about today and start listening to it. So I’m going to do some financial literacy. Yes week.

Shannon M. 49:39

Yes. I love it. Okay, ladies, thank you so much for joining us as we delve into financial wellness. We will be back next Wednesday live is fine. And don’t forget, be well be wise. And we hope to see you soon.

Unknown Speaker 50:02

Thanks for listening. This has been the women connected and wisdom podcast on air live on Wednesdays at 5pm. Eastern via Facebook and YouTube. Be sure to like, share and subscribe be part of the conversation and get connected at women connected in wisdom.com.

Leave A Comment